HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

It's been a busy year for new solar entrants. How many will survive and thrive remains to be seen.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

REVERSAL

Array Solar - Another New Solar Company Hits The Market

04/15/21 02:18:26 PMby Matt Blackman

It's been a busy year for new solar entrants. How many will survive and thrive remains to be seen.

Position: N/A

| Array Technologies is "one of the world's largest manufacturers of ground-mounting systems used in solar energy projects." Its main product is an integrated system of steel supports, electric motors, gearboxes and electronic controllers used in solar axis trackers, according to the company website. It began trading on the Nasdaq on October 15, 2020 under the symbol ARRY with an opening price of $29.50. The stock closed out the day at $36.45 on trading volume of 33.96 million shares. ARRY got a volatile start in a volatile market managing to rise to a high of $54.78 on January 8, 2021 before it began a rapid retreat to hit an intraday low of $26.13 in late March. It looked to reverse course into April. |

|

| Figure 1. Daily chart of Array Solar which began trading October 15, 2020 and rose before peaking in early January then falling to below its IPO price. The green arrow indicates its break above its down sloping top resistance line. |

| Graphic provided by: https://finviz.com/. |

| |

| As we see from Figure 1, this recent rise pushed the stock above its down-sloping top trend resistance line on April 8 which is a technical buy on 1.4 million shares, well below the 3.6 million volume average (see green arrow). The fact that the stock broke out on below-average volume is bullish, especially if the March lows hold. Low volumes on rising prices tend to show quiet accumulation by the smart money. Traders will be looking for a new base support to be confirmed in the coming trading days and rising volume to confirm that new buyers are entering the stock. |

|

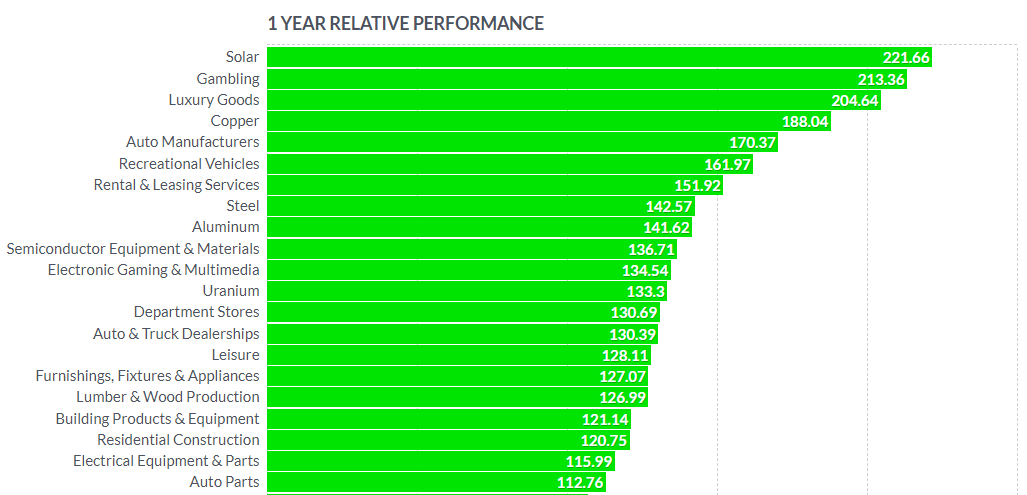

| Figure 2. One year (to April 12, 2021) showing the top performing industries with solar at the top of the list. |

| Graphic provided by: https://finviz.com/. |

| |

| Fundamentally, ARRY reported annual revenues of $872.67 million and earnings per share (EPS) of $0.49 for the year ending December 2020 up from $647.9 million and $0.33 per share in 2019 according to data from Macrotrends.net. An increasing number of players are entering the solar market as governments approve a growing number of solar and wind projects for new electricity generation. The good news is that costs for both continue to fall. It remains to be seen what impact this will have on solar company profit margins as the market gets more competitive. |

| Suggested Reading: Array Technologies website ARRY Financials Shoals Technologies - The New Solar Kid In Town |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog