HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Mark Rivest

See why an interesting historical precedent could provide clues in 2020.

Position: Buy

Mark Rivest

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

PRINT THIS ARTICLE

SUPPORT & RESISTANCE

Pfizer - Big Move Up In October?

10/01/20 01:51:01 PMby Mark Rivest

See why an interesting historical precedent could provide clues in 2020.

Position: Buy

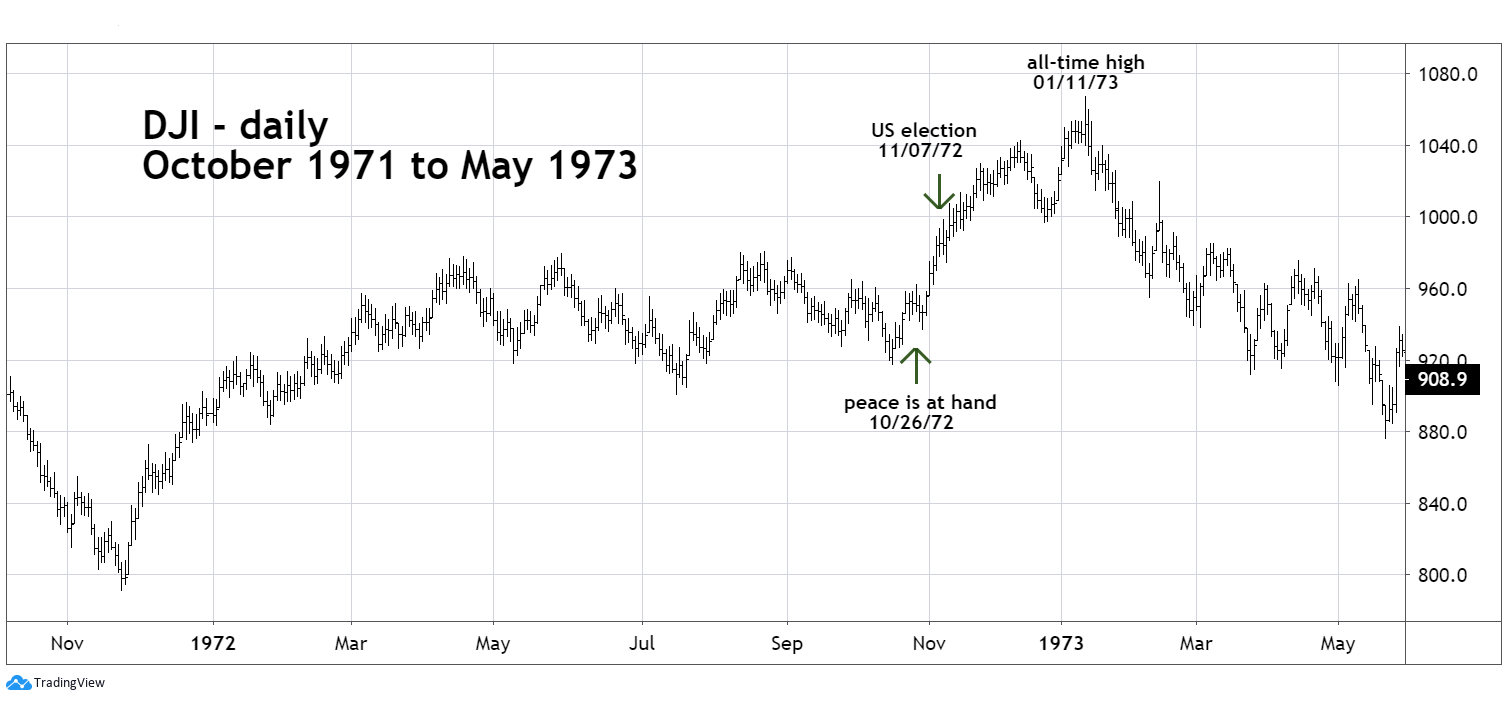

| Pfizer (PFE) is one of nine companies tasked with the goal of developing a vaccine for the Coronavirus before the end of 2020. The US Presidential Election is on November 3 and could be the real deadline for a vaccine announcement. Events that happened in October 1972 may provide a road map of what could happen for stocks in late 2020. October 1972 The following is not a prediction of the 2020 US Presidential election. It's a demonstration of how politics can affect the near-term course of a market. By 1972 US involvement in the Vietnam war had dragged on for years. There were negotiations underway to end the war — nothing was being accomplished. On October 26, 1972, National Security Advisor Henry Kissinger announced that he had been conducting secret negotiations separate from the public negotiations, and he believed "Peace is at hand" — this was twelve days before the US presidential election. The result... DJI rallied, and US president Nixon was re-elected with a 49 state landslide and 60% of the votes. Please see the daily Dow Jones Industrial Average (DJI) chart illustrated in Figure 1. Note the seasonal decline from late August 1972 to mid-October 1972. Also note the drop ended a few days before the peace announcement. Perhaps some traders had inside knowledge of coming events? After the announcement, the DJI continued to rally and didn't stop until early January 1973. This peak culminated a two-year bull run and was the commencement of a two-year bear market that cut the value of DJI nearly in half. Forward to 2020, the effects of the Coronavirus have dragged on for months with no end in sight. US President Trump initiated "Operation Warp Speed" to develop a Coronavirus vaccine before the end of 2020. Donald Trump is a former Real Estate developer who liked to have projects completed under budget and ahead of schedule. Being under budget is not a factor in developing a vaccine, ahead of schedule is a factor. Since the "Operation Warp Speed" announcement, President Trump has hinted several times that a vaccine could be developed before the November 3 election. It's possible he has more knowledge of the vaccine development progress than the general public. |

|

| Figure 1. Note the seasonal decline from late August 1972 to mid-October 1972. |

| Graphic provided by: TradingView. |

| |

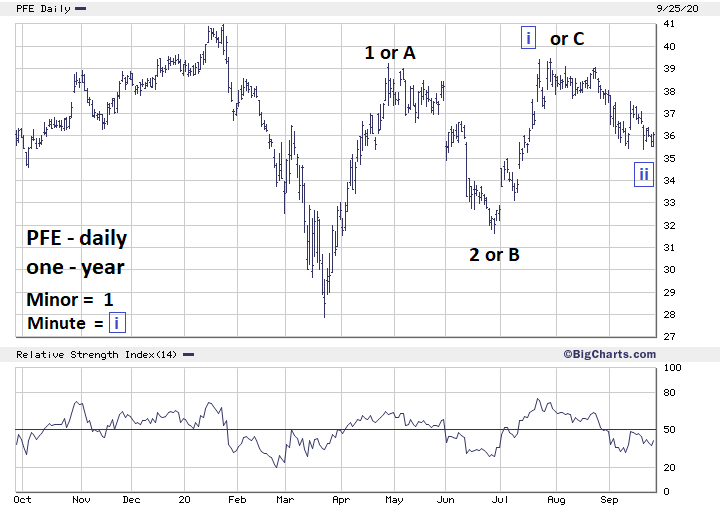

| Pfizer On September 12 Pfizer announced they were moving to enlarge the participants in the Phase 3 trial of their Covid-19 vaccine from 30,000 participants to 44,000. Expanding the trial will likely make it easier for the company to demonstrate whether the vaccine is effective against Covid-19. Pfizer CEO said the company will know if a vaccine works by the end of October. Please see the PFE daily chart illustrated in Figure 2. What makes PFE such a good candidate for speculation are the clear support/resistance levels, the July 29 high at 39.45 and the June 26 bottom at 31.61. A move above 39.45 implies that a very bullish Elliott third of a third wave up is in effect. If so, PFE could move above its all-time high of 50.04 made in April 1999. A break below 31.61 implies an Elliott wave (A-B-C) correction could be complete, opening the door for a decline to at least the March 2020 bottom at 27.88. Traders speculating on the long side could use 31.61 as a stop loss level, or a move below a .618 retrace of the rally from 31.61 to 39.45. The Fibonacci .618 retrace level is frequently a strong support/resistance level. The exact .618 retrace is at 34.60. Allowing for leeway, traders could use 34.00 as the stop point. Another strategy to enter long positions would be to buy just above resistance at 39.45. |

|

| Figure 2. A move above 39.45 implies that a very bullish Elliott third of a third wave up is in effect. |

| Graphic provided by: BigCharts.com. |

| |

| Perception Is Reality In politics perception is reality, and this perception could affect markets. In October 1972 Henry Kissinger used hedge words "believed" and "at hand". US involvement in the Vietnam war did not end in October 1972. Negotiation problems developed and in December 1972 the US conducted one of the largest bombing campaigns of the war. Yet, throughout this time the US stock market continued to rally. US military involvement in the Vietnam war ended January 27, 1973 — after the DJI reached a major bull top. Assuming one of the companies involved develops a vaccine, there could be delays in having it approved. Then there's the worst-case scenario of no approval. The important factor is perception of a vaccine. There's a possibility either Pfizer or another company involved in creating a vaccine could make a statement sometime in October "they believe a vaccine is at hand", or something similar. The vast majority of speculators do not have access to inside information. PFE,because of its distinctive support/resistance levels, could give us a chance to profit from coming events. Further Reading: Frost A.J and Robert Prechter (1985) "Elliott Wave Principle", New Classics Library. |

Independent investment advisor, trader and writer. He has written articles for Technical Analysis of Stocks & Commodities, Traders.com Advantage,Futuresmag.com and, Finance Magnates. Author of website Four Dimension Trading.

| Website: | www.fourdimensiontrading.com |

| E-mail address: | markrivest@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor