HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Energy stocks have been on a tear since early February. Here's a new energy play that looks ready to soar.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

NEW ISSUES

Rice Energy: An Interesting New Energy Play

04/21/14 05:30:23 PMby Matt Blackman

Energy stocks have been on a tear since early February. Here's a new energy play that looks ready to soar.

Position: N/A

| One search I do almost daily, which is called "New Fliers," looks for little known, under-owned stocks with low market cap and a small number of shares in the float as well as low institutional ownership. They are stocks that have the potential to move substantially higher as they become better known and appreciated by both professional and retail investors. |

|

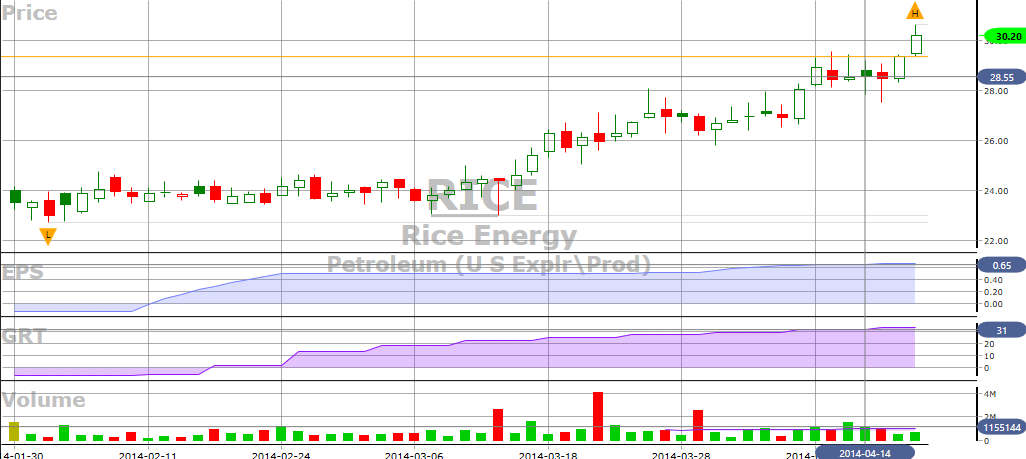

| Figure 1 – Daily chart of Rice Energy Inc. showing the steady rise in institutional participation since it first went public in late January 2014. |

| Graphic provided by: TC2000.com. |

| |

| Rice Energy Inc. (RICE), which came up in a recent search, is an oil and gas company that launched its IPO in late January 2014 at $21.00 and had appreciated nearly 50% by mid-April. There are a total of 127 million shares outstanding and as of the latest data, the company had annual sales per share of $0.57 which is impressive. As we see from Figure 1, institutional ownership has gone from zero to nearly 10% since then and the stock rise is due at least in part to this accumulation. RICE has forecasted annual Earnings per Share (EPS) of $0.66 as well as a one- to three-year forecasted growth rate of 31% (and rising), which is excellent according to the latest data from VectorVest.com (see Figure 2). |

|

| Figure 2 – Chart that includes the fundamentals showing how Earning per Share (EPS) and the forecasted Growth Rate (GRT) have been steadily rising since the company began trading. |

| Graphic provided by: www.VectorVest.com. |

| |

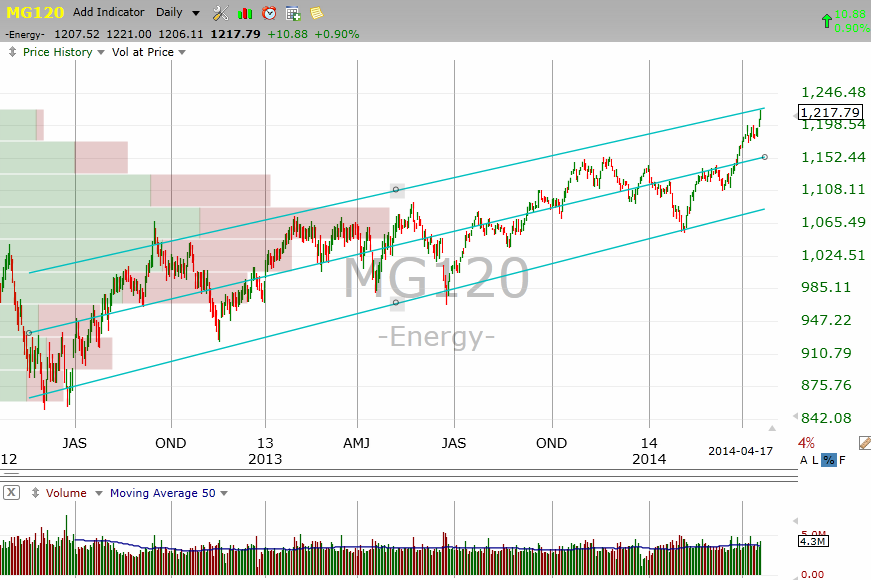

| As we see in Figure 3, the energy sector has been in a strong uptrend since early 2012 and is currently at the upper end of its one-standard deviation linear regression channel. |

|

| Figure 3 – Chart of energy sector since early 2012. |

| Graphic provided by: TC2000.com. |

| |

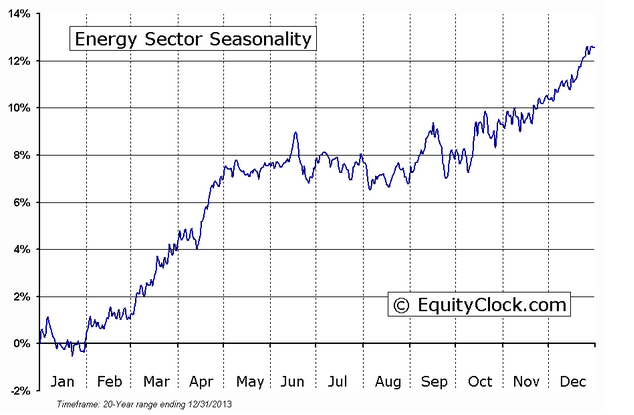

| Finally, seasonality for the energy sector will remain positive until mid-June when this sector goes sideways before resuming an uptrend in late August (Figure 4). |

|

| Figure 4 – Energy sector seasonality over the last 20 years. |

| Graphic provided by: www.EquityClock.com. |

| |

| From a trading perspective, ideally RICE will pull back closer to its linear regression mid-channel line, since like the sector it is also at the top of its upper one channel line. The risk of waiting is that energy demands remain strong and the stock just keeps on reaching higher. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog