HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Company goes public facing strong industry headwinds.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

VOLUME

Shoals Technologies - The New Solar Kid In Town

02/25/21 12:41:19 PMby Matt Blackman

Company goes public facing strong industry headwinds.

Position: N/A

| Shoals Technologies Group Inc. which bills itself as "a leading provider of electrical balance of systems ("EBOS") solutions for solar, storage, and electric vehicle charging infrastructure," began trading January 27 at an initial offering (IPO) price of $25. It opened at $31.30 and by the close February 22 had gained more than 31%. What makes the move more interesting is that it occurred while the solar sector and industry leaders were either flat, as was the case with Solar Edge (SEDG), or were down by more than 33%, as was the case with SunPower Corp (SPWR). The challenge now facing the industry is that although green technology stocks performed very well following the US election, that trend appears to have hit a wall mid-February. Solar industry ETF (TAN) rose more than 80% from $68 November 5 in an attempt to break through resistance at $125 on three separate occasions before finally dropping back to $103 by February 22. Conditions decidedly worsened as February began to fade. |

|

| Figure 1. Daily chart of Shoals Technologies Group Inc. showing how itís performed since going public on January 27 up 31% versus the Solar Industry (purple) down 9%. |

| Graphic provided by: Freestockcharts.com. |

| |

| Shoals Technologies has been around since 1996 building technologies and systems solutions for customers to substantially increase installation efficiency and safety while improving system performance and reliability according to the news release (below). Fundamentally, the company reported revenue of $144.49 million with a gross profit of $44.12 million in 2019, up from revenues of $103.75 million and a profit of $28.17 million in 2018. Earnings per share were $0.28 in 2019, up nearly triple from 2018 according to data from Macrotrends.net. Going public should provide it with much needed capital to grow revenues. Another positive is that as of the latest stock data, insiders held 84% of SHLS stock. |

|

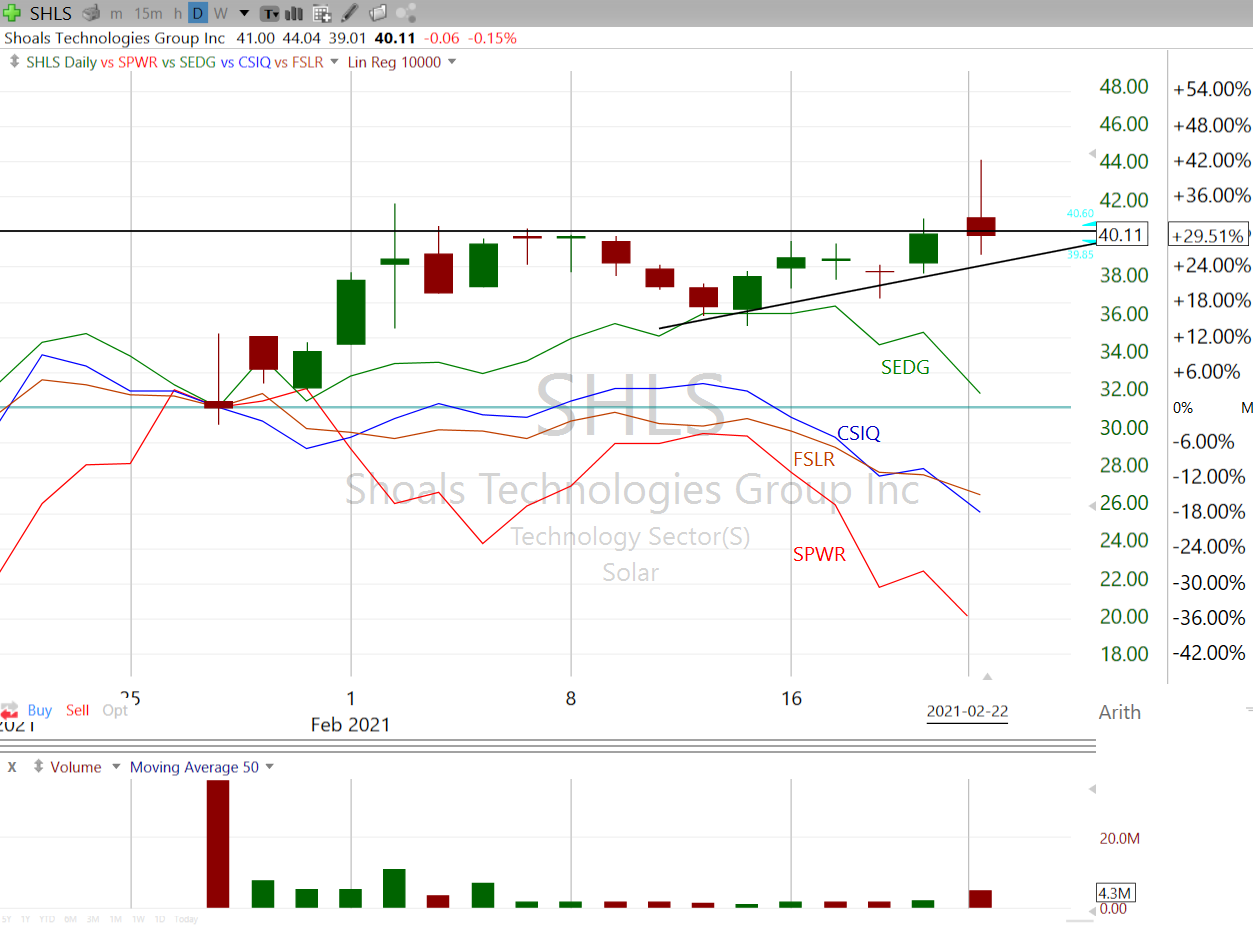

| Figure 2. Daily of Shoals (SHLS) compared to major solar companies Solar Edge (SEDG), Canadian Solar (CSIQ) First Solar (FSLR) and SunPower (SPWR), which is down 33% since January 27, 2021. |

| Graphic provided by: Freestockcharts.com. |

| |

| The billion dollar question now facing investors and traders is whether the late February downturn is simply a small correction or indication of more headwinds to come for the industry and/or markets. If Shoals Technologies is to remain a stock leader, what it does from here will determine if recent out-performance was simply IPO euphoria or something more sustainable. Price holding support around $36 followed by a decisive breach of resistance above $40 on strong buying volume would confirm bullish action. Otherwise it would be best to wait for a new buy signal and more positive market conditions. |

| Suggested Reading: Shoals Technologies Group, Inc. Announces Closing of Initial Public Offering Shoals Technologies Financial Statements - Macrotrends.net |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog