HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Pent-up consumer demand and a massive liquidity injection are about to fuel the greatest bull run you've ever seen with Amazon leading the way

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

Amazon Is About To Take The Market Higher

04/22/21 04:30:02 PMby Billy Williams

Pent-up consumer demand and a massive liquidity injection are about to fuel the greatest bull run you've ever seen with Amazon leading the way

Position: Buy

| Volatility is in vogue again fueled by pent-up consumer demand which is bubbling over into the stock market. Adding fuel to the fire, all that stimulus money is spilling over into companies that benefited from the lockdown. But questions linger if the market is overbought and whether or not it can continue? The world went into lockdown due to Covid-19 and companies like Zoom, Netflix, Dash, and others stepped up and filled in the gap in key areas of the economy. People stayed home but companies on the cutting edge of communications, cloud computing, distribution, and entertainment helped the public work and thrive during an unprecedented time in history. Now, signs of life are beginning to spark as fast-tracked vaccines work their way through the world and people are starting to venture outside again. It may take awhile for the masks to come off but restaurants are starting to fill up again and people are beginning to travel outside their homes. With almost a year of being couped up, consumers are aching to get back to normalcy which includes shopping en masse with money ready to be spent. That said, a lot of money has been printed to keep families afloat while the economy was ground to a halt. It's likely that inflation, or worse, stagflation, may pose a risk down the road, but, for now, there is a massive amount of liquidity being pumped into the economy. More, now that people are starting to shop again they have more dollars to spend which will show up in the form of higher corporate earnings and higher stock values. |

|

| Figure 1. AMZN Weekly. Volatility is contracting as Amazon stays range-bound but it won't stay there forever. |

| Graphic provided by: TC2000.com. |

| |

| Amazon (AMZN) has benefited from the lockdown with its superior distribution system as well as its entertainment division. Over the last year, the public was basically under house arrest as governments around the world scrambled to cope with a historical public health crisis. With movie theaters empty and grocery shopping at limited capacity, Amazon benefited from its frictionless ordering system and relentless drive to deliver anything and everything to its customers. From its price low of $1,626 in March of 2020, the stock has doubled and currently appears ready to break higher, taking the stock market with it. On the weekly chart, the stock reached a price high of $3,552 in August of last year then settled into a trading range. Since then the stock appears to be under accumulation with volatility declining. At the end of October, Amazon's volatility fell to the degree that the Bollinger Bands moved inside the stock's Keltner Channels indicating very low volatility where it has remained. |

|

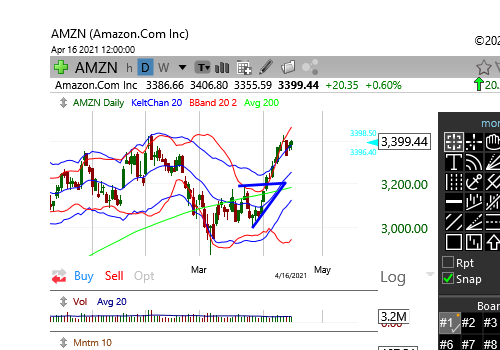

| Figure 2. Amazon's daily chart shows volatility spiking higher and taking the stock's price with it. |

| Graphic provided by: TC2000.com. |

| |

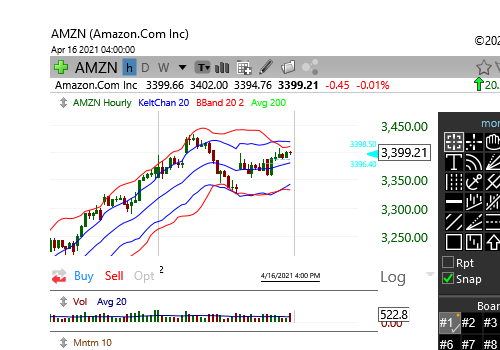

| On the daily chart, the stock's price also reveals low volatility but over the last few days has spiked in volatility. This is revealed by the Bollinger Bands emerging outside of the Keltner Channels indicating a rise in volatility. Like sparking a match to light the dynamite, the price action on this chart could be "Ground Zero" of a new bull run. Chunking down further, on the hourly chart, you can see that the volatility is low on the smaller time frame. Here, the Bollinger Bands are trading within its Keltner Channels which indicates a long setup in the direction of the dominant trend. As price emerges, volatility is likely to rise and go higher as it reverts back its mean. For traders, this is a golden opportunity to latch onto a new bull run as it reemerges to take the market into higher territory. |

|

| Figure 3. Chunking down evern further, Amazon's 60-minute chart shows a volatility setup presenting an opportunity to get in on the ground floor of a massive bull run. |

| Graphic provided by: TC2000.com. |

| |

| If all 3 time frames fire off together it could likely usher in a new bull run for the next 8 months, give or take a month. Take advantage of the low volatility and purchase in-the-money call options for May or June. As price goes higher and volatility spikes, you benefit from both the price gain but also the low premium which will be repriced higher to account for the new volatility. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor