HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Move aims to create "one of the world's largest integrated pure-play renewable energy companies"

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

DIVIDEND YIELD

Clean Consolidation - What Does The Brookfield Purchase Of Terraform Power Mean?

08/13/20 04:34:52 PMby Matt Blackman

Move aims to create "one of the world's largest integrated pure-play renewable energy companies"

Position: N/A

| As anyone who follows the clean technology revolution has witnessed, companies in this space have experienced impressive growth in the last few years as billions of dollars have shifted from fossil fuels to renewables, and this trend is in the early days. An incredible $11.5 trillion will be invested in new energy generation between 2018 and 2050 with $8.4 trillion going into wind and solar alone according to Bloomberg New Energy Finance ('Seasons in the Sun' below). On July 31, 2020 Brookfield finalized a share swap and exchange, in which each Brookfield Energy Partners (BEP) shareholders received a share of newly-formed Brookfield Renewable Corp (BEPC) stock (see Figure 3) and Terraform Power (TERP) shareholders received 0.47625 BEPC shares for each TERP share, that "will create one of the world's largest integrated pure-play renewable power companies, with a 15-GW development pipeline and one of the strongest investment grade balance sheets in the sector," according to an article in Renewables Now (see link below). TerraForm Power owned and operated a portfolio of solar and wind assets in North America and Western Europe producing more than 3.7 gigabits of renewable power under long-term contracts. Brookfield Renewable Corp owns a portfolio of renewable energy facilities in North America, Europe, China, India and other markets. Electricity projects include hydro-electric, wind, solar, biomass, cogeneration and electrical storage generating more than 17 gigawatts of power plus Terraform Power assets. BEPC is part of the Utilities - Independent Energy Producers industry that includes companies such as Vistra Corp ( VST), NRG Energy (NRG), Algonquin Power & Utilities (AQN), Nextera Energy Partners (NEP) and Ormat Technologies (ORA). |

|

| Figure 1. Daily chart of the Brookfield Energy Partners showing the stock approaching its previous high on the day of the TerraForm buyout. The red line shows the long-term linear regression "far value" line. |

| Graphic provided by: Freestockcharts.com. |

| |

| Fundamentally, BEP showed a relatively strong balance sheet before the buyout that included a dividend yield (trailing) of 4.9% ($0.54) which has a five-year growth rate of 6.89% leading up to the deal. The company earned $24 million in the last year and $0.06 per earnings per share in the latest quarter. |

|

| Figure 2. Here we see the daily chart of Terraform Power leading up to the buyout showing that the stock breached the previous pre-covid high before backing off just prior to the deal. |

| Graphic provided by: Freestockcharts.com. |

| |

| As we saw in 'Fossil Fuels versus Clean Energy' (see link below), fossil fuel companies have had a tough six-years with a basket of 20+ companies losing an average 40% versus an average gain of more than 60% for a basket of clean energy and technology companies over the period. |

|

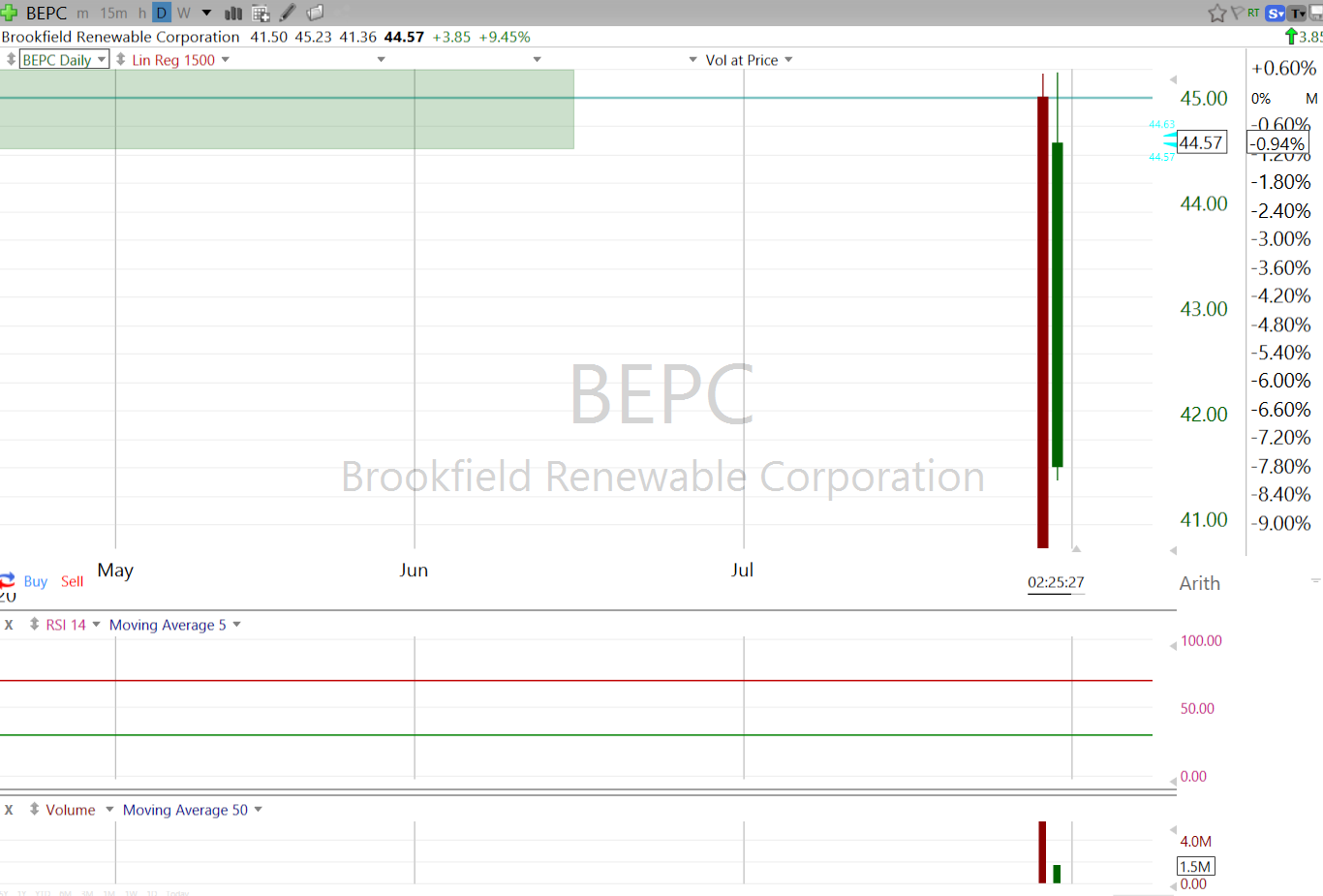

| Figure 3. Daily chart of the new Brookfield Renewable Corp on July 31. It will take a few weeks for the chart to form to provide reliable technical signals. |

| Graphic provided by: Freestockcharts.com. |

| |

| Technically, since the BEPC chart shows no history, we can use the BEP chart recent high of $45 (Figure 1) history to watch for trading signals. A move above $46 on higher volume would signal a new high and new momentum buy signal. A decisive move below $41 on higher volume would signal further weakness and a time to exit to wait for signs of confirmation that buyers are accumulating the stock again. |

| Suggested Reading Seasons in the Sun - Sourcing New Economy Winners and the Best Times to Trade Them Brookfield Renewable wins shareholders' nod to buy out TerraForm Power TerraForm Power - A Short-Term Trade Or One For The Long Haul? Brookfield Renewable Partners LP - Trending Against The Odds Fossil Fuels Vs. Clean Energy - Time to Shift Your Money? |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog