HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mark Rivest

Here's how this mathematical ratio can be used to find the next important stock market bottom.

Position: N/A

Mark Rivest

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

PRINT THIS ARTICLE

MARKET TIMING

The Golden Section

06/08/15 04:32:18 PMby Mark Rivest

Here's how this mathematical ratio can be used to find the next important stock market bottom.

Position: N/A

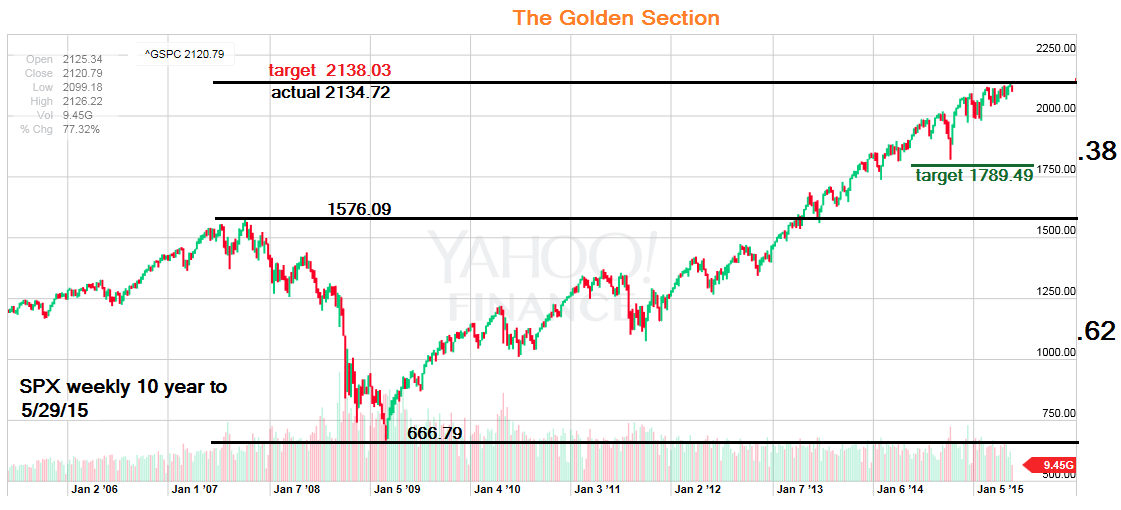

| Perhaps the single strongest piece of evidence that US stock indexes have reached an important peak maybe unknown to almost everyone using fundamental analysis. Most technical analysts are probably unaware of the evidence. Even some practitioners of Elliott wave theory may have missed the evidence. The evidence is a simple calculation. Take the decline of the S&P 500 (SPX) from 2007 to 2009 of 909.30 points x 1.618 = 1471.24 added to the 2009 bottom at 666.79 targets 2138.03. The Fibonacci ratio of 1.618 is a main tool in Elliott wave analysis. Two of the factors that govern the importance of a Fibonacci turn point are time and proximity to the target. The longer the time between Fibonacci coordinates the more important the potential turn. The SPX peak made on May 20, 2015 is over 7.5 years from the beginning coordinate. The high of the SPX so far is 2134.72, only 3.31 points from the target — incredible precision! Time and proximity factors strongly imply a pinnacle that could hold for years. |

| Price Dimension The SPX, by getting so close to the 1.618 target, has formed a golden section with the 2007 peak at 1576.09 as the dividing line (Figure 1). Unfamiliar with the golden section? If you look at the human body from top of the head to toe and use the navel as the dividing line, that creates a golden section. This phenomenon occurs throughout nature, even in the stock market. For more detail, click here for the Wikipedia definition. |

|

| Figure 1. Weekly Chart Of SPX. The new target for the bottom is 1789.49. |

| Graphic provided by: Yahoo! Finance. |

| |

| Assuming the May 20, 2015 peak at 2134.72 holds, it can be used to calculate the next smaller golden section and SPX bottom. My April 3, 2015 article "Stock Market Turns Down" discussed the possibility the SPX had formed an ending diagonal triangle (EDT) from the February 2014 bottom. Because of the subsequent movements of the SPX since the April 3, 2015 report, evidence now strongly suggests that a EDT started at the October 15, 2014 bottom. As noted in my previous articles, after completion of a rising EDT the decline is sharp at least to the level of the point of origin. Notice on the weekly chart of the SPX the October 2014 bottom at 1820.66 comes close to the golden section divide. The 2015 peak at 2134.72-1576.09 the 2007 peak = 558.63 x.618 = 345.23. The 2015 peak 2134.72-345.23 targets 1789.49 which is our new bull's eye bottom target. A broader bottoming zone is in the range of SPX 1830 to 1780. |

| Time Dimension My May 27, 2015 article "The Battlefield" reiterated that 26 days continues to be a valid model for a near-term SPX rapid decline. There are factors during the week of June 14-June 20 that could cause any potential decline to last longer than 26 days. May 20, 2015 plus 26 days targets June 15, 2015. The next day June 16, 2015 is a new moon. New and full moons occasionally are the focal points for market turns. June 17, 2015 is the second day of a FOMC meeting, a time notorious for violent moves and reversals. Perhaps the FOMC will take action, or add an unexpected word to their statement. What ever happens, this day is the prime candidate for a potential bottom. Finally, the October 15, 2014-May 20, 2015 rally was 217 days multiplied by .145 (a Fibonacci ratio) equals 31 days plus May 20, 2015 targets June 20, 2015 a Saturday, June 19, 2015 is the nearest trading day. The trading week of June 15-June 19 is the broad target zone for a possible bottom, with June 17, 2015 as the bull's eye day. |

| Knowledge vs. Emotions Markets are ruled by mass emotions. Successful trading requires you to control your emotions at crucial market turning points. This control is gained through knowledge. The current SPX golden section gives you the knowledge of when to sell, when to buy, and where to place stop loss orders. Knowledge of the SPX golden section is a powerful tool. It's your choice to use this knowledge. |

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

| Website: | www.fourdimensiontrading.com |

| E-mail address: | markrivest@gmail.com |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog