HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

This renewable energy stock has been fighting market headwinds. But can it keep up the pace?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

RSI

Brookfield Renewable Partners LP - Trending Against The Odds

01/02/20 05:00:12 PMby Matt Blackman

This renewable energy stock has been fighting market headwinds. But can it keep up the pace?

Position: N/A

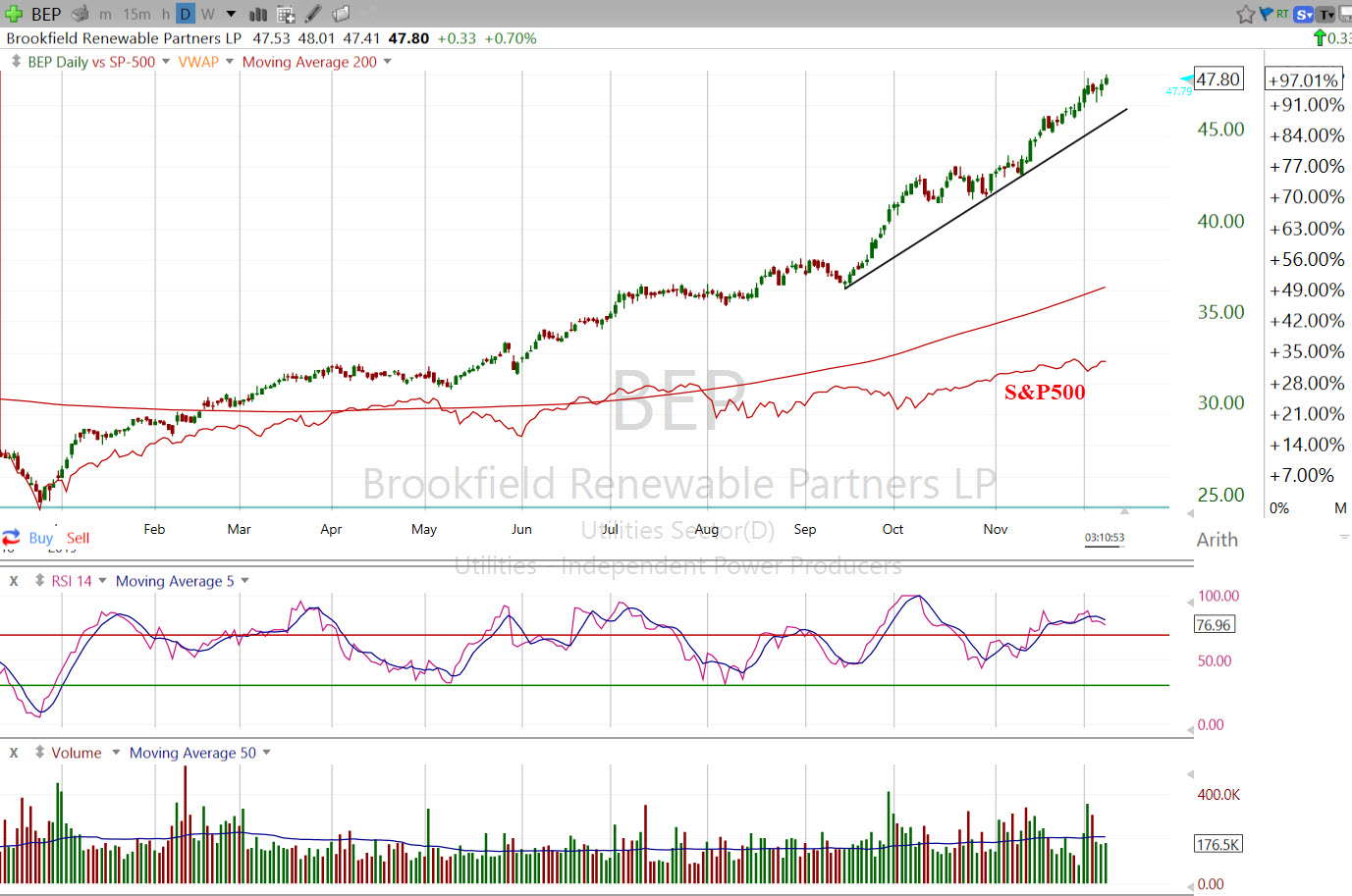

| Brookfield Renewable Partners L.P. (BEP) owns a portfolio of renewable energy facilities in North America, Europe, China, India and other markets. Electricity projects include hydro-electric, wind, solar, biomass, cogeneration and electrical storage generating 17.4 gigawatts of power. It trades on both the New York Stock Exchange and the Toronto Stock exchange (BEP.UN). As we see in Figure 1, the stock has nearly doubled since its low in December 2018. To put this move in perspective, the S&P 500 Index rose slightly more than 30% over the same period. From mid-September, BEP had gained 32% by the first week in December. BEP earned total revenue of $2.98 billion with earnings of $46.3 million in 2018. |

|

| Figure 1. Daily chart of Brookfield Renewable Partners showing how itís performed through 2019 compared to the S&P 500 Index. |

| Graphic provided by: Freestockcharts.com. |

| |

| BEP is part of the Independent Energy Producers industry that has been trending higher since 2016 and includes companies such as Algonquin Power & Utilities (AQN), Terraform Power Inc. (TERP), Pattern Energy Group (PEGI), Ormat Technologies (ORA) and NRG Energy (NRG). |

|

| Figure 2. Weekly chart showing how BEP has risen since first going public in 2010 compared to the Independent Power Producers industry. |

| Graphic provided by: Freestockcharts.com. |

| |

| Technically, the stock has risen rapidly in a parabolic blow-off type movement and so is at risk of a significant retracement, compounded by a lofty P/E of 107 (TTM). The stock has also remained firmly in overbought territory since March but has so far shown no signs of weakening. Brookfield Energy Partners belongs to an emerging group of stocks providing renewable energy for an expanding market around the globe that now employs more than 11 million workers and will experience investment of more than $8 trillion between now and 2050, according to Bloomberg New Energy Finance. For more information, please see Suggested Reading below. |

| Suggested Reading: Seasons In The Sun - Sourcing New Economy Winners And The Best Times To Trade Them TerraForm Power - A Short-Term Trade Or One For The Long Haul? Enphase Energy - New Economy Shiner? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog