HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Taylor Ireland

In this article, we examine the order flow and limit order book data in the WTI futures market that provides insight into sell response at key resistance following a rally on Wednesday, June 23, 2021. Market structure and order flow provide insight into the actual transactional activity of a dual-auction's price discovery process. Analysis of this data provides real-time insight into the actions of market participants, providing a dynamic dataset to inform one's risk management process.

Position: N/A

Taylor Ireland

Sharedata Futures, Inc. provides historical data mining and visualization for the benchmark NYMEX Energy Futures Markets.

Sharedata combines structural analysis of the market generated data, dynamic systems analysis, and Bayesian causal inference techniques favored by the scientific and intelligence communities to provide a robust framework for addressing the uncertainty and risk in energy pricing.

PRINT THIS ARTICLE

ENERGY

WTI Weekly: Rally Continued To Statistical Resistance Where A Sell Response Developed

07/15/21 04:33:57 PMby Taylor Ireland

In this article, we examine the order flow and limit order book data in the WTI futures market that provides insight into sell response at key resistance following a rally on Wednesday, June 23, 2021. Market structure and order flow provide insight into the actual transactional activity of a dual-auction's price discovery process. Analysis of this data provides real-time insight into the actions of market participants, providing a dynamic dataset to inform one's risk management process.

Position: N/A

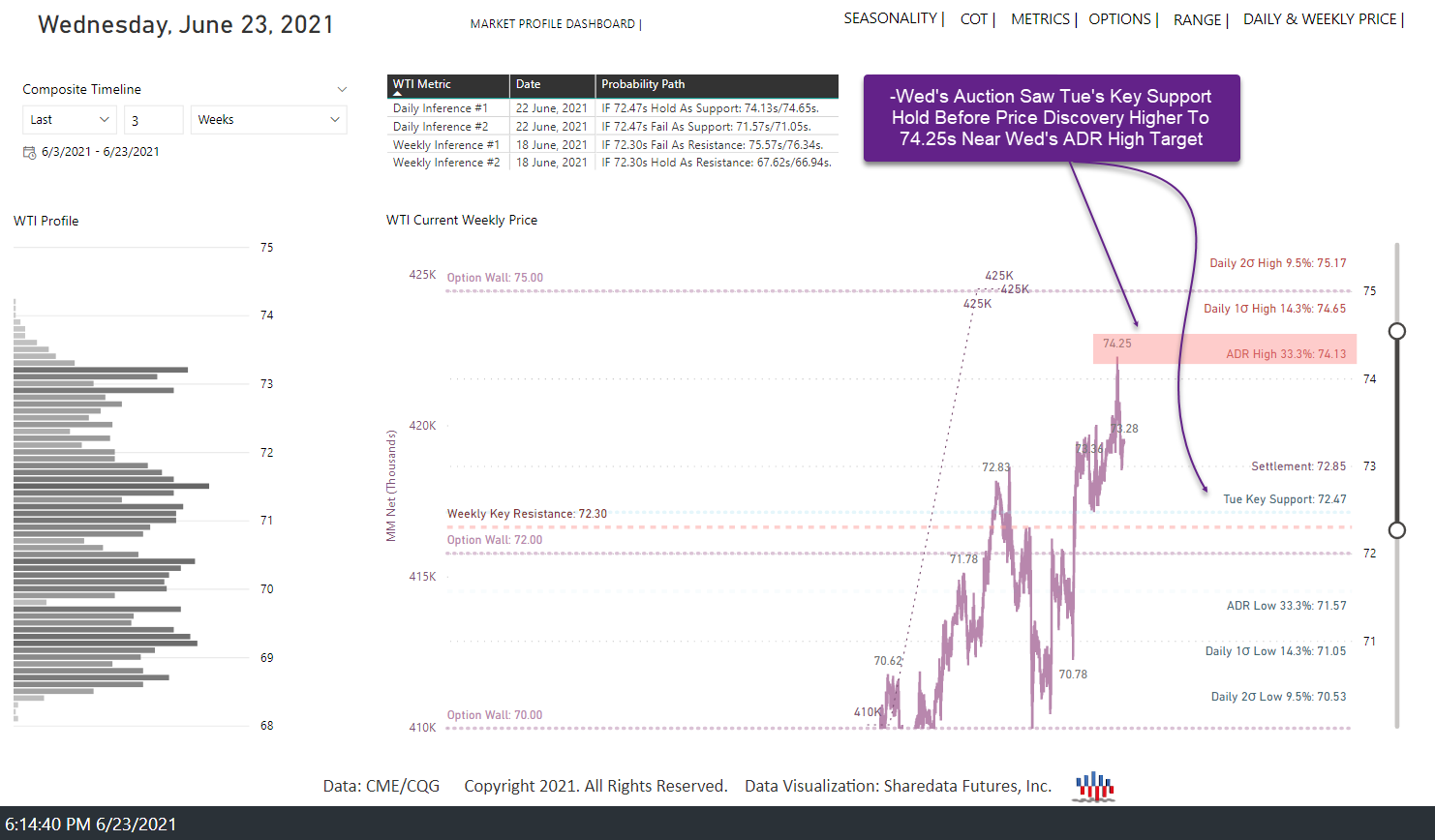

| June 23, 2021: The primary expectation in Sharedata's Energy Daily Dashboard for Wednesday 23 June 2021's auction was for price discovery higher. Our daily dual probability path assigned the primary expectation for price discovery higher, noting statistical resistance targets were: 74.13s/74.65s/75.17s, respectively. Qualitatively, these levels had held as resistance 67%, 86%, and 90% of recent market auctions, respectively, based on the market generated data. This data provided a buy-side framework with a probable resistance "zone" between 74.13s-74.65s. As discussed frequently, markets are probabilistic not deterministic. Within this framework, the secondary expectation was for price discovery lower. Statistical support targets were: 71.57s/71.05s/70.53s, respectively, with a probable support "zone" between 71.57s-71.05s. This type of daily framework, while useful, is more effective when using live order flow and structural analysis to confirm or negate the most probable daily inference. In this case, statistical resistance held following Wednesday's Globex rally and breakout attempt, driving price lower to 73s ahead of the NY close. |

|

| Figure 1. WTI Daily Dashboard Jun 23, 2021. |

| Graphic provided by: Sharedata Futures, Inc.. |

| |

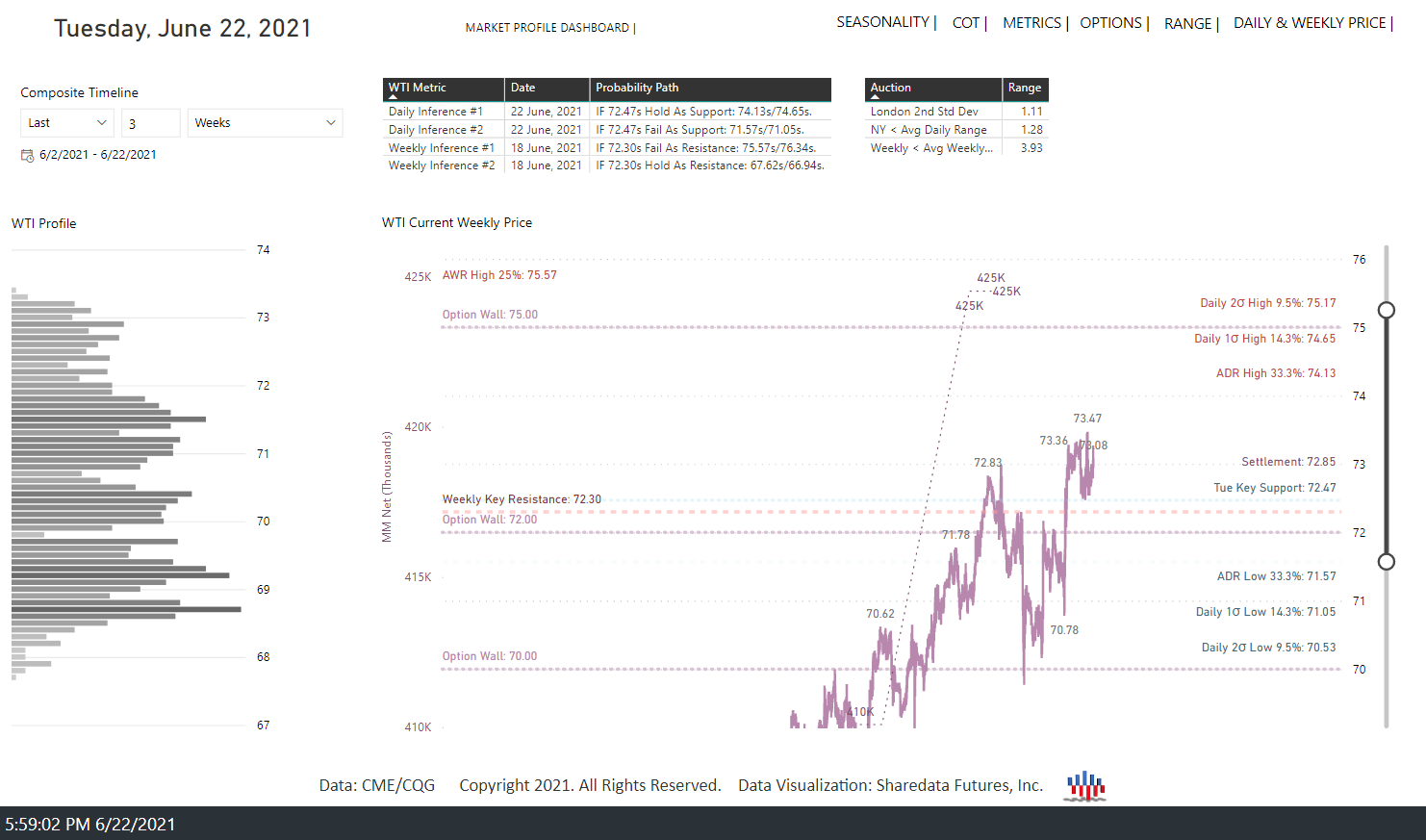

| Heading into Wednesday's auction, Tuesday's auction saw buying interest into the NY close. Price discovery higher developed early during the Globex auction, before a breakout through structural resistance developed to 73.75s into the NY open. Buyers trapped trapped amidst selling interest and excess early in NY trade, driving price lower to test the breakout area. Sellers trapped there amidst buy excess, halting the pullback into the NY Close. |

|

| Figure 2. WTI Daily Dashboard Jun 22, 2021. |

| Graphic provided by: Sharedata Futures, Inc.. |

| |

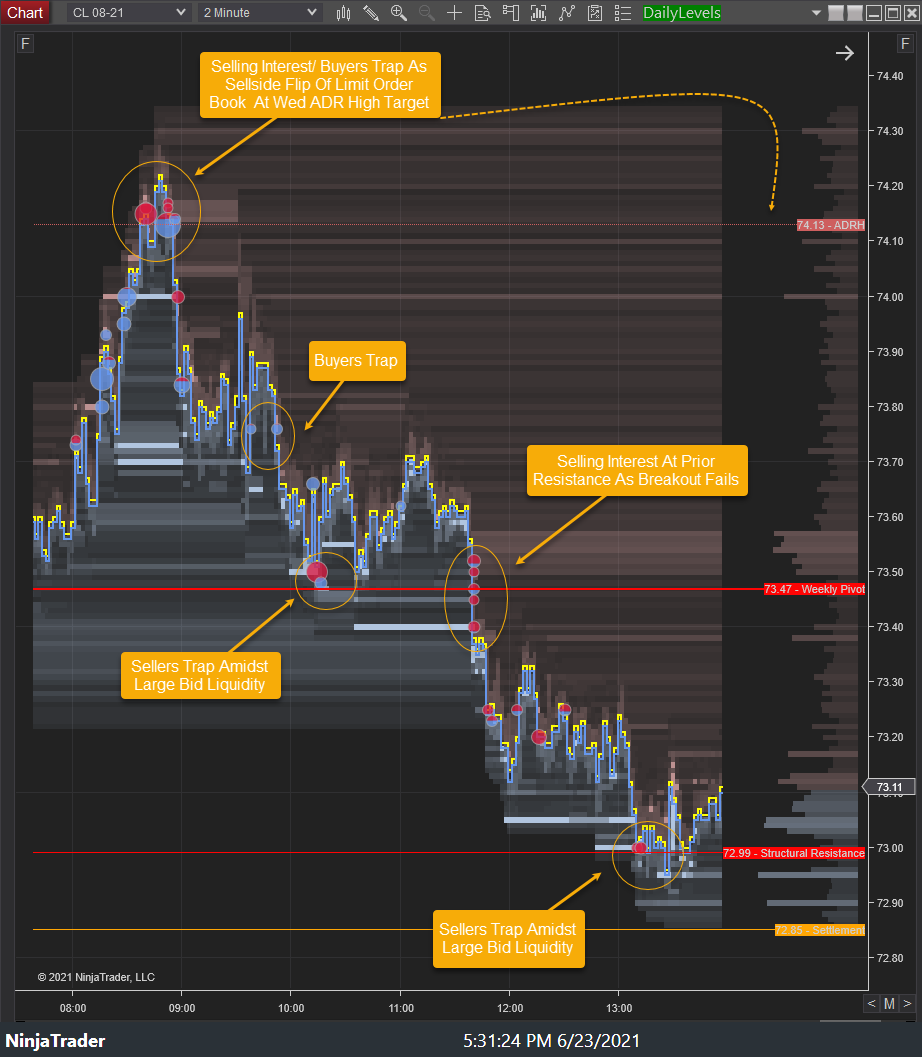

| The practice of analyzing market structure development is best accomplished with the use of order flow and limit order book (LOB) analysis. In short, plotting the buy and sell transactions of significance (in this case volume equal to or greater than 125 contracts) as well as the resting limit bids and offers allows us to see both the actions and intent of larger participants (who significantly affect price). |

|

| Figure 3. WTI Auction Jun 23, 2021. |

| Graphic provided by: NinjaTrader. |

| |

| In this week's analysis, the primary expectation was for price discovery higher. Following a rally in the Globex auction and continuation higher early in NY trade, selling interest emerged as buyers trapped at Wed's ADR High target. A sell-side flip of the LOB developed as a pullback ensued to test the prior structural resistance (what should now hold as support). Initially, sellers trapped there as balance developed before selling interest emerged, absorbing the large bid liquidity in the LOB as price discovery lower continued toward 73s. Sellers trapped there amidst large bid liquidity in the LOB, halting the selloff into the NY Close. |

|

| Figure 4. WTI Limit Order Book Jun 23, 2021. |

| Graphic provided by: NinjaTrader. |

| |

| The daily framework identified both statistical support and resistance targets and their qualitative potential to hold. Key support held early as a rally developed to Wed's ADR High target early in NY trade. The order flow and LOB indicated a likely stopping point there before the selloff ensued. This confluence of structural, statistical, and order flow data provided insight into the auction's outcome based not on lagging fundamental data or media hype but rather structural formation and transactional behavior of significant quantity that drives price discovery. |

Sharedata Futures, Inc. provides historical data mining and visualization for the benchmark NYMEX Energy Futures Markets.

Sharedata combines structural analysis of the market generated data, dynamic systems analysis, and Bayesian causal inference techniques favored by the scientific and intelligence communities to provide a robust framework for addressing the uncertainty and risk in energy pricing.

| Title: | Founder |

| Company: | Sharedata Futures, Inc. |

| Dallas, TX | |

| Website: | www.sdfanalytics.com |

| E-mail address: | support@sdfanalytics.com |

Traders' Resource Links | |

| Sharedata Futures, Inc. has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog