HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Electric and alternative energy vehicles got a huge lift in June, and here is one that caught the wave.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

NEW HIGHS-NEW LOWS

Workhorse Breakout

07/01/20 06:16:34 PMby Matt Blackman

Electric and alternative energy vehicles got a huge lift in June, and here is one that caught the wave.

Position: N/A

| My last Workhorse Group Inc. article provided a company background (see article link below) and corporate progress to June 2019. A year ago, the company was manufacturing a number of products that included the W-15 electric hybrid gas pickup, the Surefly electric helicopter and the Horsefly delivery drone, but what a difference a year makes. At the time WKHS was trading in the mid-$2 range. In November 2019, Workhorse signed an intellectual property agreement with Lordtown Motors to manufacture the W-15 electric-gas hybrid pickup truck. In December 2019 Workhorse sold its Surefly eVTOL (electric vehicle takeoff and landing) assets and Horsefly electric delivery drone operating unit to Moog Inc. This allowed Workhorse to focus on its core business of manufacturing electric delivery vans for courier corporate and other clients. |

|

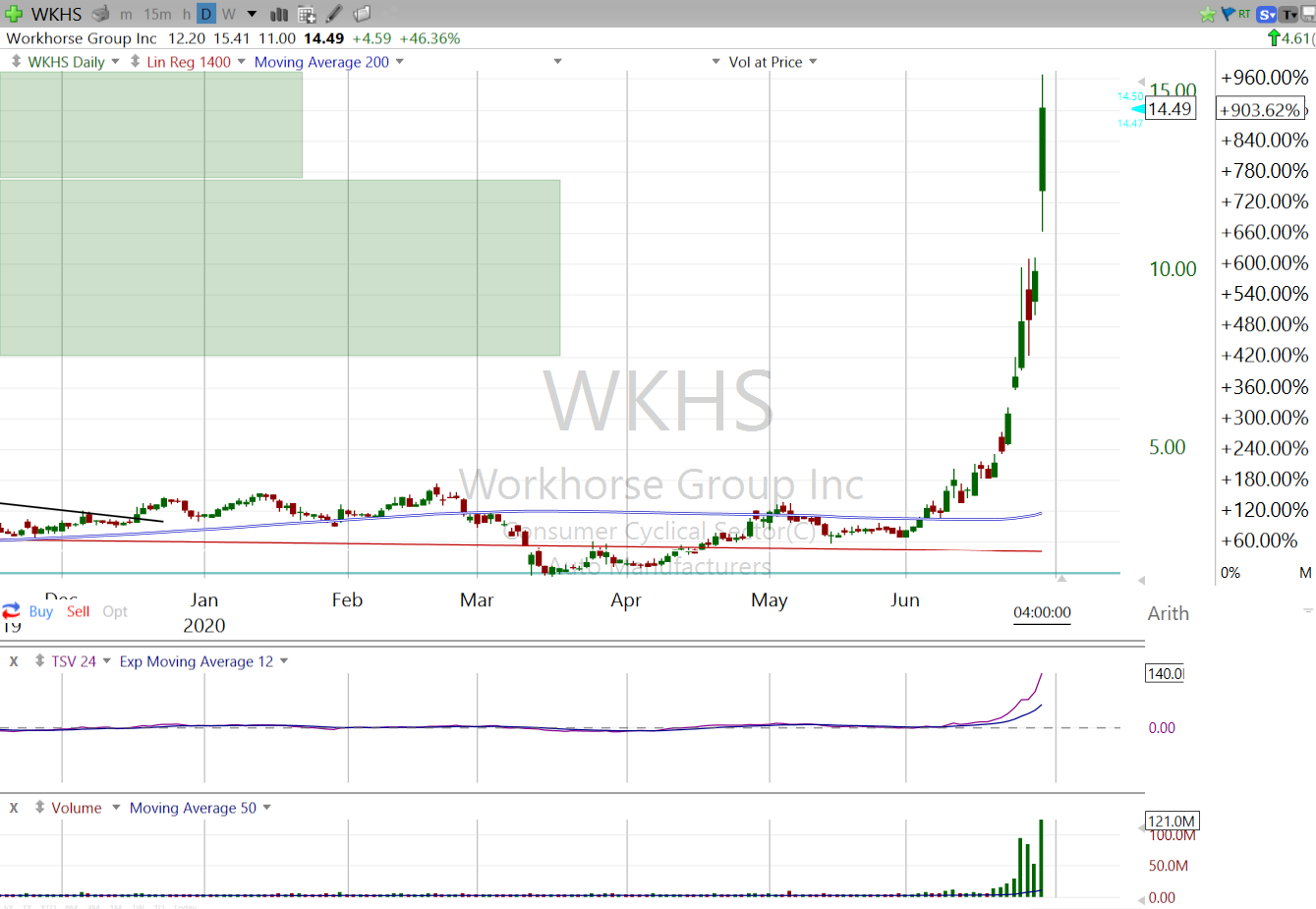

| Figure 1. Daily chart of Workhorse Inc. showing its incredible rise in June. |

| Graphic provided by: Freestockcharts.com. |

| |

| But what drove the rise of WKHS and a number of companies manufacturing electric and hybrid vehicles was soaring interest in alternative energy vehicles including Nicola Corp (NKLA), makers of the hydrogen-electric semi tractor that will compete with the Tesla battery electric Tesla tractor. NKLA stock experienced a more than 200% gain in June following its Initial Public Offering before settling back toward the end of the month. Compared to Nicola, Tesla which manufactures an all-electric semi tractor, and has been producing and selling electric vehicles for more than a decade, enjoyed a modest 20% June lift. But unlike Workhorse (and Tesla) which have products to sell, Nicola has yet to produce its first production vehicle. The fact that the Nicola semi tractor will also be powered by hydrogen adds additional risk given that there were a just 43 public hydrogen filling stations (up from 39 stations in 2019) compared to 25,894 electric charging stations across the US according to the US Department of Energy (see link below). And the Workhorse corporate financial picture has improved somewhat over the last year. Net income was $4.8 million in Q1-2020, compared with a net loss of $6.3 million in Q1-2019. Sales for the first quarter of 2020 were $84,000, compared with $364,000 in the first quarter of 2019. The decrease in sales was primarily due to a decrease in the volume of trucks shipped according to the company website. |

|

| Figure 2. Weekly WKHS chart with its ten-year linear regression (fair value) line as the stock put in new all-time highs in June 2020. |

| Graphic provided by: Freestockcharts.com. |

| |

| From a technical point of view, WKHS stock has gone parabolic which has made buying the stock recently a challenge. It will be interesting to see how this stock and the alternative energy manufacturing sector perform in the coming months after the current stretch of volatility that has been anything but rational. It would be great to see the stock settle and form a new base before taking a new position. Otherwise, jumping in at these prices could be considered little more than an optimistic gamble. But compared to Nicola, still in the development phase, WKHS could be considered a more logical choice given that it actually produces products, real product revenues and has existing contracts in place. |

| Suggested Reading: Workhorse Group Inc website Workhorse Wonder? 6/28/19 Hydrogen Fueling Stations by State Fossil Fuels Vs. Clean Energy: Time To Shift Your Money? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog