HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Environmental, Social and Governance funds have changed the trading game. But do they really offer a compelling investment case?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

CHART ANALYSIS

Do ESG Stocks Rate A Place in Your Portfolio?

12/13/22 03:35:40 PMby Matt Blackman

Environmental, Social and Governance funds have changed the trading game. But do they really offer a compelling investment case?

Position: N/A

| Turn on the financial news or open a trading website and you are likely to come across the term "ESG". Every major fund in the US and Europe now offers a wide array of investment vehicles that adhere to Environmental, Social and Governance principles. No longer are fund managers tasked with the primary and mundane goal of maximizing returns. They must now find companies that also meet a checklist of environmental, social and governance goals as well. Relegated to yesteryear are the long list of oil, gas, mining, equipment, auto, defense, arms, transportation, manufacturers and other companies and even sectors that fail to make the ESG grade, even if they do offer necessary products and services and generate healthy returns. So what should you expect on the ESG return front? To answer that question I examined five prominent ESG funds. And while the fund with signature symbol %91ESG' had the longest trading history, it also had the lowest average daily trading volume of less than 5,000 shares. As it turns out, this wasn't the only curious characteristic of the group. |

|

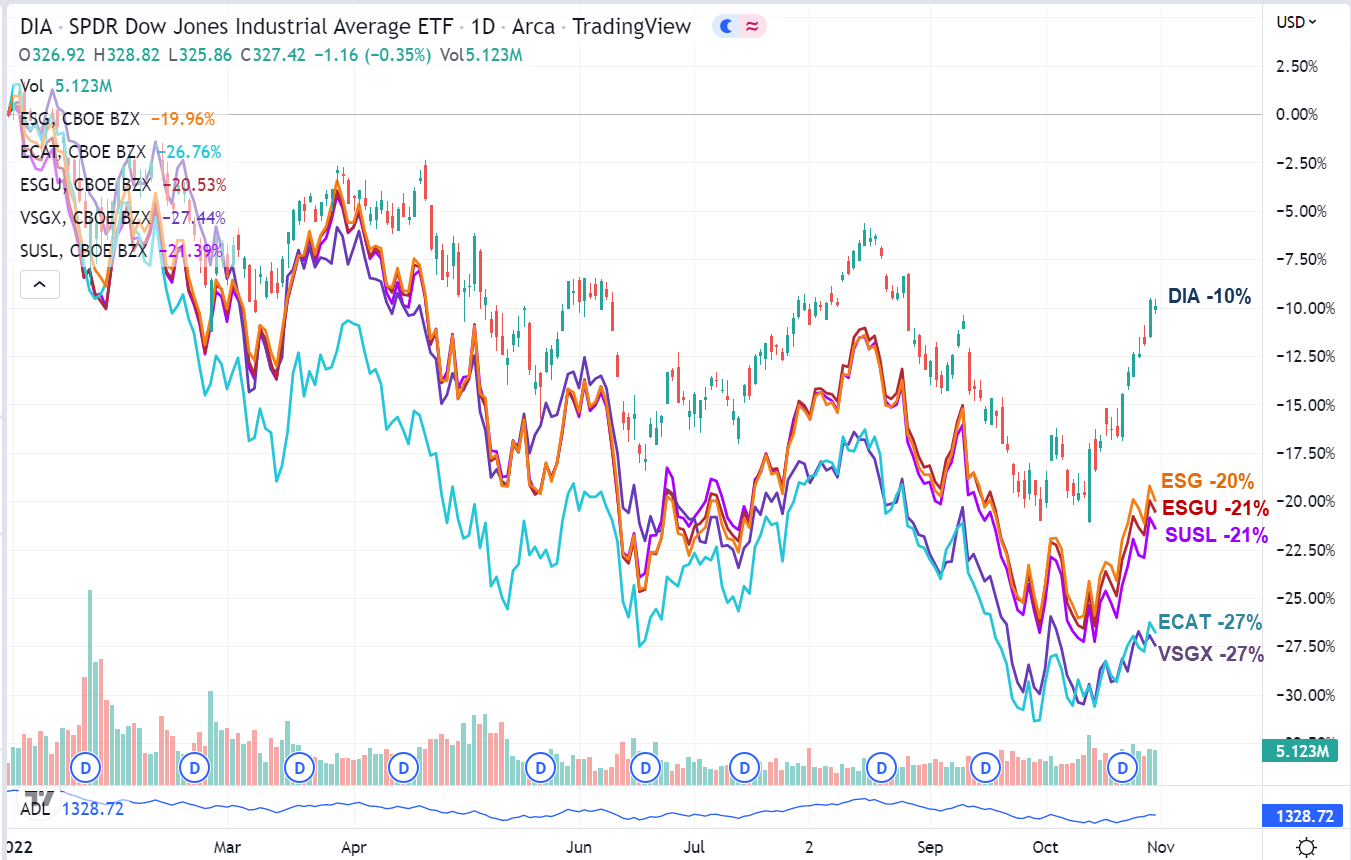

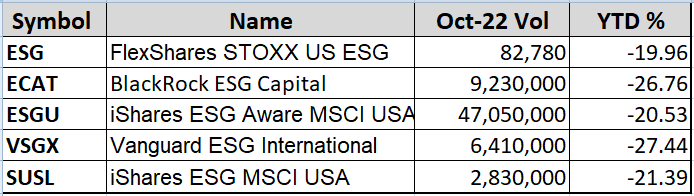

| Figure 1. Comparison of the DIA versus FlexShares STOXX US ESG Select Index Fund (ESG), BlackRock ESG Capital Allocation Trust (ECAT), iShares ESG Aware MSCI USA ETF (ESGU), Vanguard ESG International Stock ETF (VSGX) and iShares ESG MSCI USA Leaders ETF (SUSL). |

| Graphic provided by: TradingView. |

| |

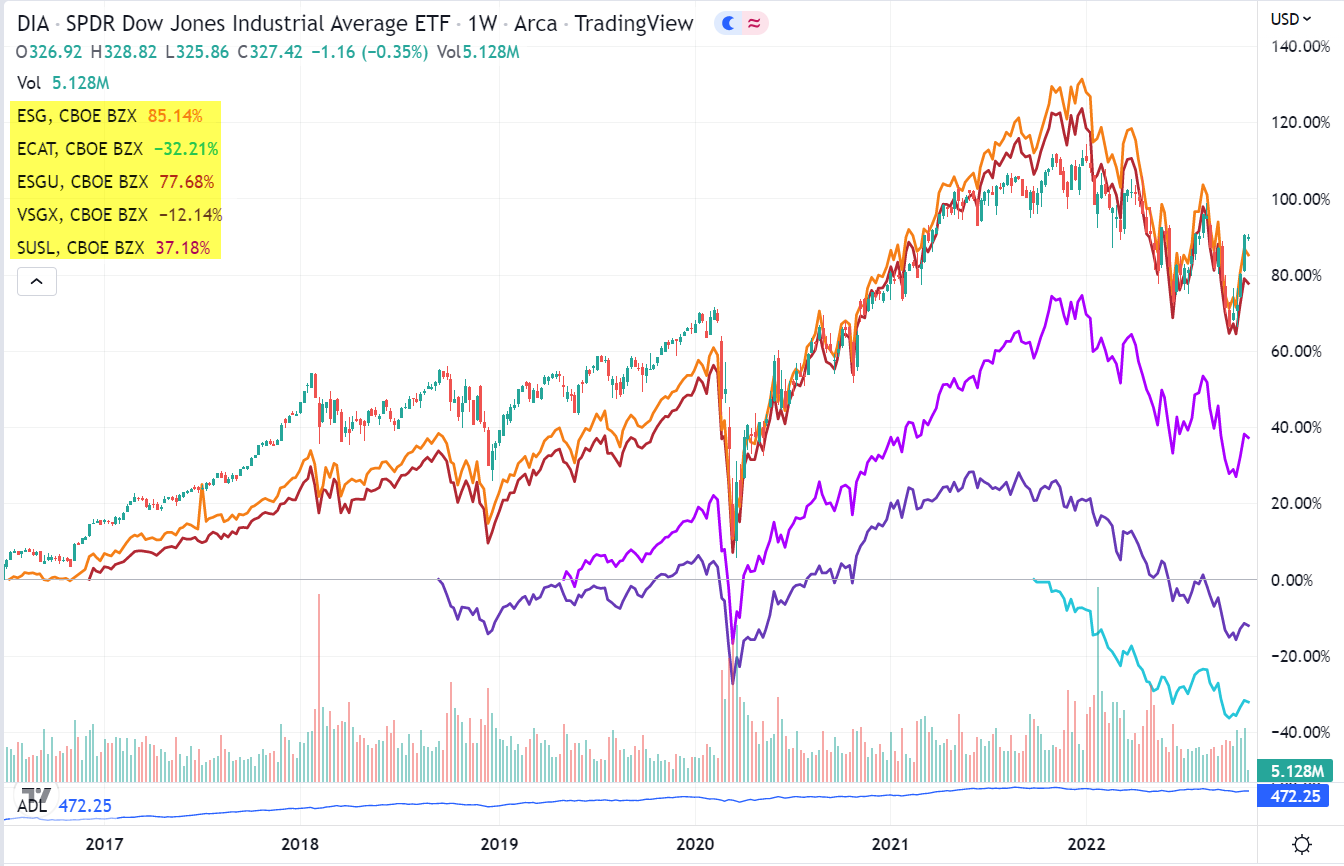

| As we see in Figures 1 and 2, the five ESG funds have significantly underperformed the SPDR Dow Jones Industrial Average ETF symbol DIA which is down 10% year-to-date October 31, 2022. Our best ESG performer symbol ESG lost 20% over the period. The worst two, VSGX and ECAT, lost 27% each over the ten-months. And unfortunately for Blackrock's ECAT that began trading October 1, 2021 missing the 2020-21 bull, it's been all downhill from the outset. Looking at the Bigger Picture But how did our ESG funds perform over the longer haul? As we see, the two best performers, ESG and ESGU roughly matched DIA at ~85% return from 2017 through 2022 while SUSL gained 37%, VSGX lost 12% from 2019 and ECAT dropped 32% from October 1, 2021 (see Figure 3). |

|

| Figure 2. Comparison of five ESG funds in 2022. |

| Graphic provided by: TradingView. |

| |

| Looking at the larger universe, as of December 2021 global exchange-traded sustainable funds setting environmental, social and governance objectives totalled more than $2.7 trillion assets under management with 81% located in Europe and 13% in the U.S. according to the Harvard Business Review (link below). Unfortunately, while the highest Morningstar rated ESG funds attracted the most capital, "none of the highest rated funds outperformed any of the lowest rated funds" according to the article. So if the raison d'etre of this class of investment funds appears to defy traditional investment logic, you are not alone. Silicon Valley entrepreneur Vivek Ramaswamy author of Woke, Inc. - Inside Corporate America's Social Justice Scam, firmly believes that politics has no place in business. In Woke, Inc. he challenges Wall Street's ESG preoccupation by asking if their performance is a direct function of improved underlying corporate performance or simply the result of an asset bubble driven by growing pools of capital chasing "socially conscious" investment opportunities. He has a point. A total of $143 billion in new capital flowed into these ESG funds Q4 -2021 alone. And as it turns out, the lackluster performance of our small sample of ESG funds isn't all that unique. "Institutional Investor observed that the median annualized return between 2010 and 2019 of ESG equity funds with a track record of at least 10 years and $100 million in assets was only 11.98%, while the S&P 500 had returned an annualized 13.56%," according to Ramaswamy. |

|

| Figure 3. As we see, between July 2016 when ESG was first launched to Q3-2022, it has provided an almost equal return to DIA at 85%. The newest of the group, ECAT, launched September 2021 and is also the worst peformer so far. |

| Graphic provided by: TradingView. |

| |

| So if your aim is to support fund managers with goals other than maximizing shareholder returns, you've come to the right place in the ESG fund space. But if you wish to truly change the world by investing in companies that make the differences that matter and generate the returns you are looking for, you will probably be better off picking them yourself. |

| Suggested Reading: Environmental, Social And Governance: What Is ESG Investing? List of ESG stocks 2021 ESG 100 Ranking An Inconvenient Truth About ESG Investing - Harvard Business Review Ramaswamy, Vivek - Woke, Inc. - Inside Corporate America's Social Justice Scam |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog