HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The tectonic plates of the market are shifting, and the once unnoticed and unloved sectors are beginning to emerge with Southern Copper leading the way.

Position: N/A

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

VOLUME

SCCO And The Unnoticed, Unloved

05/20/21 04:38:50 PMby Billy Williams

The tectonic plates of the market are shifting, and the once unnoticed and unloved sectors are beginning to emerge with Southern Copper leading the way.

Position: N/A

| Inflation fears have started to climb the "wall of worry" and for good reason. In the U.S., the combined stimulus money printed by the Fed has created 40% of the country's currency in just the last year. Inflationary heat has been starting to simmer, but after the country's anemic job growth reported this last week, it's now starting to boil over. The White House reports that due to pent-up demand and supply chain issues that Americans can expect a "modest" increase in prices. They go on to say that after a modest period of time prices will settle back to their starting baseline. However, the White House has announced plans for additional government spending as well as a possible 4th stimulus payment to its citizens. It's worth noting, there are no current tax revenues or surpluses to tap, but the Fed is already starting to oil it's presses to print more money to fund it. This only adds stress on the country's economic engine and sets the stage for a fundamental change to the country's economic future. |

|

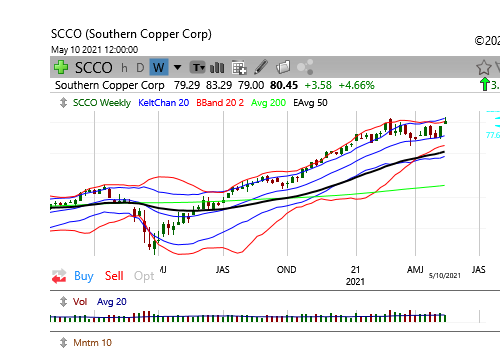

| Figure 1. SCCO has rallied off its price lows from 2020 to gather steam and triple in value. Moving from the Mark-Up Phase to the Consolidation Phase, it appears to be under accumulation to setup another Bull Run. |

| Graphic provided by: TC2000.com. |

| |

| While there are plenty of signs of bad news of an impending shock to the system it's important to step back and take the larger view on the market. Simply, for a trader, it begins with the question of "Where can I make money?" In an inflationary environment there is too much money that is chasing too few goods. More, the value of money is declining while the value of certain goods increases in value. For the trader, it's a matter of looking for companies that have real assets on their balance sheet. Steel, lumber, gas, oil, silver, natural gas, cotton, real estate, cocoa, sugar, gold, and other asset-based commodities are likely to rise in value as inflation picks up steam. The first step is to locate sectors of the market that deal in real assets and/or have real assets on their books. As inflation pushes up the value of hard assets then share value should follow. |

|

| Figure 2. Chunking down to the daily price action, volume surged and pushed the stock's price to a new high. With low volatility in the accumulation period, the stock's price action is about to revert to its mean and enter high volatility again. These factors set the stage for SCCO to launch into a new Mark-Up Phase as the Bulls prepare to rally. |

| Graphic provided by: TC2000.com. |

| |

| Personally, I like to look in areas that are unnoticed, and even better, unloved. Few traders are willing to dip their toes into unknown waters but that is where the best fishing spots are typically found. Southern Copper Company (SCCO) is actively involved in the mining of copper in Peru and Mexico. Not only are they involved in the extraction of copper but also own and operate smelting facilities. This makes them a self-contained operation that controls every level of the copper mining operation which has translated into them being the top leader in their group with the earnings quality to prove it. This combination of factors is reflected in the company's stock's price action. The stock rallied from the early crash of 2020 to enter a phase of accumulation/mark-up. Price has more than tripled off its lows and appears to have entered a period of consolidation. The consolidation has caused price volatility to drop as it appears to get ready for another rally. |

| Volume tripled on May 10, 2021 as the stock pierced its all-time high but the daily price action backed off. This could have just been a stop-run on the Bears but momentum is definitely on the side of the Bulls. Commodity-driven/hard asset businesses are going to become more en vogue in the months and years to come. Look for unnoticed, unloved companies like SCCO to start taking positions in now. Timing is often everything and at this macro-level view of the game it's a good time to be committing capital as this group emerges. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog