HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

In my last article, we looked at the January Barometer which says that stock performance in the first month is important in determining what stocks will do for the remainder of the year. As it turns out, this indicator is even more accurate following longer-term rallies.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

CYCLES

As Goes January... Part 2

02/07/14 04:43:29 PMby Matt Blackman

In my last article, we looked at the January Barometer which says that stock performance in the first month is important in determining what stocks will do for the remainder of the year. As it turns out, this indicator is even more accurate following longer-term rallies.

Position: N/A

| The 2014 Stock Trader's Almanac discusses something called the January Barometer, which says that as goes January for the SPX, so goes the rest of the year. Invented by founder Yale Hirsch, it has registered just "seven major errors" in the last 63 years. But as we learned in "As Goes January..." the barometer has not been as accurate in the last two decades — of seven down Januarys, only three accurately forecasted yearly S&P 500 index losses. |

| To insure we weren't throwing the proverbial baby out with the bathwater, I took another long look at the charts to see what followed a down January in the wake of a rally lasting four years or more. And as we see from the next chart, when a down January occurred on the heels of a rally, it proved a lot more useful as a prognosticating tool. |

|

| Figure 1 - Monthly chart of the S&P500. |

| Graphic provided by: TC2000.com. |

| |

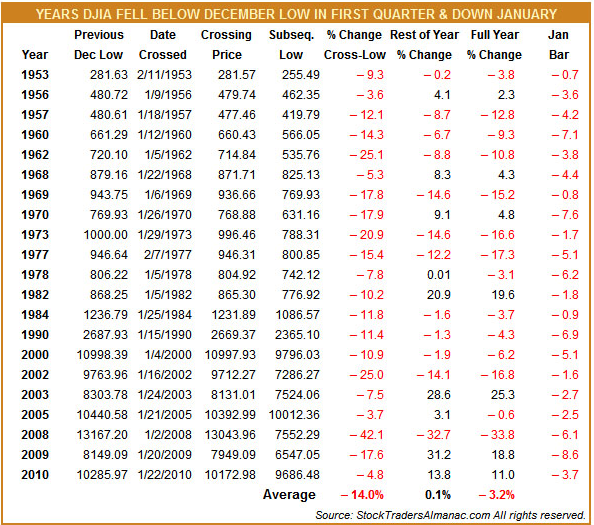

| In Figure 2 we see a table from the 2014 Stock Trader's Almanac blog showing how accurate a negative January barometer was in predicting down years. As we see, down Januarys on the tail ends of a bear market resulted in signal failures — of 21 signals since the early 1950s, just 14 proved accurate (66.6%). |

|

| Figure 2 – Chart from the 2014 Stock Trader’s Almanac showing the overall stats for down Januarys and the performance of the S&P 500 following them. On average however, the January Barometer performed pretty well with an average annual loss of 3.2% for years that began with January losses. |

| Graphic provided by: http://blog.stocktradersalmanac.com/. |

| |

| Clearly, that the S&P 500 posted a loss in January 2014 is a lot more reliable given that it followed a rally — in this case a rally that is now nearly five years old. Speaking probabilities, it means there is an 85.7% chance that the index will be lower at the end of 2014 based on the last 40 years of data. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog