HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Meme stocks are those stocks that have gained popularity through social sentiment. Often this sentiment is fueled by social media and is accelerated by retail investors. Is Tesla one such stock?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Is TSLA a Meme Stock?

09/23/24 03:11:48 PMby Stella Osoba, CMT

Meme stocks are those stocks that have gained popularity through social sentiment. Often this sentiment is fueled by social media and is accelerated by retail investors. Is Tesla one such stock?

Position: N/A

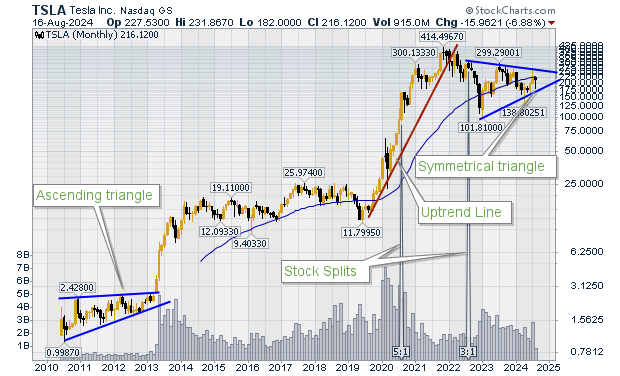

| Tesla (TSLA) started trading on the Nasdaq as a public company on June 29, 2010. Since then, its shares have had two stock splits. The first stock split was on August 31, 2020, when the company did a forward 5:1 stock split. The second stock split was on August 25, 2022, when a 3:1 forward stock split was offered. This meant that for every 1 share owned before the first split date you would have 15 shares today. |

|

| Figure 1. Monthly chart for TSLA. |

| Graphic provided by: StockCharts.com. |

| |

| On August 16, 2024, the stock closed at $216.12, which is a pre-split price of $3,241.50 per share. Figure 1 is a monthly chart showing TSLA's price history since it became a publicly traded company (prices are adjusted to take the splits into account). It took almost three years for price to break out of the ascending triangle depicted on the monthly chart. The stock broke put to the upside and proceeded to triple in the subsequent six months. |

| From here, TSLA entered a multiyear sideways trend, not breaking out until December 2019 when it proceeded to enter another steep and sustained price rise. This uptrend did not end until early January 2022 when price entered a sideways trend breaking through the uptrend line. During its last uptrend, price traded as high as $414.50 in November 2021. The last chart formation we see on the monthly chart is the current symmetrical triangle which is continuing to form as of this writing. |

| Even though it has seen its share of lackluster price activity, TSLA's price rise has been impressive. Taking the IPO adjusted price of $1.13 and August 16, 2024, close of $216.12, investors who held would be sitting on a gain of over 21,000%. Meaning that $10.000 invested at the IPO price would be worth almost $2 million today. |

| So, is TSLA a meme stock? Institutional investors hold around 45% of TSLA's float and so are a sizeable group with immense voting power, but so also are retail investors who also hold a sizeable block of shares, amounting to about 44%. This is a large percentage of shares to be held by retail investors for an individual stock like TSLA. For example, FAANG stocks have about an 18% retail investor ownership. So, with retail investors holding roughly more than twice the average for similar stock's like TSLA, it can mean they have more influence on the direction of price of the stock and its overall volatility. This fact alone could mean that TSLA can be considered a meme stock. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 09/26/24Rank: 4Comment:

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor