HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

As an overall indicator, General Motors stock has much to say about the health of the market.

Position: Sell

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

HEAD & SHOULDERS

GM Chart Shows More Trouble Ahead

05/20/14 03:49:38 PMby Matt Blackman

As an overall indicator, General Motors stock has much to say about the health of the market.

Position: Sell

| In "General Motors Chart Speaks Volumes" I argued that as a one-time stock market bellwether, what was happening on the GM chart was a reflection of overall stock health. At the time of the article, the chart had recently confirmed a bearish market topping that suggested lower prices were in store. Since then the chart looks to be setting up a second head & shoulders (H&S) pattern which is not surprising given the growing recall and litigation problems the company is encountering (see Figure 1). The first H&S pattern forecasted a minimum downside target of under $30. The second H&S pattern, if confirmed with a decisive breach of the lower neckline, would reset the downside target to less than $22. |

|

| Figure 1. Daily chart of General Motors (GM) chart showing the second head & shoulders (H&S) pattern building. A breach of the lower neckline would lower the projected price target to less than $22. |

| Graphic provided by: TC2000.com. |

| |

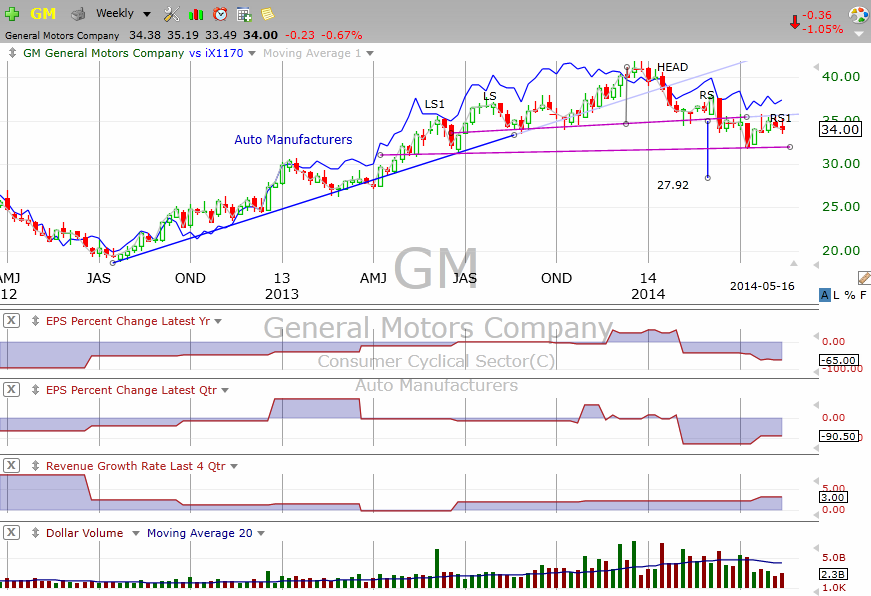

| On May 16, 2014 it was announced that GM had been hit with the maximum fine possible by the National Highway Traffic Safety Administration of $35 million for its handling and delays in the recalls. "GM did not act and did not alert us in a timely manner. What GM did was break the law. They failed to meet their public-safety obligations," U.S. Transportation Secretary Anthony Foxx was quoted as saying to reporters at a May 16, 2014 news conference, according to Bloomberg. But as the weekly chart in Figure 2 shows, investors began selling the stock in January 2014 as the breach in the medium-term up-sloping trendline shows. The first H&S pattern was confirmed March 12, 2014 (see Figure 1). |

|

| Figure 2. Weekly chart of GM showing the trends in earnings and revenues. Notice that earnings growth turning negative became clear just as the first H&S pattern was being confirmed and well after the uptrend breach. |

| Graphic provided by: TC2000.com. |

| |

| According to an April 24, 2014 Fortune article (see Suggested Reading), GM posted "a scant $125 million first-quarter profit Thursday, an 86% drop from its profit in the same quarter one year ago." As Figure 2 shows, annual earnings per share were declining at 65% and quarterly earnings were falling at a rate of 90.5% as of the latest earnings data. Even before the record fine, GM offered owners of recalled vehicles added incentives to spur sales. But until the company sees an end to its recall troubles, stock prices will continue to encounter stiff headwinds. |

| Suggested Reading: GM To Pay Record Fine of $35 Million Over Handling of Recall http://www.bloomberg.com/news/2014-05-16/gm-said-to-agree-to-u-s-fine-over-ignition-switch-recall.html GM posts huge profit drop driven by ignition switch crisis http://finance.fortune.cnn.com/2014/04/24/gm-posts-huge-profit-drop-driven-by-ignition-switch-crisis/ GM sweetens incentives to owners of recalled vehicles http://www.autonews.com/article/20140501/RETAIL01/140509978/gm-sweetens-incentives-to-owners-of-recalled-cars-sees-sales-rise |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog