HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

Is the market behaving "rationally"? 2020 has been like riding a tornado, but something is happening behind the scenes that you want to know of

Position: Buy

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

BREAKAWAY GAP

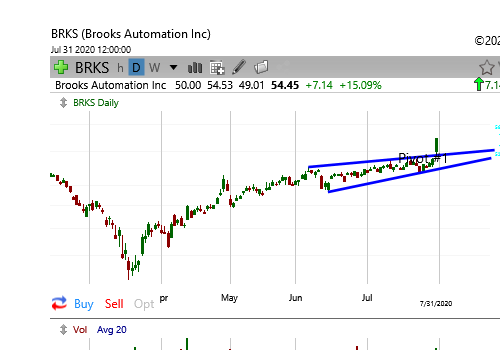

BRKS Approaching 2-Year New High

08/06/20 04:23:22 PMby Billy Williams

Is the market behaving "rationally"? 2020 has been like riding a tornado, but something is happening behind the scenes that you want to know of

Position: Buy

| Dare I say it but is the market behaving "normally"? We are coming up on the 6-month anniversary of the market declining like nothing seen in history, but is it getting better? The market in mid- to late-February gapped downward and sold off as if the world was ending and many thought that the world as we knew it was over. Worse, many doomsayers chimed in that it was the end of the American economy and that the country was entering a Japan-like, no-growth era. The rapid decline on higher trade volume was a screaming flag to sell, or at least pare down positions, and adopt a "wait and see" posture from the sidelines. I wrote about it here along with the advice to be patient and "keep your powder dry". When things are going to hell it's critical to keep your wits about you and remain rational. Adopting such a mindset can keep you from getting caught up in the herd-like frenzy of the trading majority. Better, by watching price action, you can wait for new trends to emerge and new value-oriented investing to bare fruitful bargains. |

|

| Figure 1. The market declined with dizzying speed but found long-term price support and has been closing its way back to health. |

| Graphic provided by: TC2000.com. |

| |

| I'll admit that it can be tough to remain rational when the market is swinging 500 to 1,000 point swings in the DOW. It can be even tougher when factoring in the apparent collapse of the oil market at the same time. Adding in social unrest and massive rioting it can appear that the world has taken an Insanity Pill from the outside looking in. But history is rarely a smooth curve. Mostly, historical events are jagged and uneven, which is where we are today. Tomorrow, the sun will rise and set just like the markets will rise and fall. Your job is to determine which side to be on when the moment of decision presents itself. So, having said that, have you noticed that the market bottomed off of long-term support and began clawing it's way back. So much so, that the SPX and major indexes have repaired much of the damaged technical support by closing the massive price gaps from its decline. |

|

| Figure 2. The SPX, and the broader market, has slowly been repairing the technical damage from the market crash. Along wth way, it has formed a Bullish Triangle and is about to hit the project price target of 3281. |

| Graphic provided by: TC2000.com. |

| |

| Along the way, the SPX formed a Bullish Triangle with a range of 153 points from peak-to-bottom. Upon breaking out of the upper trendline of the pattern, the pattern dictated a target of 3,281 which it has traded within 2 points of. Once that target is hit, then you have to wait and see what the market does next. In the meantime, you can notice that a new generation of stock leaders are helping the price advance bringing it within shooting distance of the SPX's previous all-time high. One stock, Brooks Automation (BRKS), is gaining traction after breaking out of a price base pattern on almost 300% of it's 20-day average trade volume. The stock reached a significant price high in early June of this year and then traded back-and-forth forming a price base. Last Friday, the stock broke out of the base on breakout volume gaining a 15% price advance before ending the day. |

|

| Figure 3. BRKS sports impressive fundamentals which have fueled its bullish run. The stock looks to displace past stock leaders as new sectors emerge to lead the market back to its previous price highs and beyond. |

| Graphic provided by: TC2000.com. |

| |

| BRKS is in a solid bullish trend which puts it in sync with the broader market. While it is not a leader in its class (yet) it is flaunting impressive fundamentals on it's balance sheet. Year-over-year, both its assets and stockholder equity have grown by an impressive margin. These solid numbers are helping power its price advance to such a height that has not been seen in the last 20 years of its operation. The market is rebuilding and as Oil & Gas has been hit hard you will see related companies fall out in favor of companies like BRKS. As you see the market transition to new stock leadership in favor of strong price action and reliable fundamentals be sure to take advantage of the rotation. Like ocean waves, stocks move in and out of favor so you want to be sure to catch a rising tide in the stock leadership as the market marches higher. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog