HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Stocks have been recovering after the drubbing they took in March and some clean technology companies are leading the pack. Here is one.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

RATE OF CHANGE

Evoqua Water Technologies ̶ Coming On Strong

04/23/20 04:08:02 PMby Matt Blackman

Stocks have been recovering after the drubbing they took in March and some clean technology companies are leading the pack. Here is one.

Position: N/A

| Evoqua Water Technologies (AQUA) delivers products, solutions and services to ensure water quality and consistency for municipalities, industrial water users and recreational facilities, according to the company website. So why is this important? There are a growing number of North American communities that have challenges providing clean water. According to the EWG.org, there are 1,477 sites in 49 states contaminated with polyfluoroalkyl substances (PFAS) alone, a group of 5,000 chemicals known as "forever chemicals" because they take so long to break down and are linked to a myriad of health problems from increased cholesterol to immune system problems and several types of cancer. PFAS are just the tip of the iceberg when it comes to toxic chemicals now found in our water. |

|

| Figure 1. Daily chart of Evoqua Water Technologies showing the bullish bottom pattern from mid-March into April with a cup like pattern and pattern resistance which is then broken. |

| Graphic provided by: Freestockcharts.com. |

| |

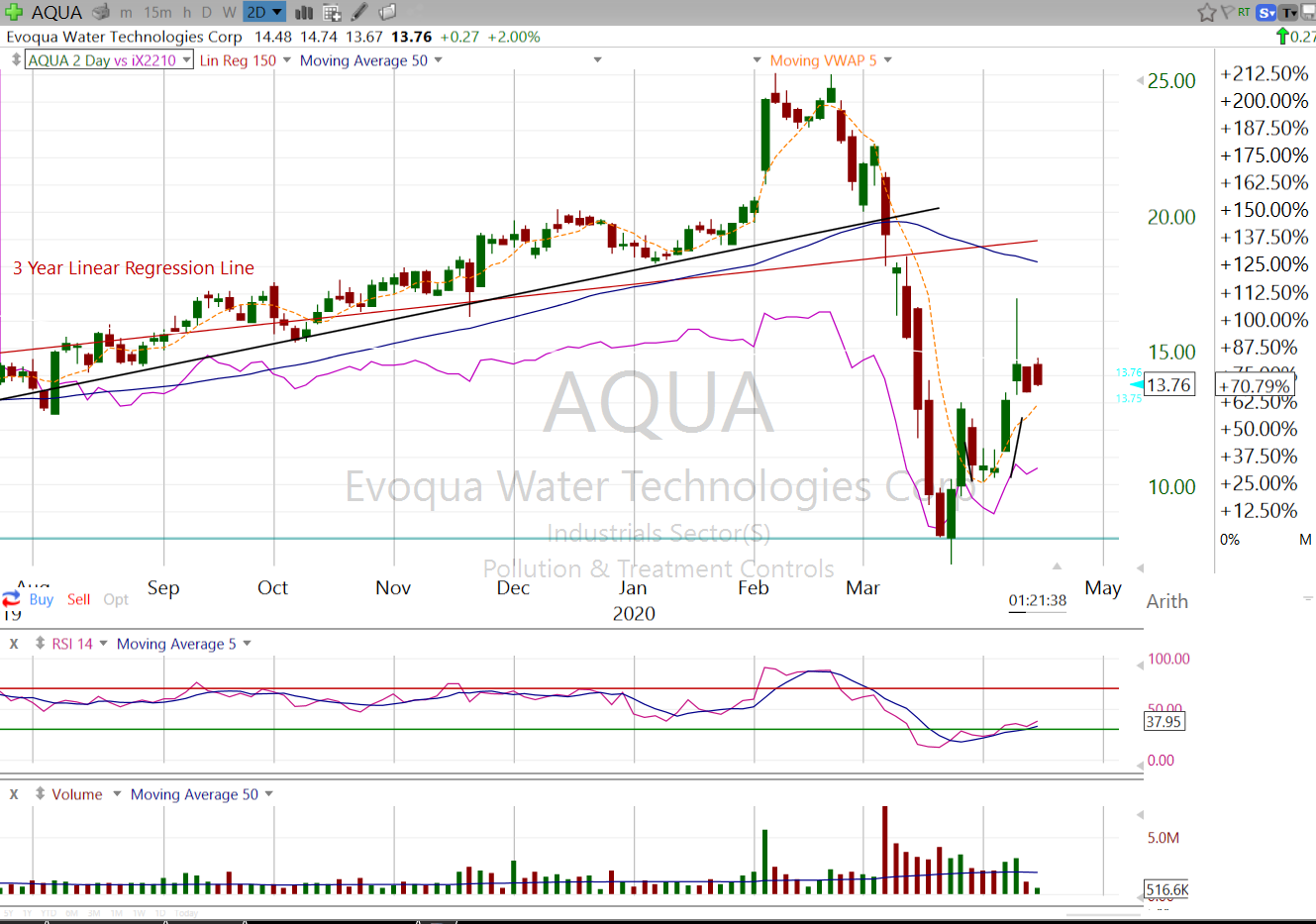

| According to the National Resources Defense Council (NRDC) nearly 77 million people were served by more than 18,000 community water systems that violated the Safe Drinking Water Act in 2015 and that is before the U.S. Administration began to dismantle environmental legislation. Needless to say this creates a significant opportunity for water pollution treatment and clean-up companies like Evoqua. The company saw its stock price rise more than 200% between late November 2018 and mid-February 2020, and although it gave most of that gain back over the next month, AQUA recovered nicely into mid-April, up 70% in just three weeks. But as we see from Figure 2, price is still below its long-term linear regression line, so still undervalued from a technical perspective. |

|

| Figure 2. Weekly chart showing AQUA compared to its Pollution and Treatment Controls industry performance (purple) and the three-year linear regression line (red). |

| Graphic provided by: Freestockcharts.com. |

| |

| AQUA shows a strong balance sheet with earnings up more 390% in the latest quarter and than 800% in the latest year on earnings of $60.4 million. More than 57% of its shares are held by institutions. Technically the stock is recovering strongly from the March meltdown as it put in a V type bottom before posting a cup pattern that looks to be morphing into a bull flag with support around $14. Assuming the market doesn't get hit with another spate of bad news, look for AQUA to work back up toward $20. If $14 is broken on above average volume, it will be time to exit and wait for more positive stock action. I discuss other clean technology companies that are leading the 4th Industrial Revolution in other articles in Traders.com Advantage and TASC. |

| Suggested Reading Evoqua Water Technologies Website Threats on Tap: Widespread Violations Highlight Need for Investment in Water Infrastructure and Protections Brookfield Asset Management - Another Good Green Tech Bet? Fossil Fuels Vs. Clean Energy: Time To Shift Your Money? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog