HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Looking for a company that has good appreciation and portfolio defensive potential?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

DIVIDEND YIELD

Brookfield Infrastructure Partners - Safety And Return.

06/25/20 04:52:21 PMby Matt Blackman

Looking for a company that has good appreciation and portfolio defensive potential?

Position: N/A

| According to the company website, "Brookfield Infrastructure Partners L.P. is one of the largest owners and operators of critical and diverse global infrastructure networks which facilitate the movement and storage of energy, water, freight, passengers and data." It has assets distributed world-wide with 30% in North America, 20% in Europe and 25% each in South America and Asia Pacific respectively. It also trades on the Canadian Toronto Stock Exchange, symbol BIP.UN. Brookfield Infrastructure Partners is the third Brookfield company I have written about (see Suggested Reading), but since a US recession has been officially confirmed, it's a good time to look at a defensive stock in the diversified utility sector. The other benefit of BIP is that is pays a respectable dividend of 4.8% and went ex-dividend date on May 28, 2020. |

|

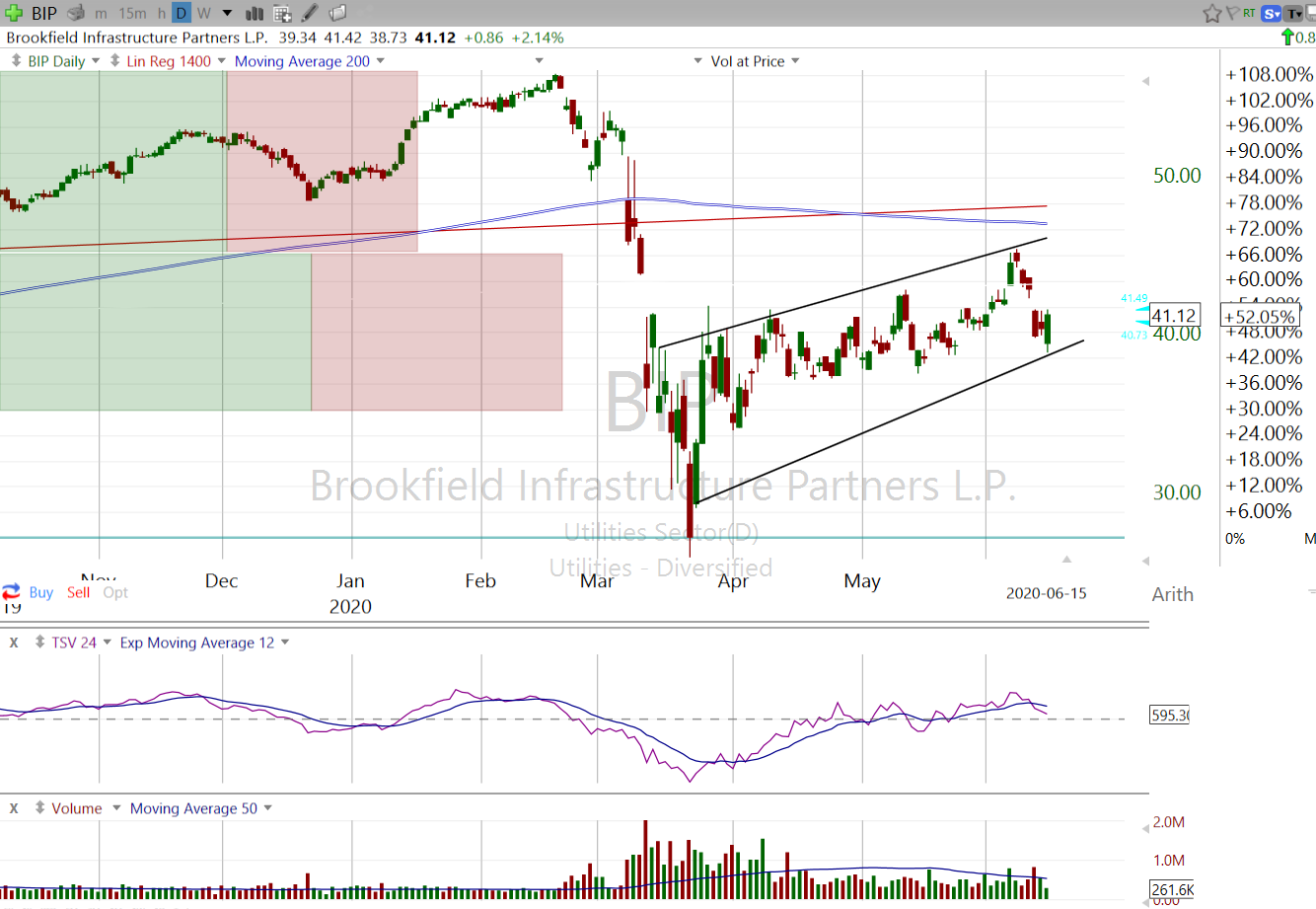

| Figure 1. Daily chart of Brookfield Infrastructure Partners LP trading below its "fair value" 1400-day linear regression line. |

| Graphic provided by: Freestockcharts.com. |

| |

| As we see from Figure 1, BIP experienced a 50% drop from its February 2020 high to March low, half of which it had recovered by mid-June. Fundamentally, BIP saw earnings per share rise 44.7% in the latest year on earnings of $333 million ($0.21/share) on $4 billion in revenue. More than 80% of its shares are owned by institutions. Given the more than $3.5 trillion of stimulus already passed out the U.S. (and around the globe) and more in the works, much of which will target infrastructure to help fill the void of nearly 40 million job losses in recent months, this sector stands to benefit handsomely. |

|

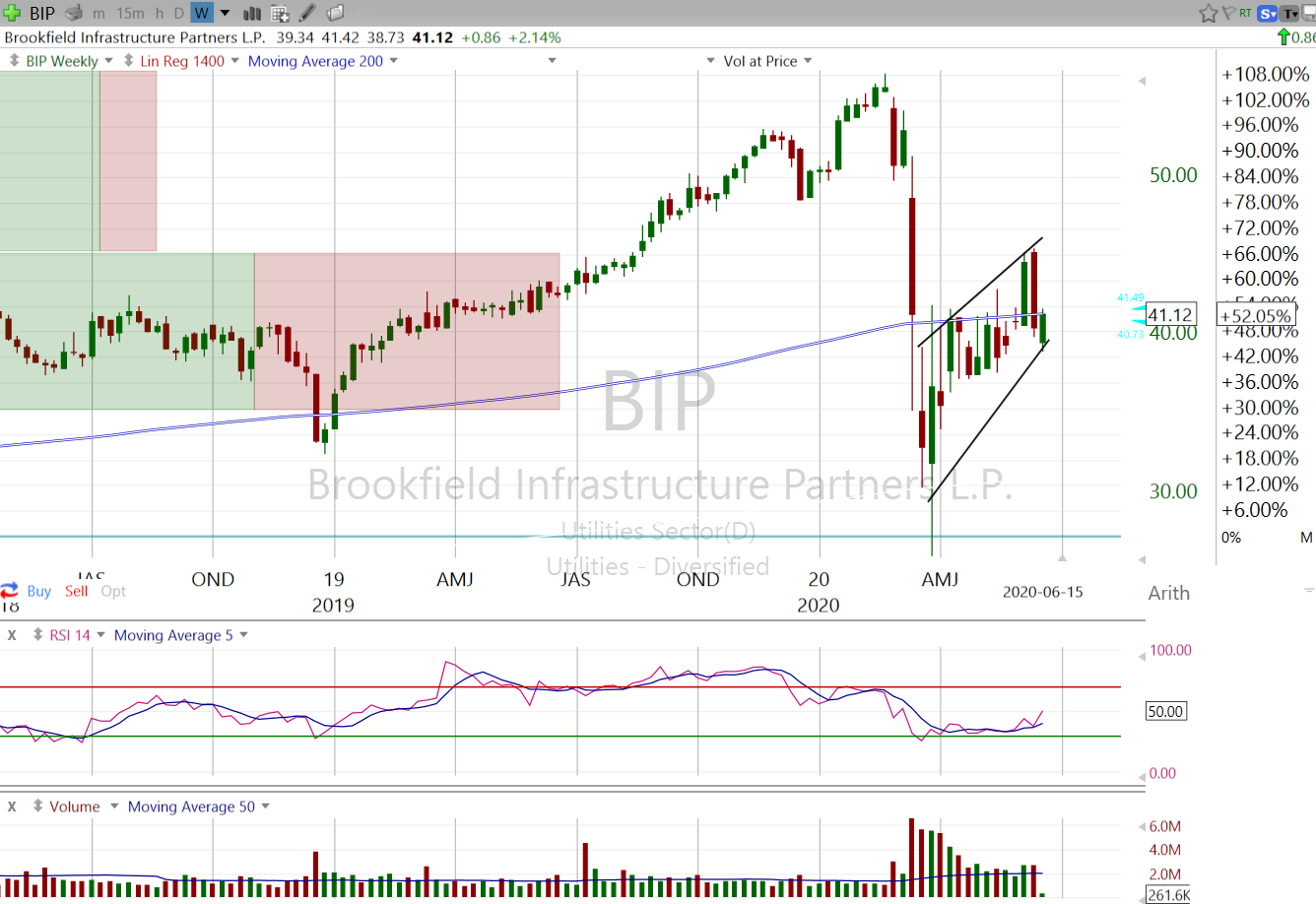

| Figure 2. Weekly chart of BIP showing stock hovering around its 200-period moving average. |

| Graphic provided by: Freestockcharts.com. |

| |

| Technically, BIP was trading at the bottom of an up-sloping trend channel in mid-June near medium term support. If channel support holds, the stock has the potential to move back up toward resistance around $46. If up-trend support in Figure 1 is broken, exit the stock to protect principal and wait for a new buy signal. |

| Suggested Reading Brookfield Infrastructure Partners Company Website Brookfield Infrastructure Partners Corporate Profile May 2020 Brookfield Asset Management - Another Good Green Tech Bet? Brookfield Renewable Partners LP - Trending Against The Odds Trump Team Envisions Up to $1 Trillion for Next Stimulus Round |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog