HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Stocks in the electric vehicle space have been quite volatile. Here's a way to play the sector while smoothing your equity curve.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

RSI

KraneShares Electric Vehicles & Future Mobility ETF - The Future Of Mobility?

04/01/21 01:50:04 PMby Matt Blackman

Stocks in the electric vehicle space have been quite volatile. Here's a way to play the sector while smoothing your equity curve.

Position: N/A

| KraneShares Electric Vehicles and Future Mobility ETF (KARS) tracks electric vehicle and component manufacturers as well as those working to change the future of mobility such as autonomous driving, shared mobility, lithium and/or copper production, lithium-ion and lead acid batteries, hydrogen fuel cell manufacturing and electric infrastructure businesses, according to its website. It began trading on the NYSE in January 2018. What KARS offers is global access to companies that operate in "all areas of new transportation methods," that lead in electric vehicle connectivity; generate growth provided by companies in the lithium ion and other non-ferrous metals space as well as access to equities listed in China, currently the largest electric vehicle market and supplier in the world. |

|

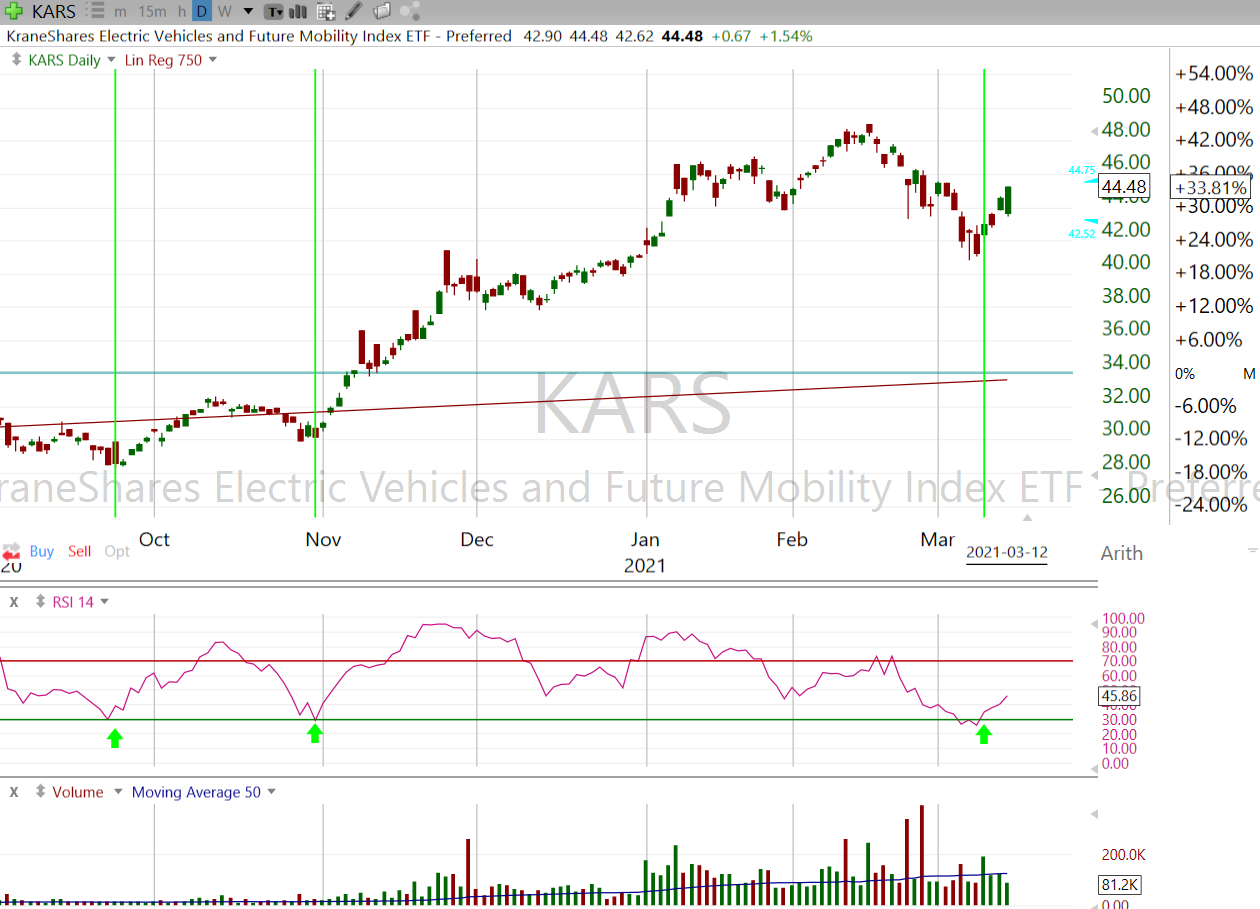

| Figure 1. Daily chart of KARS since early 2019 showing the six times the 14 day RSI has moved up through 20 (green arrows) and the one time it reversed before breaching the 20 RSI line (blue arrow). The red line in figures 1 & 2 is the 750-day Linear Regression Line. |

| Graphic provided by: Freestockcharts.com. |

| |

| As we see in Figures 1 and 2, each time the KARS 14-day RSI moved below the 20 RSI line and then rebounded back up through it since 2019, the ETF has experienced strong performance generating gains of 25% or more before experiencing a correction. And even when the RSI dropped but failed to breach the 20 RSI line before rebounding, KARS still managed to gain 20% before rolling over. As we also see from Figures 1 and 2, KARS generated another RSI buy signal on March 10, 2021. |

|

| Figure 2. Daily KARS char from September 2020 showing the latest three RSI buy signals. |

| Graphic provided by: Freestockcharts.com. |

| |

| What stocks make up the KARS portfolio? As of early March there were a total of 61 companies with the top 10 holding shown in Figure 3. Noticeably absent were General Motors (GM), Ford (F), Tesla (TSLA), Workhorse (WKHS), as well as newer entrants Nikola (NKLA), and Lordstown (RIDE). It is interesting to note that electric truck maker Rivian with major investments from Ford ($500 million) and Amazon (AMZN) ($700 million) is also not represented. |

|

| Figure 3. Table showing the top 10 KARS holdings. |

| Graphic provided by: https://kraneshares.com/kars/#. |

| |

| A full list of companies in the KARS portfolio can be found at https://kraneshares.com/kars/# and downloading the .csv file. |

| Suggested Reading KARS Website XPeng - Chinese EV Maker In Orbit? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog