HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Since hitting bottom in late June, gold and precious metal prices have posted impressive gains. But the best way to play this rally may be to not buy the metals themselves.

Position: Buy

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

REL. STR COMPARATIVE

What's The Best Way To Play The Gold Rally?

08/30/13 12:27:02 PMby Matt Blackman

Since hitting bottom in late June, gold and precious metal prices have posted impressive gains. But the best way to play this rally may be to not buy the metals themselves.

Position: Buy

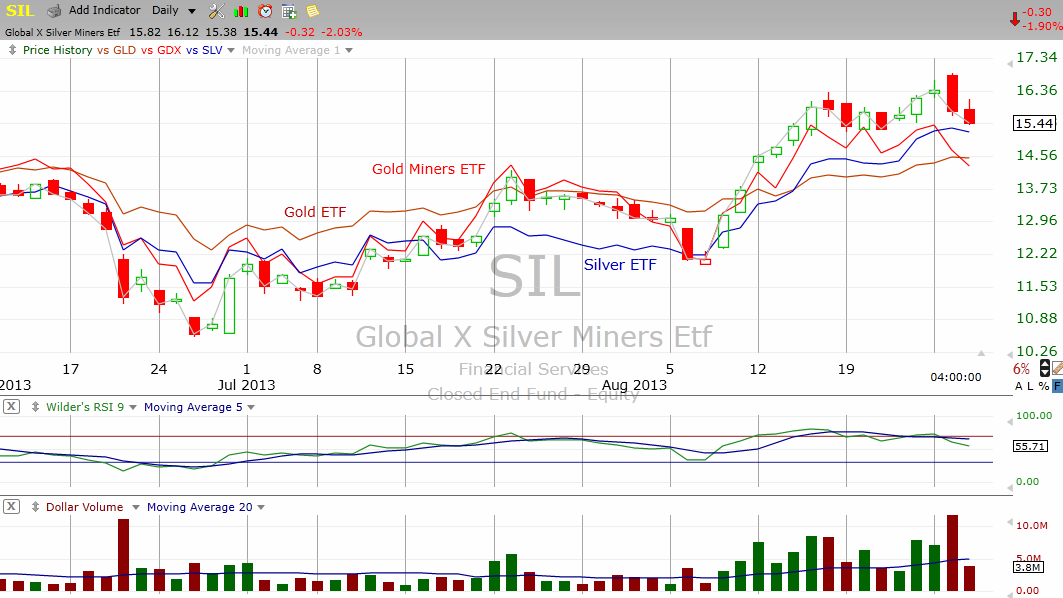

| After falling for nearly nine months, gold hit a bottom on June 27, 2013. Since then it has posted an impressive rally as have the other precious metals. So is gold the best way to play this rally going forward? As the chart in Figure 1 shows, gold, gold miners, silver, and silver miners have all performed well even with the two-day sell off August 26 and August 27, 2013. |

|

| Figure 1 – Chart comparing percentage gains in the gold, gold miners, silver and silver miners exchange traded funds since bottoming in late June. |

| Graphic provided by: TC2000.com. |

| |

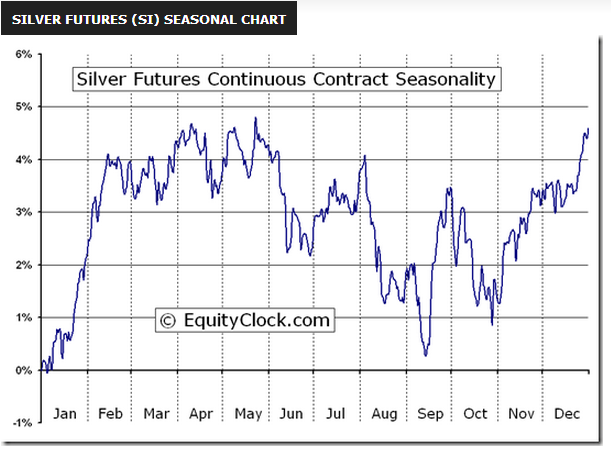

| Between bottoming in June and the rally to late August 2013, the SPDR Gold Trust ETF (GLD) was up 19%, the Gold Miners ETF (GDX) gained 27%, and the Silver ETF (SLV) added 32%. But the best performer was the Global X Silver Miners ETF (SIL) which jumped 47%. As discussed in my TCA article entitled, "Is EFO Glittering Again", Eldorado Gold led the rally and put in a bullish inverse head & shoulders pattern ahead of the metal which bodes well for gold. In the two weeks after the article was written, EGO rose 32%. Until we get signals to the contrary this precious metals rally is alive and well. As the charts in Figure 2 and Figure 3 show, the fall has typically been a good time to be in silver and precious metals. Silver has typically bottomed in mid-September and then rallied almost steadily into mid-February. |

|

| Figure 2 – Composite chart for silver over the last 20 years showing periods of strength and weakness. |

| Graphic provided by: Chart courtesy www.equityclock.com. |

| |

| The gold and silver sector has behaved a little differently. After bottoming in early August, this sector experienced strong price appreciation into year-end over the last 20 years. |

|

| Figure 3 – Although silver has typically exhibited weakness in early September, this isn’t the case with the Philadelphia Gold and Silver Sector (XAU) which traditionally has been strongest between the end of July and end of September. |

| Graphic provided by: Chart courtesy www.equityclock.com. |

| |

| For those who have lamented the fact that they have missed the precious metals rally, there is still a chance for some respectable gains if you know how to find the biggest winners in this sector. And based on past performance, the silver miners look to be a very good bet. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. He is the host of TradeSystemGuru.com. Matt has earned the Chartered Market Technician (CMT) designation. Find out what stocks and futures Matt is watching on Twitter at www.twitter.com/RatioTrade

| Company: | TradeSystemGuru.com |

| Address: | Box 2589 |

| Garibaldi Highlands, BC Canada | |

| Phone # for sales: | 604-898-9069 |

| Fax: | 604-898-9069 |

| Website: | www.tradesystemguru.com |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog