HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

Gold has been stuck in a sideways range recently, but the pressure is building, and it could be about to pop higher soon.

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

Gold: Pressure Building For Breakout

06/19/20 05:48:00 PMby Fawad Razaqzada

Gold has been stuck in a sideways range recently, but the pressure is building, and it could be about to pop higher soon.

Position: N/A

| Sentiment towards risk took a sharp turn on Thursday, June 11, as global stocks slumped, giving back a good chunk of the recent rally. Concerns grew over a second wave of coronavirus infections, while a dire assessment of the economic recovery by the Federal Reserve also unnerved investors. The sell-off initially boosted gold, but as the dollar rallied the metal gave up some of its earlier gains. However, gold remained overall supported because of its haven demand. But what about the slightly longer-term view? Will gold continue to shine or would a potential recovery in the stock markets undermine it? I think, fundamentally, gold remains supported despite what the stock market does, and so I continue to expect more gains to come in the weeks ahead. |

| Last Friday, June 5, gold was looking rather bleak after a much stronger US jobs report gave rise to speculation that the Federal Reserve could taper QE as an upbeat assessment of the economy. However, gold then started to recover again. Market participants decided that the rebound in May employment was unlikely to cause a rethink by the Fed. Indeed, that turned out to be the case as Fed Chair Jay Powell said he was "not even thinking about raising rates." Powell said the FOMC was concerned the jobs market might struggle to recover even as lockdown restrictions are eased. As a result, the FOMC projected in the dot plots that interest rates will be held at their current levels until the end of 2020. On top of this, the Fed made it clear QE was not going to be reduced and that it would be there until the economy has "weathered" the negative impact of the coronavirus pandemic. |

| So, the key takeaway point is that the Fed will keep QE at full throttle. This comes as the ECB has also recently announced beefing up its bond buying program. The long and short of it is that long-term yields will likely remain under pressure for the foreseeable future. Consequently, the appeal of the noninterest-bearing precious metals should remain intact. However, the key risk to this assessment is if we do not see some of the dangers highlighted by the Fed and other central banks. What if there are no new large waves of coronavirus infection? What if global recovery turns out to be stronger than expected and the US-China trade tensions de-escalate? If so, it is reasonable to expect that some investors will prefer buying the dips in the racier stock markets instead of safe-haven gold. |

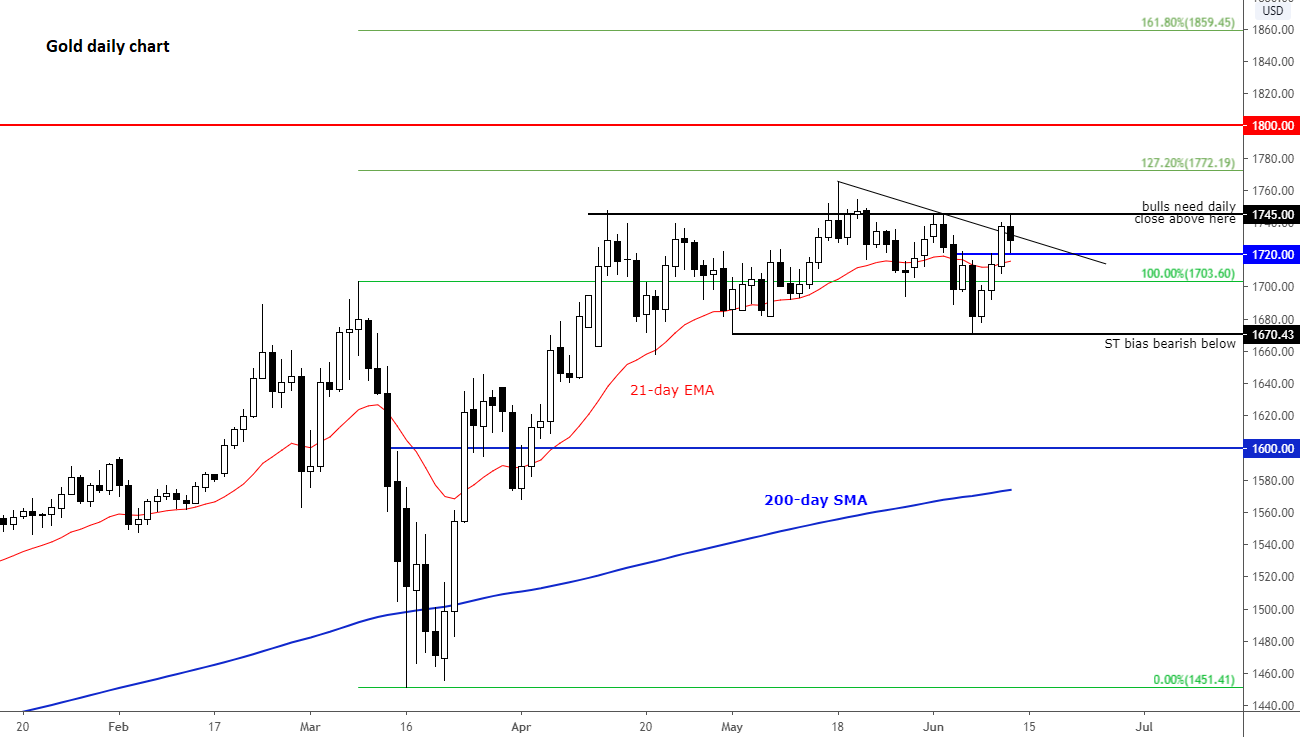

| But I still think there are more supporting factors than headwinds for gold. We just need to see the metal clear resistance around $1745, where it has previously struggled. If it posts a daily close above here, I think this could give rise to fresh technical buying in the days or weeks ahead. But we must wait for that trigger before turning technically bullish on gold again. Alternatively, if support at $1670 gives way first, then that would be the end of any short-term bullish bias. |

|

| Figure 1. Gold Daily Chart. |

| Graphic provided by: TradingView. |

| |

| So, there you have it. I think gold is fundamentally supported because of the Fed and other central banks keeping yields down. But we need a bullish technical development to trigger a breakout from the current price range. Once that condition is met, we could see renewed buying interest in gold. |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog