HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Unlike many Original Equipment Manufacturers in the electric vehicle space, this company has been around for a while, has real revenues AND looks to be building a compelling chart pattern.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

ASCENDING TRIANGLES

Workhorse Wonder?

06/28/19 04:21:26 PMby Matt Blackman

Unlike many Original Equipment Manufacturers in the electric vehicle space, this company has been around for a while, has real revenues AND looks to be building a compelling chart pattern.

Position: N/A

| As the digital revolution driven by renewable energy gathers momentum, many companies are competing for position. Unfortunately, few have real revenues and an expanding market. Workhorse is different. The Workhorse Group, Inc. consists of two plants — a 50,000 sq ft facility that designs and produces battery-electric power trains, as well as a 200,000 sq ft facility that produces Original Equipment Manufactured (OEM) medium duty trucks for the commercial delivery van market and fleet sales. Its principle focus is on electrifying and manufacturing commercial vehicles. It is currently also taking fleet sales orders for its hybrid electric pickup truck. Products include the all-electric NGEN 5,600 lb delivery van with 100 mile range per charge, the Workhorse W-15 hybrid electric pickup with 80 mile electric-only range and the two person Surefly hybrid-electric autonomous helicopter. |

|

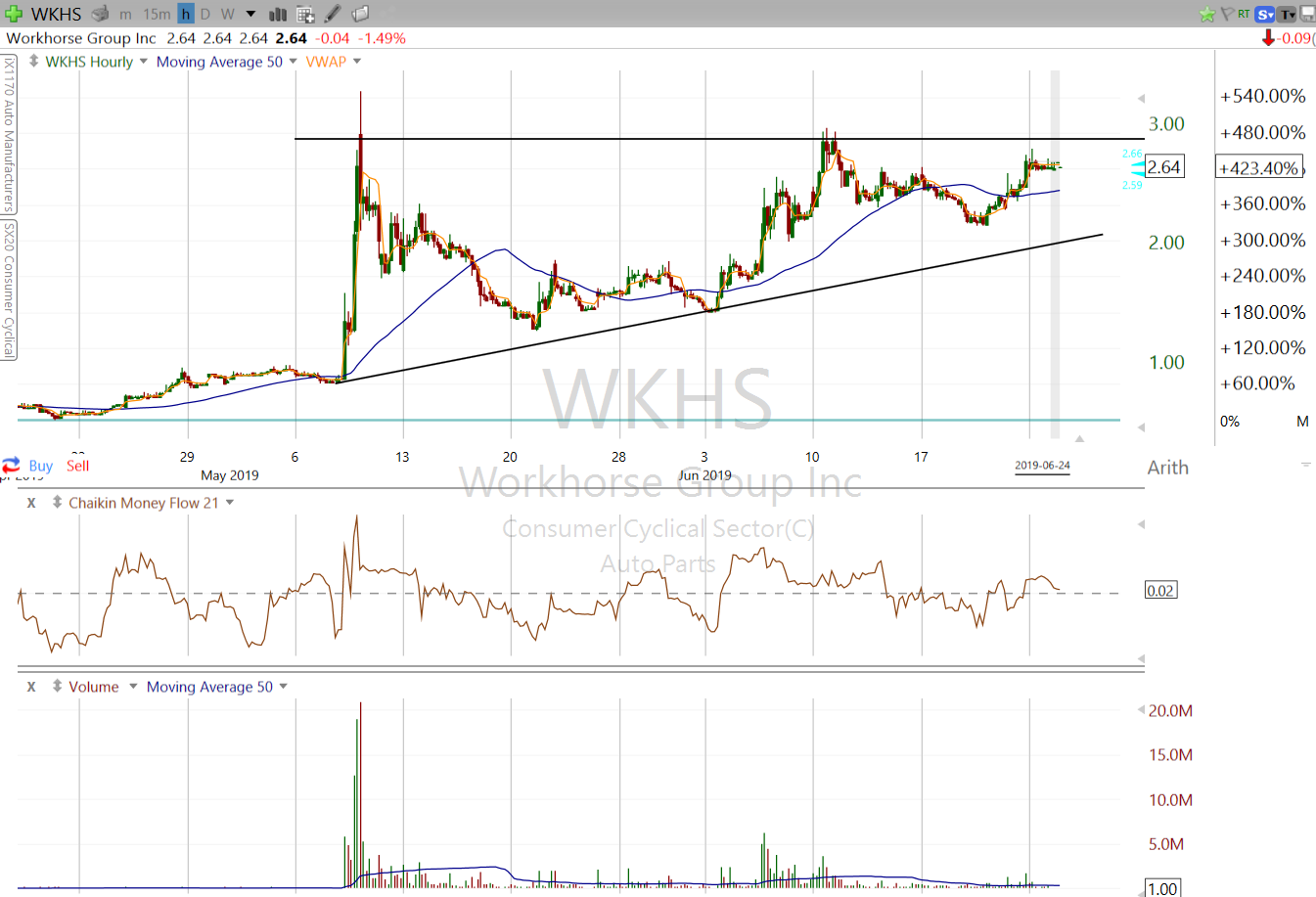

| Figure 1. Daily chart of Workhorse Group (WKHS) showing the rising triangle forming on the stock and its most recent low. |

| Graphic provided by: Freestockcharts.com. |

| |

| In Q1-2019, the company reported sales of $364,000, down from $560,000 in Q1-2018 due primarily to a decrease in the volume of trucks delivered, which is a concern. However, you'd never know it from the daily chart in 2019 which shows a jump of more than 400% since mid-April (Figure 1). In the process, it has posted a bullish ascending triangle chart pattern. From a long-term perspective (Figure 2), the weekly chart shows how volatile the company has been since it began trading on the Nasdaq in 2010. |

|

| Figure 2. Weekly chart of WKHS since appearing on the Nasdaq in 2010. |

| Graphic provided by: Freestockcharts.com. |

| |

| This volatility is further demonstrated on a seasonal chart showing how the stock has performed on average throughout the year. This chart shows periods of strength from mid-February to May, August into September and in early December. |

|

| Figure 3. Seasonal chart showing how WKHS has performed through an average year. |

| Graphic provided by: EquityClock.com. |

| |

| The electric vehicle (EV) market has demonstrated incredible growth, making forecasting an ever-moving goal post. In 2018, Bloomberg New Energy Finance forecasted that there would be 548 million EVs on the road by 2040, up significantly from the 400+ million BNEF forecast in 2016. Not surprisingly, in 2018 oil company Exxon forecasted just 162 million EVs on the world's roads by 2040, which is 70% lower than the BNEF base case (see article link below in Suggested Reading) and also well below forecasts by OPEC and BP. But one thing is clear. It will be hard for companies making internal combustion and diesel motors to compete with much more efficient electric vehicles when EVs achieve purchase-cost parity with their fossil fuel counterparts, which is anticipated by 2024! It will be companies that have survived long-enough in this space to achieve sustained profitability and the ability to compete long-term that will capture the largest market shares. If WKHS can break above overhead resistance in the $3 range on above average volume, it has the potential to approach its 2017 high of $4.50. The stock hit an all-time high of $11.70 in April 2016. |

| Suggested Reading: Workhorse Group Website http://workhorse.com/ Researchers have no idea when electric cars are going to take over https://qz.com/1620614/electric-car-forecasts-are-all-over-the-map/ |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor