HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

More signs that there are sunny days ahead for solar stocks. Enphase is back in the lead.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

DESCENDING TRIANGLES

Enphase Breaking Out

05/07/21 03:34:56 PMby Matt Blackman

More signs that there are sunny days ahead for solar stocks. Enphase is back in the lead.

Position: N/A

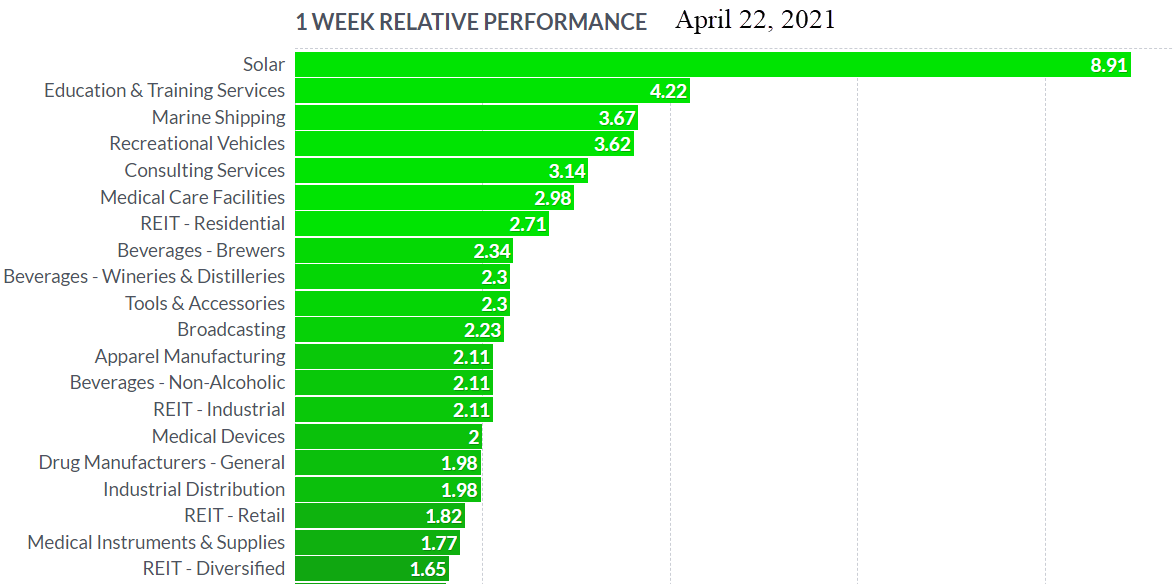

| Enphase Energy, makers of solar equipment components, has installed "over 32 million solar microinverters on more than 1.4 million homes and counting" according to the company's website. Customers can also use their solar gateway to track how much clean energy their systems are producing in real-time. In total the company holds more than 300 patents at last count. We installed Enphase microinverters and a gateway monitor on our home solar system in 2016 and enjoy being able to track output for our 3 kW Net Metered system. From a stock market perspective, it's been a rough few months for solar stocks. The group of 17 stocks lost an average 39.2% over last quarter and were down an average 8.54% for the month. But as Figure 1 shows, they more than made up the deficit in the week ending April 22 with a respectable gain of 8.91%, according to data from Finbiz.com. |

|

| Figure 1. Bar chart showing 1 week performance for the top 20 industries. |

| Graphic provided by: https://finviz.com/. |

| |

| And based on its chart, Enphase Energy has regained at least some of its former glory with a decisive breakout above its descending triangle top line recently (see Figure 2). In the last year ENPH is up more than 320% even after factoring in the 24.15% loss in the last month. This recent move looks to be signaling a recovery under way if current support levels hold. |

|

| Figure 2. Daily chart of ENPH showing the bullish breakout above the descending triangle. |

| Graphic provided by: https://finviz.com/. |

| |

| From a number of fundamental metrics, the stock looks attractive as well. Enphase has the highest operating margin at 24.1%, second highest gross margin of 44.7% and third highest profit margin at 17.3% in the solar industry, according to the latest financial data. Institutions hold more than 70% of the shares which is another positive sign. Traders appear to be cautiously optimistic given there have been a couple of false solar starts. Continued buying and strong $160 level support would be bullish. A drop below the long-term support level of $140 would spell trouble for this rally. As always, best to have a written trading plan with concrete stop-loss and profit goals set before considering jumping in with both feet. |

| Suggested Reading: Enphase Energy website Solar Stocks - Time To Start Shopping Again? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog