HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mark Rivest

Here's a look at the US presidential election and how it can affect the stock market.

Position: Hold

Mark Rivest

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

PRINT THIS ARTICLE

MOMENTUM

Too Close to Call

11/08/16 04:41:23 PMby Mark Rivest

Here's a look at the US presidential election and how it can affect the stock market.

Position: Hold

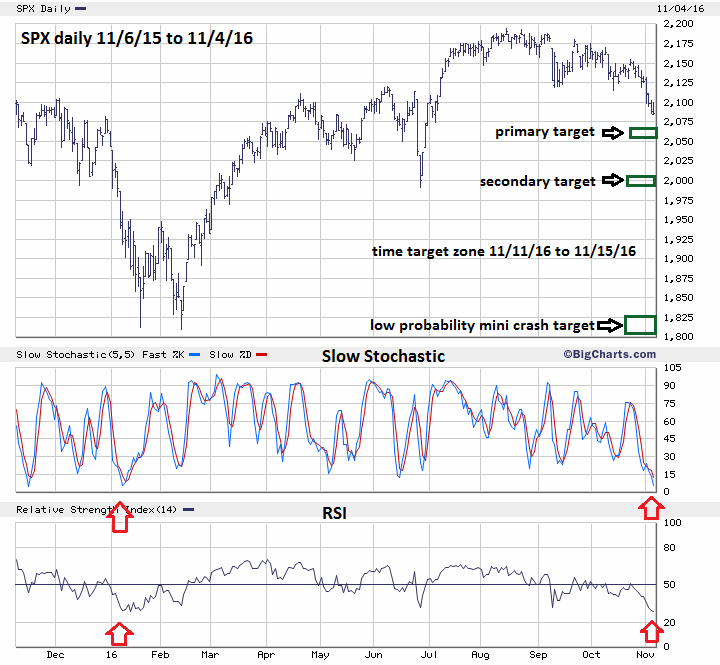

| For several weeks, the contest appeared to be over and a landslide was possible. Then, suddenly, there was a shift and the outcome is now too close to call — the US president election? No, the stock market. Since late July more and more evidence has been suggesting that stocks were poised for a sharp and deep landslide type decline, yet as of the close on November 4th the drop has been shallow. Is the stock decline finished or can there still be a sharp decline? The results of the US presidential contest could affect the contest between stock market bulls and bears. Time and Momentum Dimensions September, and especially October, are seasonally bearish for stocks and with weakening momentum (please see my article "Nasdaq Versus The World") it appeared likely a sharp deep decline could be imminent. Yet October saw a continuation of the narrow range that began in mid-July. Shorter term Fibonacci time cycles pointed to November 1st as a possible turn date, with the presumption that a decline into that time would be a bottom. November 1st opened higher, but this rally is too small to be considered as a cycle peak and since the low made on November 1st was subsequently exceeded it can't be considered a cycle bottom. It's possible the time cycle is no longer working or it could mean the stock market will turn at future Fibonacci date. Please see the daily S&P 500 (SPX) chart illustrated in Figure 1. The daily Slow Stochastic and RSI have both reached the oversold zone so it's possible a bottom is in place as of November 4th. Additionally, the low on November 4th came within a point of the SPX - 200-day Simple Moving Average which is a logical area for the bulls to defend. If a bottom is not yet in place the .618 retrace of the June-August rally is at SPX 2068.90. A second Fibonacci price coordinate is at SPX 2064.90 this is where the decline from August would equal the June 128.90 point decline. If this Fibonacci support doesn't stop the decline the next logical area for a bottom would be near the Brexit low, SPX 1990 to 2010. Finally, if something was to panic the stock market, perhaps an unexpected result of the US presidential election, the lows made in January and February are major support. One very interesting aspect about market momentum is that the SPX as of November 4th had declined nine consecutive days, something that has not occurred since 1980. On the surface this appears ominous until you discover that the SPX only declined a meager 3% over the nine-day period. Please examine the nine-day non-consecutive decline from December 30, 2015 to January 13, 2016. This decline was 173 SPX points as compared with the only 66 SPX point decline from October 24, 2016. On January 13th, the RSI was 28.45 on November 4th the RSI was 28.25. The recent SPX decline has expended a lot of downside energy and has little to show for the effort. |

|

| Figure 1. SPX Daily. |

| Graphic provided by: BigCharts.com. |

| |

| Sector Analysis Please see the Dow Jones Transportation Average (DJTA) chart in Figure 2. My article "Stock Market Lessons from Mr. Fibonacci — Part Two" noted this index was nearing important Fibonacci resistance at DJTA 8199.78 and needed to exceed the April 20th high of 8149.00 to confirm an Elliott wave A-B-C rally from the January bottom. Confirmation came on October 4th at DJTA 8171.93, the subsequent decline was only 3.5%. On November 4th, DJTA was down only 1.1%. If the broader stock market is in a bear market, then someone forgot to send this index an invitation. Additionally, since the June bottom there are two basing periods that look like the cup with handle pattern developed by William O'Neil. Another sector that is bullish relative to the broader market is the financials. The Financial Select Sector SPDR Fund (XLF) peaked September 2nd at 20.00 and was 19.49 on November 4th, down only 2.5%. Two important sectors close to making new 2016 highs implies the broader stock market could be at or near a correction bottom. |

|

| Figure 2. DJTA Daily. |

| Graphic provided by: BigCharts.com. |

| |

| US Presidential Election In my October 3rd article, I stated there are many reasons why the stock market could have a large decline — the US presidential election is not one of those reasons. What I mean by large decline is a bear market lasting several months or years. There are times when the macro-economic forces are so powerful that it doesn't matter who's in charge. The last eight years has seen massive fiscal stimulus. The US has stopped Quantitative Easing, while Europe and Asia have continued, but it won't last forever. After the end of fiscal stimulus there is a good chance a global recession could begin bringing most stock markets down. Near term there is a good chance the US stock market could be affected by the November 8th election. After the first presidential debate, which was viewed as a Clinton victory, US stocks rallied. After the FBI director announced that the Clinton email investigation would be reopened, US stocks dropped hard. It's clear the US stock market views Clinton winning the election as bullish. With the polls tightening it is nearly impossible to say who could win and we don't know the degree of the stock market's reaction. |

| Summary and Strategy The seasonal time clock is running out for the bears, while October is the most likely time for a large stock market decline there have been instances when declines continued into November. For example, the late 1929 crash didn't bottom until November 13th The February to August rally was 130 trading days x 50% = 65 trading days added to the August 15th peak targets November 15th as a possible turn date, November 14th is a full moon. There is also a calculation using Fibonacci calendar days the yields a time target in the same zone. Adding a Fibonacci- 89 calendar days to the August 15th top targets November 11th as a possible turn date. The time zone of November 11th to the 15th could be a top or a bottom, it all depends on the market's reaction to the election. Be prepared for anything, even though market momentum is indicating a bottom could be forming there's still a chance of a break all the way down to the SPX low 1800 area. The last recommendation was to sell all long positions on a break below SPX 2114 and increase the short position to 100%. Maintain the short position and lower the stop loss to SPX 2181. Further Reading: Frost A.J and Robert Prechter (1985) "Elliott Wave Principle", New Classics Library. O'Neil J. William (2009) "How to Make Money in Stocks", McGraw-Hill |

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

| Website: | www.fourdimensiontrading.com |

| E-mail address: | markrivest@gmail.com |

Click here for more information about our publications!

Comments

Date: 11/10/16Rank: 5Comment:

Date: 11/10/16Rank: 2Comment:

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor