HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Stocks were rocking in 2021. So what changed?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

RATE OF CHANGE

Berkshire - A Safe Port in a Storm?

05/12/22 04:28:22 PMby Matt Blackman

Stocks were rocking in 2021. So what changed?

Position: N/A

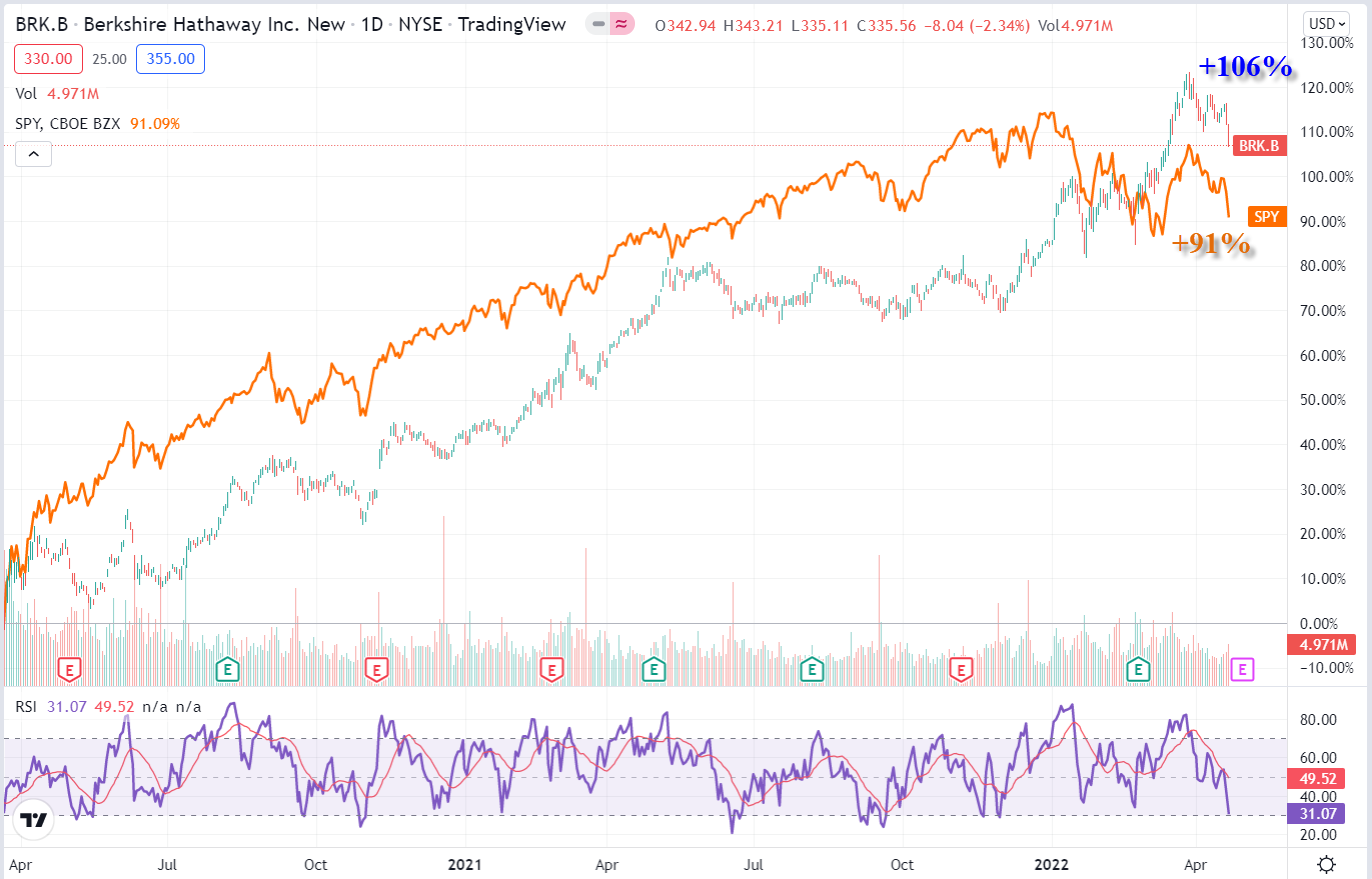

| In 2021 stocks seemed unstoppable as the major indices put in higher high after higher low and bulls ruled the roost. But that mood seems to have quickly cooled as a new year dawned in 2022. But some stocks have fared better than others. As we see in the first chart below, Berkshire Hathaway (BRK.B) and the Spyder S&P500 ETF Trust (SPY) registered impressive gains from the March 2020 lows, up 106% and 91% respectively in the 25 month period that followed. By the end of 2021 the SPY was the undisputed leader notching up an impressive 114% gain from the lows. Meanwhile, BRK.B posted a more subdued, albeit still impressive, gain of 85% over the same period. But then the riders appear to have switched horses. |

|

| Figure 1. Daily chart comparing the Spyder S&P500 ETF Trust (SPY) and Berkshire Hathaway (BRK.B) from the market lows in March 2020. |

| Graphic provided by: TradingView. |

| |

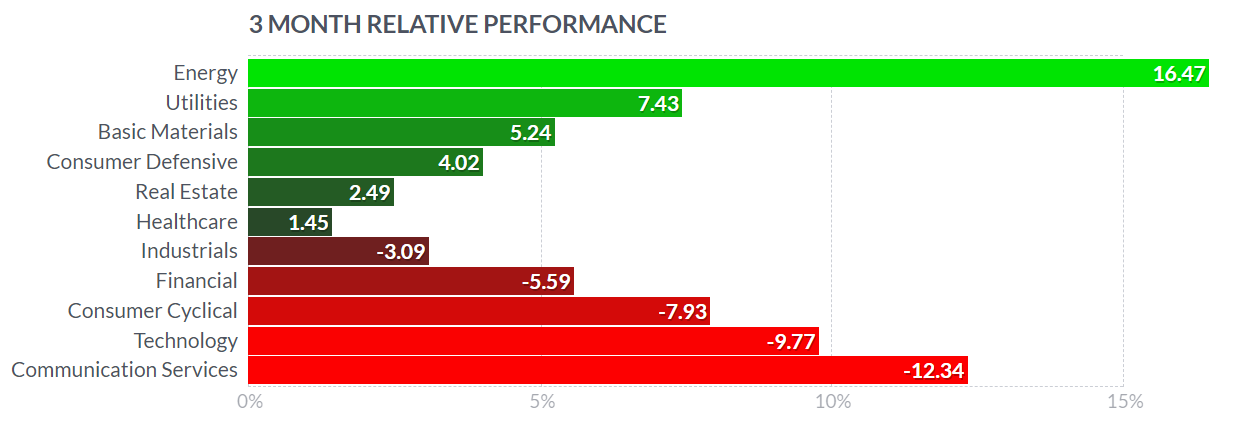

| Howeve,r as we see in Figure 2, while BRK.B continued to post gains in 2022 up more than 12% to mid-April, SPY lost more than 10% over the same period. Why the divergence? For starters, the SPY reflects the value of the 500 stocks of the S&P500 Index that includes a wide array of sectors and industries (see https://www.slickcharts.com/sp500). Berkshire Hathaway is composed of just 44 stocks from Apple (AAPL) to United Parcel Service (UPS) and includes energy company Chevron (see https://www.dataroma.com/m/holdings.php?m=BRK). As we see in Figure 3 as a group, energy stocks have performed strongly, up more than 16% in the last three months. They are up 50% in the last 12 months. But the SPX has more energy companies so that's not the excuse for its lackluster performance. |

|

| Figure 2. Daily chart of the Spyder S&P500 ETF Trust (SPY) and Berkshire Hathaway (BRK.B) from January 3, 2022. |

| Graphic provided by: TradingView. |

| |

| Could it be the ability of Warren Buffett and his team to pick high alpha stocks? As of Q2-2021 Berkshire had nearly 75% of its funds in just two sectors: financials and technology (see article below). Although this doesn't explain why BRK.B has done so well in 2022, it does point to Buffett's uncanny ability to pick winners reflecting his penchant for buying when there is blood on Wall Street. When times get tough, he makes money. Given that the headwinds we now face won't disappear anytime soon, job one of preserving capital at times like these remains paramount. As Will Rogers who quipped following the Great Depression, "I'm much more concerned with return of my capital than the return on my capital." |

|

| Figure 3. Three month sector performance to April 22, 2022. |

| Graphic provided by: https://finviz.com/. |

| |

| Suggested Reading As Warren Buffett turns 91, the legendary investor prepares Berkshire Hathaway for a new economy. |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog