HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

The Death Cross and Golden Cross are technical patterns that are often used to signal stock selloffs or rallies.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Can Crosses Help Our Trade?

07/23/20 04:41:45 PMby Stella Osoba, CMT

The Death Cross and Golden Cross are technical patterns that are often used to signal stock selloffs or rallies.

Position: N/A

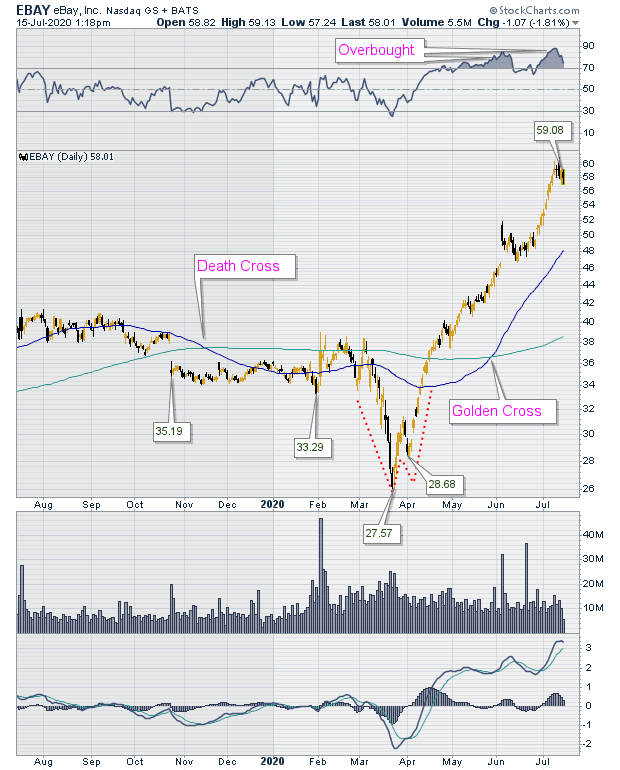

| The Death Cross When the 50-day moving average moves below the 200-day moving average, the technical pattern is often termed a Death Cross. The faster average moving below the slower average is often a sign of an impending sell off. Figure 1 is a daily chart of eBay, Inc. (EBAY). We can see the Death Cross marked on the chart when the shorter-term moving average (faster line/blue line) slips below the slow line (green line). Since moving averages are lagging indicators, we can see that the down trend had already been in effect well before the death cross signal, also after a large gap down in price. If the death cross was the only signal used to take a trade, then it is questionable if the trade would have succeeded. Once again, this depends on how long the trade was held. As the chart shows, the sideways movement which continued until early 2020 resolved in a sharp downtrend. The selloff eventually happened but not until well after the signal happened. |

|

| Figure 1. Daily chart for EBAY. |

| Graphic provided by: StockCharts.com. |

| |

| After forming a W bottom (see Figure 1) EBAY started a massive trend reversal. |

| The Golden Cross A Golden Cross is formed when the faster moving average (blue line) moves above the slower moving average (green line). The signal is indicated on the chart in Figure 1. The moving averages are lagging indicators, so the signal did not coincide with the reversal. The averages did not cross until the uptrend was well underway, nearer to about half-way up its current move. However, using the Golden Cross as a signal would have resulted in a successful trade because of the steepness of the uptrend. |

| Once again, this shows that technical signals are not mechanical; they were not meant to be because market psychology, which they depict, is not mechanical. Sometimes technical signals can result in successful trades and sometimes not. People often disparage technical analysis because they say signals do not work, but it is important to remember that signals and chart patterns are the map and not the territory. The market does not know what it should do. Our job is to let it tell us what it will do, using technical signals as a guide to lead us in the right direction. |

| In this case, if you had decided to use the crosses as signals for trades, then the correct method would have been to take both trades depending on the signals. With the first trade, the short trade, you would have likely lost money unless you held on into the March decline. The second trade, which is the long trade, would have been more successful if you could have held on during the reactions and let the trade run until a signal told you the uptrend was over. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor