HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

With the Federal Reserve cutting the Fed's Fund Rate at their meeting in September, this would be an interesting time to look at home builders' stocks. Will lower interest rates be a positive for this segment in the market?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL INDICATORS

Home Builders

09/23/24 03:07:28 PMby Stella Osoba, CMT

With the Federal Reserve cutting the Fed's Fund Rate at their meeting in September, this would be an interesting time to look at home builders' stocks. Will lower interest rates be a positive for this segment in the market?

Position: N/A

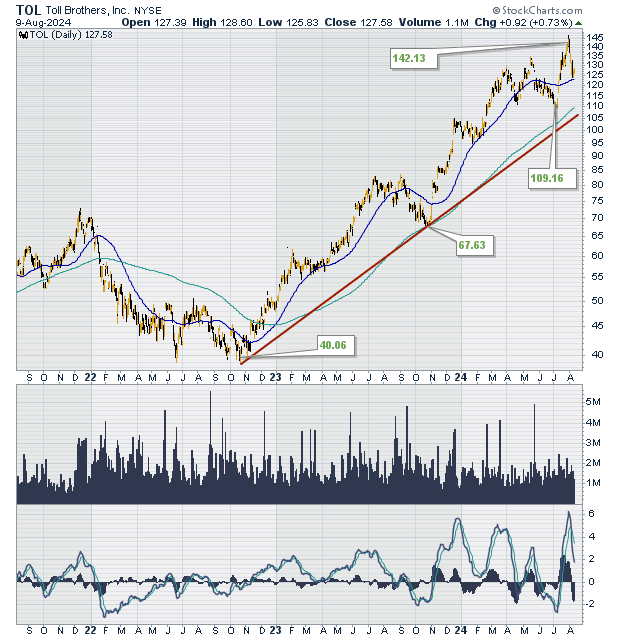

| Toll Brothers, Inc. (TOL) is a large capitalization stock in the home construction industry. They engage in the building of homes in residential communities. Figure 1 is a daily price chart showing three years of price history. From a low of $38.72 on 21st October 2022, the stock has been in an uptrend. It closed on August 9, 2024, at $127.58. |

| So, from October 2022, TOL has been in an uptrend. If as is expected the Feds Fund Rate is cut from where it currently is today which is between 5.25% - 5.50%, by a quarter or a half of a basis point at the next FOMC meeting in September 17-18,2024 that should filter down through the economy affecting everything from mortgage rates to credit card interest rates. It is therefore likely that the rate cut will cause a corresponding reduction in the mortgage rates banks offer to home buyers. This rate reduction may well make residential home mortgages a tad more affordable. While one rate cut will have minimal impact on the overall cost of homes, the rate reduction trend may well be what is needed to open up the slowdown that ultra expensive mortgages have had on home sales. |

|

| Figure 1: 3-year daily chart for TOL. |

| Graphic provided by: StockCharts.com. |

| |

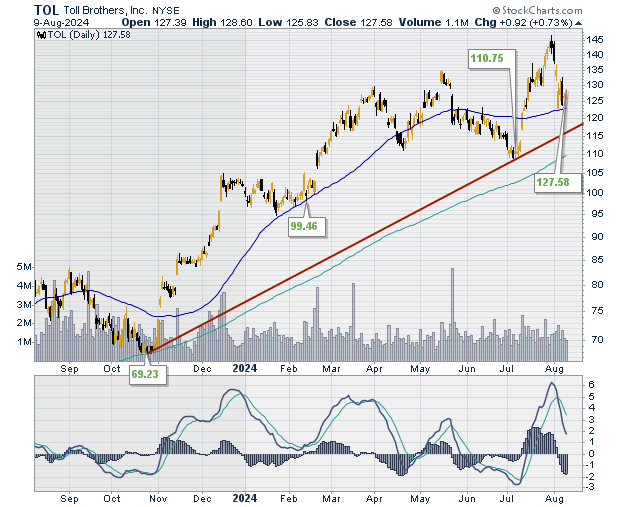

| With this simple analysis, will the trend of lowering interest rates have an impact on home builders shares and with that anticipation in mind, would it be a good idea to buy the shares before the rate cut is in effect? Figure 2 is a daily chart of one year of price action for TOL. What is interesting to see here is that its shares are still in a sustained uptrend which has been in place since the fourth quarter of 2022. Since then, TOL has not broken its up-trend line. Figure 2 shows an even steeper unbroken up trend line. On August 9, 2024 price closed just above the 50-day moving average and is comfortably above the longer 200-day moving average. Everything we are seeing on the charts is showing a chart in a healthy up-trend, and that is before even speculation of a rate cut in September has gained traction. |

|

| Figure 2: 1-year daily chart for TOL. |

| Graphic provided by: StockCharts.com. |

| |

| Price action of TOL should be a reminder that it is not wise to trade on news. Trade instead on the price action as revealed by price charts. While I am not saying here that it will, it is completely possible that the break in the up-trend line could come in September as rate cuts begin. Unanticipated news can affect the price of a stock, but it is less likely that anticipated news will. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog