HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

What's next for Facebook, and what lessons can we learn after its rebound from the 200-day moving average?

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

What Trading Lessons Can We Draw From Facebook?

06/13/19 02:54:47 PMby Fawad Razaqzada

What's next for Facebook, and what lessons can we learn after its rebound from the 200-day moving average?

Position: N/A

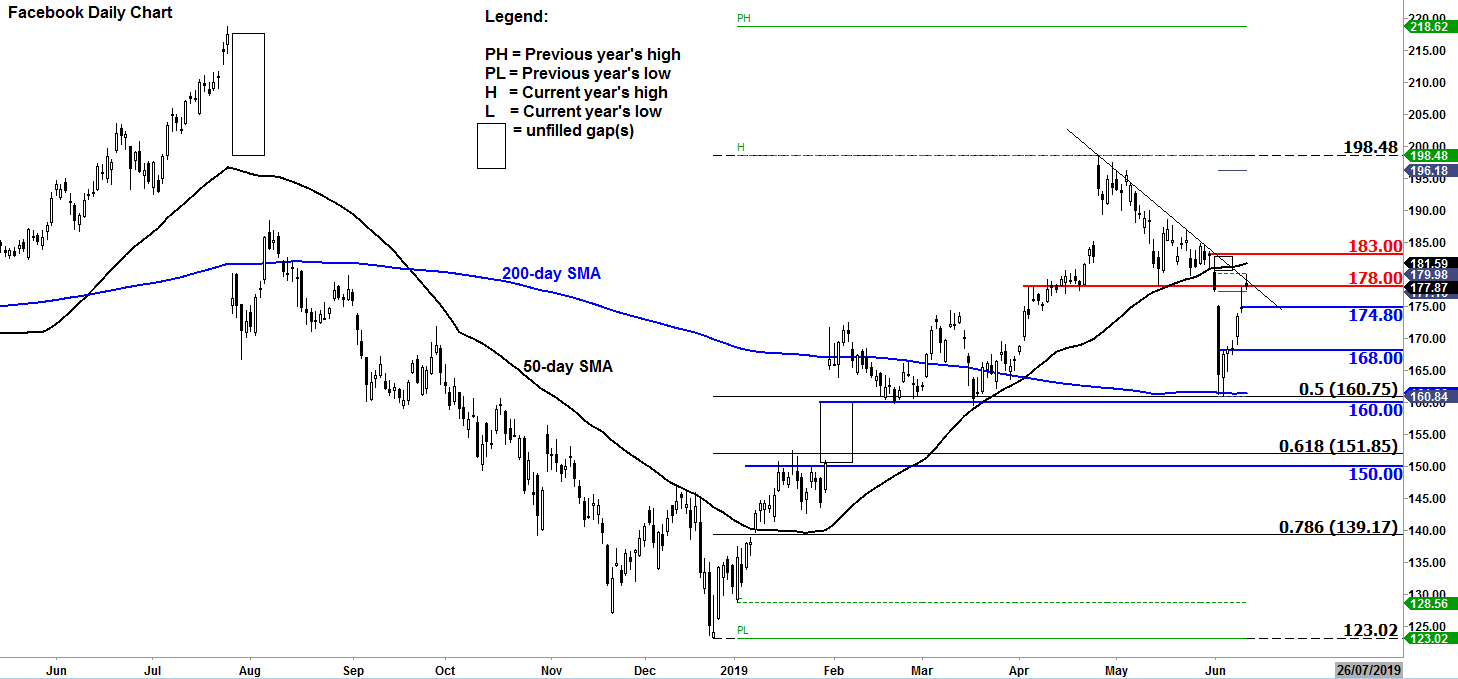

| Last week, I wrote a report on Facebook, highlighting the potential for a bounce from the 200-day moving average after some big technology stocks, including FB, had dropped on the back of reports that regulators in the US were preparing to investigate whether they had misused their market power to harm competition. As mentioned as a possibility in that article, Facebook did indeed manage to regain some lost ground after it found good support initially from the 200-day moving average at just above $161.00 and it managed to break through $168 short-term resistance. But FB has now reached a more significant resistance level around $178.00, a level which I had highlighted last week. As well as this being an old support level, we have a bearish trend line converging here. There is the potential therefore for renewed selling pressure to resume from around here. Going forward, if FB shares start to break down then a return towards support levels at $174.80 and $168.00 would become likely, though if the latter breaks then this would strongly point to an eventual breakdown below the 200-day average and support around the $160/61 area. But if FB manages to build a base above the $178 resistance first then at the very minimum, it could go on to fill the gap below $183, before potentially rising to a new 2019 high above $198.50. |

|

| Figure 1. Facebook Daily Chart. |

| Graphic provided by: eSignal. |

| |

| Now if you didn't buy FB after it showed reversal bullish signals around its 200-day average last week, then you can at least learn some lessons from it so that in the future if similar setups were to show up, you know exactly what to look for. |

| In this case, there were several reasons why FB rebounded like it did. As well as the fact we had the 200-day average providing support, there was the 50% retracement level and a horizontal support, all converging in close proximity around $160/61 area. In addition, price had already formed an inside bar daily candle there, providing us with confirmation that the buyers were happy to step in at, or around, this key support zone. While buying after confirmation means you won't get the best price, at least this would provide you some market structure to work with on the next day, meaning you will know exactly where to place you stop loss (i.e. below the inside bar candle from the previous day) etc. |

| But analyzing the chart and entry are just parts of a trade. Equally important are trade and risk management strategies once you are in a trade. Remember, you realize a profit or loss once you close the trade, and this is why drawing your levels ahead of time is important. It helps to ensure that you don't lose sight of the bigger picture, as it is very easy to get emotionally attached to a trade. But with your resistance levels already drawn on the chart, you know where the objectives are for the trade ahead of time. While Facebook could go on from here to make significant gains, the reaction from Monday's candle goes to show how sensitive price can be to such important levels — notice how after spiking to $178 resistance on Monday price quickly dropped to close at $174.80. (On a side note, that reaction alone could have provided a decent intra-day sell trade.) But the stock could well have gone on to fall significantly on Monday from that resistance level (in fact, it may still do so as FB is still technically holding within that zone) which makes it imperative that regardless of your conviction in a trade, always book at least some profit along the way and ideally around such key technical levels. |

| You can always leave some in there in case price starts to trend significantly higher so that you don't miss out on any big moves. That small portion alone could provide you with some significant gains every now and again when a stock starts moving sharply higher. But more to the point, leaving a small portion in there also allows you to re-enter full size or add more at higher levels in such a way that your average price will still be below market. Among other things, this would mean that you could comfortably afford a wider stop loss on the whole of the position than you would otherwise, should you become convinced —due, for example, to the evolution of price action — that a significant move might be on the way. However, if you had closed your entire position at first resistance or prematurely, then re-entering at a later time and at unfavorable prices could prove to be very tricky as it might require you to have a very wide stop loss (which in turn means you may only be able to afford a relatively small position and therefore not be able to profit much, even if the stock were to rise 5 or 10 percent from there). Think of taking small profits along the way as reward for your hard work: you need to pay the trader. Paying yourself will also relieve some of the emotional attachment that you may have to a particular trade. |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog