HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

One-hundred years ago, the world found itself in almost the same place as it is now and Tesla stands ready to usher in an Economic Golden Age

Position: Accumulate

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

RISING TREND

The Rhyme Of History And Tesla

05/07/21 03:41:26 PMby Billy Williams

One-hundred years ago, the world found itself in almost the same place as it is now and Tesla stands ready to usher in an Economic Golden Age

Position: Accumulate

| The rising bullish sentiment combined with the pent-up consumer demand being released has been rocket fuel for the recent bull run. As Covid-19 vaccinations become more available, countries are easing restrictions making it possible for businesses to begin opening their doors. This collection of positive events are starting to translate into "signs of life" into the wheels of the economic engine beginning to gather steam in 2021 But, can it continue? To put a finer point on it, should it continue? Is the market overvalued like the Dotcom Era where ridiculous stock valuations pushed the market into the stratosphere only to "pop" which ushered in a fierce bear market that lasted for years? Or, is there something else fueling the market's bull run? In 1918, the U.S. first experienced the Spanish Influenza epidemic. Historians theorize that the virus originated in China and then mutated across Europe before arriving in the U.S. Due to overcrowding in urban areas and a 6-year climate anomaly that accelerated the vector of the virus' contamination, it spread like wildfire. Worldwide, as a result, 500 million people (1/3rd of the world's population at the time) were affected with no solution in sight. |

|

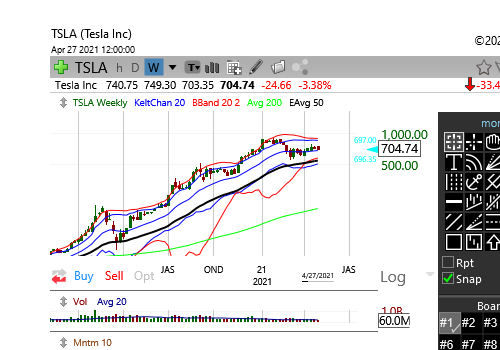

| Figure 1. Weekly chart for TSLA. |

| Graphic provided by: TC2000.com. |

| |

| Worse, due to malnutrition, poor hygiene, and hospitals being overrun with infected patients, a bacterial super-infection developed in addition to the virus. This toxic cocktail of factors increased the death toll across the globe and caused the U.S. to enter into panic mode. The country went on lockdown with government asking people to wear masks and not shake hands with each other as well as keep their distance. They recommended everyone stay home as often as possible with little to no contact with their neighbors. Four waves of the epidemic surged at different times across the country up till 1920 when the viral spread began to fade. Slowly, people came out of their homes and got back to work. With the pent-up demand for goods and services, the economy grew 42% in the 1920s. All this optimism helped fuel the enthusiasm for the future among the new, younger generation who wanted to party after having been in lockdown for 2 years. As a result, the 20s were an enormous period of growth and prosperity which later morphed into a speculative bubble. In August of 1929, weakness began to show in the economy and was marked by the stock market crash in October of that year. This ushered in the Great Depression which lasted until 1933. |

| Is any of this starting to sound familiar? Today, more money has gone into stock-based funds over the past five months than the previous 12 years combined, according to Bank of America. In raw numbers, $569 billion has flowed into global equity funds since November, compared with $452 billion going back to the beginning of the 2009-2020 bull market. History may not repeat itself but it does rhyme. So, what should you take from this? The market and economy are coming out of lockdown and, fueled by pent-up demand and stimulus money, are likely to keep expanding. Technology, and a focus on economic growth, could be the signposts to a golden era of prosperity until another "tulip-like" mania washes over investors. When that happens, the mother of all bubbles could form and who knows what the impact could be. |

|

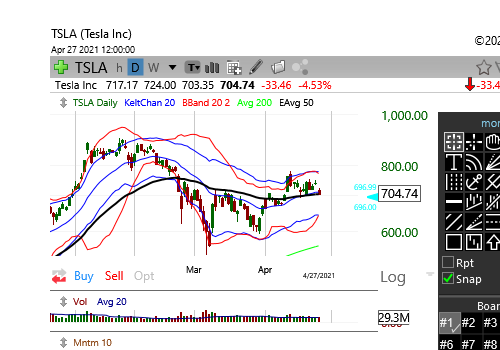

| Figure 2. Daily Chart for TSLA. |

| Graphic provided by: TC2000.com. |

| |

| Yes, there might be inflation along the way but job growth will keep that fire from spreading and, if not, then there will be new opportunities in the market. But one company is standing at the tipping point of another rally and likely to lead it higher. Tesla (TSLA), lead by Elon Musk, is a company with a singular mission — to accelerate the world's transition to sustainable energy. Given the historical comparison's to the past, Musk is a pioneer at a unique time in recent history. With an eye towards the future, TSLA stands ready to change the direction of how our transportation is formed in the next decade just as the an economic boom is at the starting blocks of a long sprint. The weekly chart of TSLA (Figure 1) shows that the stock is making it's way back up to its former price high of $900. But, on both the weekly and daily chart (Figure 2), price action has slowed and entered a period of low volatility. This is marked by the narrowing of the Bollinger Bands contracting inside of the Keltner Channels. Once volatility reverts back to its mean and expands, the stock looks ready to cross the divide between where it currently trades back to its former price high at $900, to resume its upward trend. In the months and years to come you will hear lots of speculation about a crash and doom-and-gloom on the horizon. For the media and doomsayers, the negative news cycle serves to grab more views, eyeballs, and clicks in the digital age. For the trader, uncertainty is a constant companion but so is objective reason in the current moment. And, currently, the market is trending higher with companies like TSLA leading the way. Be mindful of the risk, but continue to trade the trend with the bulls until the day the "fat lady sings" and calls the bears to the stage. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog