HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

The stock recently launched into space, but how long will it take for revenues to follow suit?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

MOMENTUM

Arcimoto - Three-Wheeled Stock Phenom

07/09/20 01:34:23 AMby Matt Blackman

The stock recently launched into space, but how long will it take for revenues to follow suit?

Position: N/A

| In my ongoing search for clean technology companies leading the 4th Industrial Revolution, Arcimoto popped up as a niche candidate in the electric vehicle space. An Oregon company with a mission "to catalyze the shift to a sustainable transportation system," it manufactures three-wheeled battery electric "Fun Utility Vehicles" for recreation and last-mile delivery, according its website. It's a niche company because it was the only publicly traded pure-electric vehicle manufacturer in the U.S. recreation vehicle industry at check. Classed as motorcycles for insurance purposes, FUVs do not require crash testing in the U.S. that standard four-wheel light passenger and cargo vehicles must undergo. FUVs will appeal to motorcycle riders as they provide seat belts and enhanced safety features such as optional side panels and doors that grant riders greater comfort. But as anyone who has driven a three-wheeled vehicle will tell you, handling characteristics are very different than four-wheelers, especially in heavy rain and snow. With a top speed of 75 mph and 102 mile city battery range, FUVs are powered by two front-wheel electric motors and steered by handle bars. Prices start at $19,900 and reservations can be made with a $100 refundable deposit with an expected delivery time of approximately one-year according to their website. On June 22 the company announced that their Deliverator last-mile delivery FUV would be available for rental through the HyreCar platform in Los Angeles beginning in the summer of 2020. |

|

| Figure 1. Daily chart of Fun Utility Vehicle maker Arcimoto Inc. (FUV) showing the June/July 2020 move to new all-time highs together with the long-term linear regression (fair value) line. |

| Graphic provided by: Freestockcharts.com. |

| |

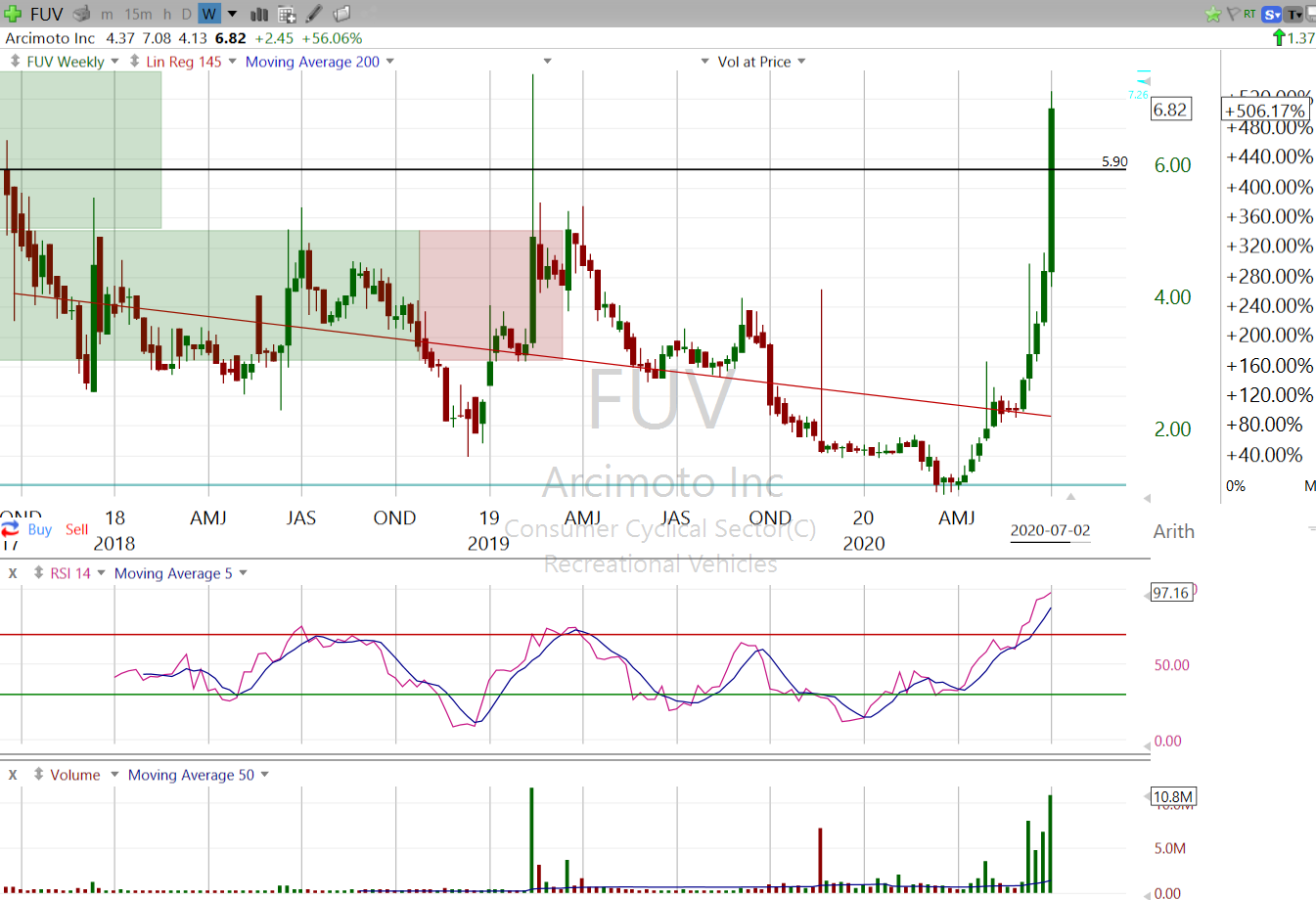

| Following the Initial Public Offering, FUV opened on September 21, 2017 at $5.90, a price it surpassed for only the second time on July 2, 2020 (see Figure 2). It jumped 64% in the last month, enjoying the same euphoria that drove other clean transportation companies in the space including Workhorse (+ 86%), Nio (+ 40%), Nicola (+ 41%) and Tesla (+ 27%). Arcimoto lost $15.9 million in the latest year or $0.15 per share on a total net income (loss) of $3.6 million with a Price/Sales of $17.57, has float of 11.6 million shares with a total of 19.4 million shares outstanding. On June 30, the company announced the sale of 1.7 million shares at $5 per share to institutional investors that raised $8.5 million "for general corporate purposes, including working capital, acceleration of the manufacture of finished goods for delivery against pre-orders, and to address increased customer demand for its products," according to the new release. |

|

| Figure 2. Weekly chart showing FUV from its IPO open of $5.90 in September 2017 together with the long-term linear regression “fair value” line (red). |

| Graphic provided by: Freestockcharts.com. |

| |

| Like many other companies in this space making parabolic moves, it has been challenging to trade. Although no one knows when the euphoria will evaporate, it would be prudent to wait for the stock to build a new base and technical buy signal before getting too carried away for those who don't already own the stock. But how far it will move up from here is anyone's guess which will undoubtedly tempt those short on patience should subsequent rallies materialize. Short of manufacturing miracles, it will still be many months before the company starts delivering on its roughly 3500 pre-order reservations and banking the sales proceeds in earnest. But if it approaches the success of the three-wheeled gas powered Can Am Spyder, which sold 100,000 units between its 2008 launch and 2015, this stock could still provide plenty of upside especially if it can make a sizable dent in the first and last mile delivery vehicle market, expected to surpass $1.1 billion by 2026 globally according to the report (below). |

| Suggested Reading: Workhorse Breakout Arcimoto Website Arcimoto Announces $8.5 Million Common Stock Only Registered Direct Offering Arcimoto Begins Renting Pure Electric Deliverator in Los Angeles Using HyreCar First and Last Mile Delivery Market to Surpass US$ 1,100 Mn by 2026 |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog