HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Dark clouds are gathering. My last article about the stock entitled "What's Next For Netflix?", marked the beginning of some bearish action.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

HEAD & SHOULDERS

Netflix - Negative Reaction To Positive Earnings A Bad Sign

05/01/14 04:22:44 PMby Matt Blackman

Dark clouds are gathering. My last article about the stock entitled "What's Next For Netflix?", marked the beginning of some bearish action.

Position: N/A

| There is a well worn adage in trading to describe what kind of a market it is based on investor reaction. Bad news, good action denotes a bull when participants take most news in stride and don't sell their positions at the first hint of trouble. Goods news, bad action describes a bear in which investors react negatively no matter what news they get. And it was this latter response to positive news from Netflix that is troubling, especially given the pattern that's been flashing on the NFLX chart. |

|

| Figure 1 – Daily chart of Netflix showing positive earnings and revenues to which traders have responded by driving the stock into a bearish head & shoulders pattern with the stock testing neckline support on Friday, April 25, 2014 (last candle). |

| Graphic provided by: TC2000.com. |

| |

| Netflix Inc. reported Q1-2014 earnings on April 21 (see green arrow in Figure 1) with a 24.04% increase in year over year revenues and net income of $0.86 per diluted share versus $0.05 for Q1-2013 as well as an increase of 1.75 million in international subscribers. That should be good news for investors. But other than a one day pop, the stock responded negatively to the news despite an overall positive market every day except on April 25, 2014 (the last bar on the chart) which saw the stock fall more than 6%. In the process, the stock looked to be in the final stages of confirming a bearish head & shoulders (H&S) pattern with the April 25 close testing neckline support. |

|

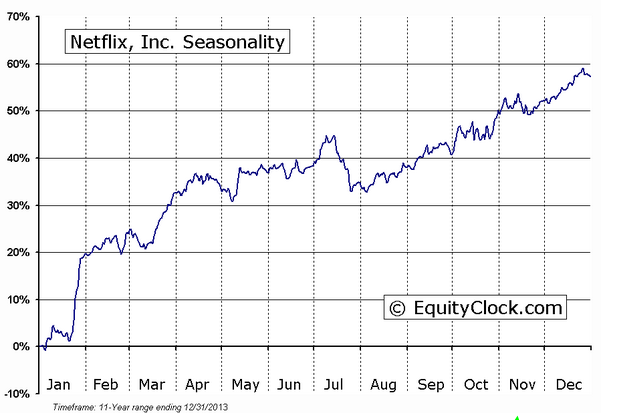

| Figure 2 – Seasonal chart of Netflix over its 11-year history. |

| Graphic provided by: www.EquityClock.com. |

| |

| What makes this action more concerning is the seasonal response. As we see in Figure 2, spring has been a good time to buy the stock and the H&S pattern is clearly unusual. The appearance of three black crows on April 23, 24, and 25 makes the pattern all the more bearish. |

| If this is simply a necessary corrective action in a longer term uptrend, expect the H&S pattern to be invalidated and the reversal could prove to be an excellent buy signal. However, if the pattern is confirmed on above average volume and tech stocks continue to weaken, the minimum H&S pattern projection for NFLX would take the stock down to under $190, a drop of more than 30%. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog