HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Periodically new stock plays come along that have yet to be recognized by the wider investing public. Here's one that you probably haven't heard of yet.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

ACCELERATION

Spectra Energy - Flying Below The Radar

05/12/14 04:01:47 PMby Matt Blackman

Periodically new stock plays come along that have yet to be recognized by the wider investing public. Here's one that you probably haven't heard of yet.

Position: N/A

| As May began, the overall stock market was in the doldrums, market leaders were struggling and indexes were barely treading water. But a few companies were consistently making new highs like oil & gas pipeline supplier Spectra Energy Partners (SEP). It was the only company to pop up on my "New Flier's" search on May 5, 2014 that looks for stocks with high growth and low institutional ownership. (For more see "Rice Energy: An Interesting New Energy Play") |

|

| Figure 1 – Daily chart of Spectra Energy showing the breakout above $48 in February together with the accelerating fundamentals. |

| Graphic provided by: TC2000.com. |

| |

| There are a number of facts about SEP that make it a compelling stock. First, it has continued to appreciate in value despite having little news appear about the stock. It was last in the news back in July 2013 following an announcement that the company had won a $3 billion bid with NextEra Energy to build a pipeline to supply Florida's natural gas needs. Second, it has clearly not hit the money manager's radar yet with just 16% of the shares held by institutions. Third, income is ramping up fast with revenue up 692% in the past four quarters and earnings up 174% in the past year. This growth has pushed its PE ratio down to an attractive value south of eight times earnings according to the latest data available. |

|

| Figure 2 - Weekly chart comparing Spectra Energy with other companies in the space (blue line) showing that both are heading in the same direction. |

| Graphic provided by: TC2000.com. |

| |

| Note the big jumps recently in revenues and income on the right-hand side of the weekly chart in Figure 2 which would explain the price rise in lieu of any news. |

|

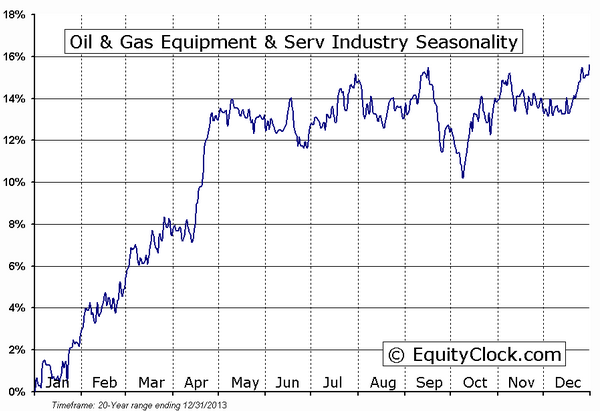

| Figure 3 – Seasonal chart of the Oil & Gas Equipment and Services industry showing the best times of the year to be invested. |

| Graphic provided by: www.EquityClock.com. |

| |

| It is important to point out that from a seasonal standpoint the best period in the calendar year for this group is behind it based on the seasonal chart in Figure 3. However, the company still has the potential to outperform its peers in the industry given the factors discussed above. And even if the company performs just as well as its peers, the period between mid-October and May has proven to be a good time to hold companies in this space. |

| SEP is a compelling momentum play which is well worth adding to your watchlist of stocks to buy on the next breakout. Ideally, the stock will take a rest and consolidate through the summer which would make buying it an even more attractive proposition. Suggested Reading: Spectra Wins $3 Billion Interstate Florida Gas Pipeline |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog