HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Gilead's (GILD) Remdesivir appears to have been shown to be somewhat effective in the treatment of patients severely affected by Covid-19, which is the disease caused by the coronavirus. This news has had an effect on the share price of the company. The market had been waiting for GILD to set a price for the drug, which they announced last week.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TRIANGLES

What's A Drug Worth?

07/09/20 01:41:43 AMby Stella Osoba, CMT

Gilead's (GILD) Remdesivir appears to have been shown to be somewhat effective in the treatment of patients severely affected by Covid-19, which is the disease caused by the coronavirus. This news has had an effect on the share price of the company. The market had been waiting for GILD to set a price for the drug, which they announced last week.

Position: N/A

| Remdesivir is given intravenously. The non-negotiable price set by the drug company for each vial of the drug is $520 for patients with private insurance, or $390 per vial for patients on government-sponsored insurance like medicare and medicaid. The cost of a 5-day treatment using 6 vials of remdesivir is therefore $3,120 or $2,340. Since the total course of treatment may run from 5 to 10 days, these costs may double. It's been estimated that the drug costs perhaps $10 per vial to produce, and the drug was initially developed with $70 million of public money. Critics therefore accuse GILD of overcharging for its drugs. |

| But others (often Wall Street analysts) have said that the cost of the drug is not exorbitant. GILD's CEO Daniel O'Day said that the value the drug provides for patients is measured as the savings of approximately $12,000 per patient from faster hospital discharges resulting from treatment with the drug. They chose to go the "altruistic" route by charging less than this value. The question then becomes, how much is too much when it comes to drugmakers profiting off the sick? What is the value to a pharmaceutical corporation of a human life? Since most developed societies realize that fair profits are fine while price gouging is not, countries mostly limit how much pharmaceutical companies can charge for medicines because when it comes down to it there is an argument for the most exorbitant price tacked to a drug if it improves the odds of human survival. |

| So with GILD announcing the nonnegotiable price of the only drug so far on the market shown to have some efficacy in the treatment of covid-19, will the possibility of massive profits drive the stock price to lofty highs? |

|

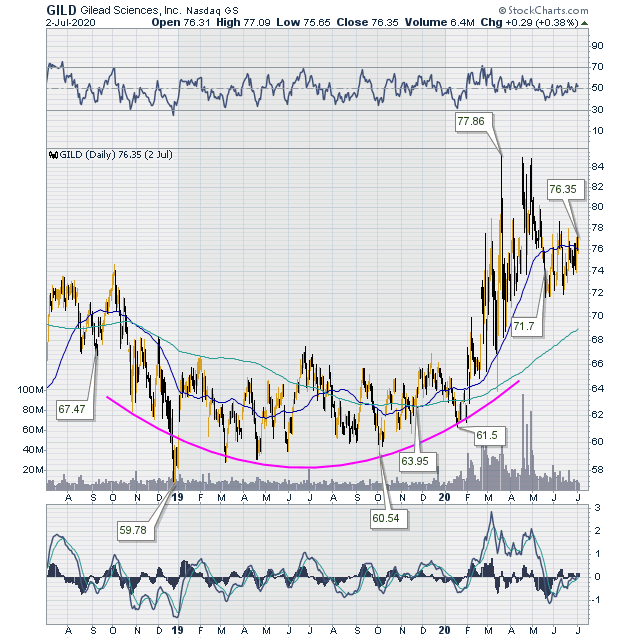

| Figure 1. Daily chart for GILD. |

| Graphic provided by: StockCharts.com. |

| |

| Figure 1 is long-term daily chart of GILD showing price making a rounded bottom over a period of about a year. We see price touching the pink curved line for the last time in January 22, 2020 when price closed at lows of about $61. After that, price began to climb, making higher highs and higher lows. On March 20, 2020 price touched a high of $80 amid much volatility. |

|

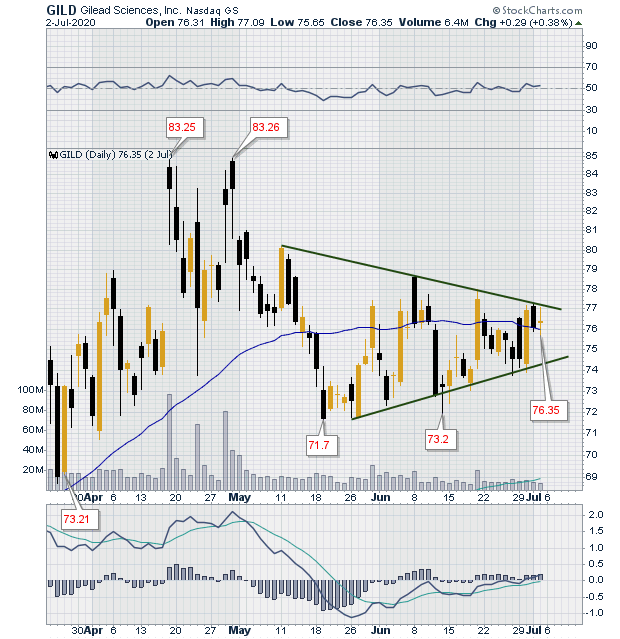

| Figure 2. Triangle pattern on daily chart for GILD. |

| Graphic provided by: StockCharts.com. |

| |

| Figure 2 is a close-up of recent daily price action. Price has slipped below the 50-day moving average and volatility has eased. The bottom panel shows the MACD moving up in-sync with price. The price pattern on the chart is a symmetrical triangle, also known as a coil. Symmetrical triangles are also often continuation patterns which mean when price breaks out of the pattern it will likely continue in the direction it entered the pattern. If this is true in this case, then the next likely move is down. It is possible that the market had already priced in the profits expected from GILD's remdesivir into the price of the stock resulting in limited anticipation of higher prices in the near future. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog