HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

All eyes are on the mega-tech companies lately, but blue chips are where the opportunity lies.

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

American Express & The Blue Chip Opportunity

08/12/21 04:44:55 PMby Billy Williams

All eyes are on the mega-tech companies lately, but blue chips are where the opportunity lies.

Position: Hold

| The last week of July was set to be a busy week. Why? Because corporate earnings from several stock market leaders were set to be released. Plus, the Fed was set to announce its monetary guidelines along with a laundry list of economic data crucial to the future economy. The impact of these events is far-reaching and likely to set off a major run-up in the market. Apple (AAPL), Amazon (AMXN), Facebook (FB), Microsoft (MSFT), and Alphabet (GOOGL) were set to announce quarterly earnings for the second quarter. Optimism is high for these companies and the market as a whole. According to FactSet, analysis shows that 24% of the S&P's companies have reported earnings higher than expected feeding high expectations for these mega-tech companies to do the same. If they do, then the market will likely go higher. Adding to that, Snap (SNAP) and Twitter (TWTR) reported earnings recently which served as a backdrop for Facebook and Alphabet. This feeds the narrative that internet-based companies involved in online ads are strong as a whole. Facebook and Alphabet have rallied on the backend of this analysis, trading at all-time price highs. |

| So, with all this positive news on the horizon, what's the play? While Wall Street and everyone else is keeping an eye on these companies and the news that follows it might be a good time to look for contrarian plays. Rallies on positive earnings tend to take the market higher and everyone jumps on board. But, the party has to end at some point, so when the initial excitement cools off the market starts to drift and pulls back. Again, taking the market with them. It's at this point where new opportunities lie, and not just with the mega-tech companies. Instead, new opportunities can be found in traditional blue-chip companies. And, it's worth noting that they have excellent risk/reward rations without all the volatility of the tech stocks as well as solid brand names. |

|

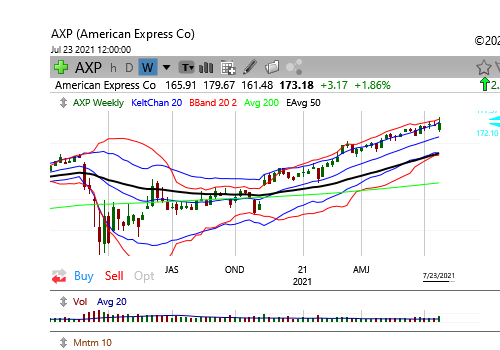

| Figure 1. The weekly AXP chart entered a period of low-volatility price consolidation during the fall of 2020. Later, as the New Year rung in 2021, AXP emerged and rallied to a 52-week price high of $180. |

| Graphic provided by: TC2000.com. |

| |

| American Express (AXP) announced earnings that crushed all expectations with a 866% increase and revenue climbing 23% to $9.47 billion. The company reported that card usage has exceeded the previous pandemic levels. More than likely, it's because as more of the population has been vaccinated, with more being vaccinated every day, people are getting out to shop and travel again. AXP formed a Cup & Handle Pattern on the daily chart where price traded higher in late April of this year, signaling a buy signal. At the time, price was in a tight period of consolidation marked by low volatility. This added momentum to the rally once enough buying volume entered the stock to take it to its 52-week price high at just below $180. AXP is currently trading in a low-volatility range on the daily chart which currently indicates an upward bias. |

|

| Figure 2. On the daily chart, AXP steadily traded higher going from price contraction to price expansion. This natural ebb and flow helped the stock to trend higher. Now, AXP is in another period of low-volatility price consolidation leading many to wonder if a pullback is in the tea leaves. |

| Graphic provided by: TC2000.com. |

| |

| That said, patience favors the bold. As the major tech companies start releasing earnings just as key data from the government on the economy and monetary guidelines from the Fed, trade short-term with risk but be mindful that if there is a rally there will be a pullback that follows. It's during this pullback where you can buy a solid blue-chip company at a discount and start building a core position. As the economy continues to improve and open up, hungry consumers with pent up demand will flood stores and shops, online and offline. And they will have their American Express cards in hand. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog