HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Coty, Inc. (COTY) has been in the news recently because of the story from Forbes alleging that the value of Kylie Cosmetics was inflated. COTY's shares took a hit because in January, it had forked over $600 million to buy a 51% stake in Kylie Cosmetics. At the time the deal was announced in November 2019, some analysts thought the price they were paying for what was a young, celebrity brand seemed high.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

An Expensive Trade

06/05/20 02:51:21 PMby Stella Osoba, CMT

Coty, Inc. (COTY) has been in the news recently because of the story from Forbes alleging that the value of Kylie Cosmetics was inflated. COTY's shares took a hit because in January, it had forked over $600 million to buy a 51% stake in Kylie Cosmetics. At the time the deal was announced in November 2019, some analysts thought the price they were paying for what was a young, celebrity brand seemed high.

Position: N/A

| COTY is a mid cap value beauty company in the consumer staples industry. It was founded in 1904 by Francois Coty and with over $9 billion in revenue for fiscal year ending in June 2018, it has become one of the world's largest beauty companies. In November 2019, it reached a deal to snap up Kylie Cosmetics for $600 million, valuing the company at $1.2 billion. The business rationale for the purchase might have been the attractiveness of adding a hip, young, fast-growing, social media savvy company to its stable with the idea that the purchase would aid in rejuvenating the struggling older company with a sagging balance sheet. |

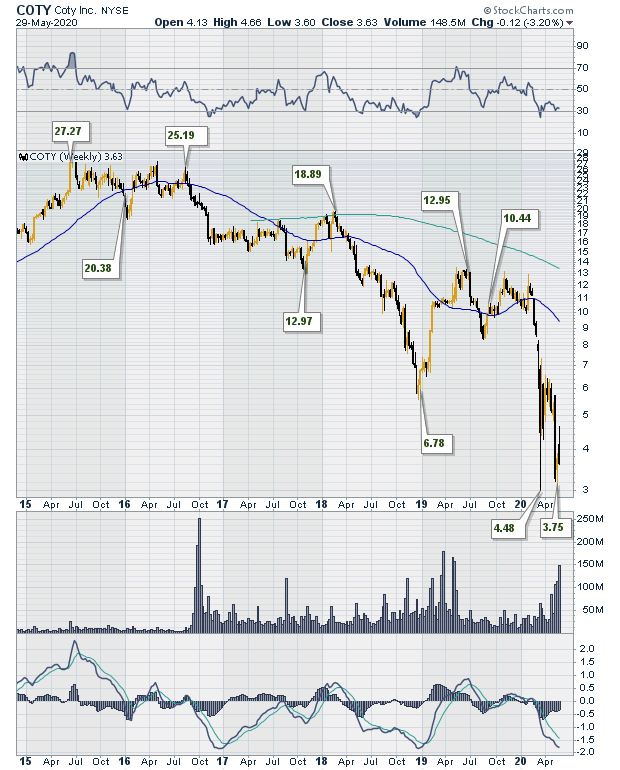

| COTY's shares have been in a downtrend since August 2016 when it traded at around $25 (See Figure 1). The chart clearly shows price making a series of lower lows and lower highs. It traded as low as $3.02 in March 2020. |

|

| Figure 1. Weekly chart for COTY. |

| Graphic provided by: StockCharts.com. |

| |

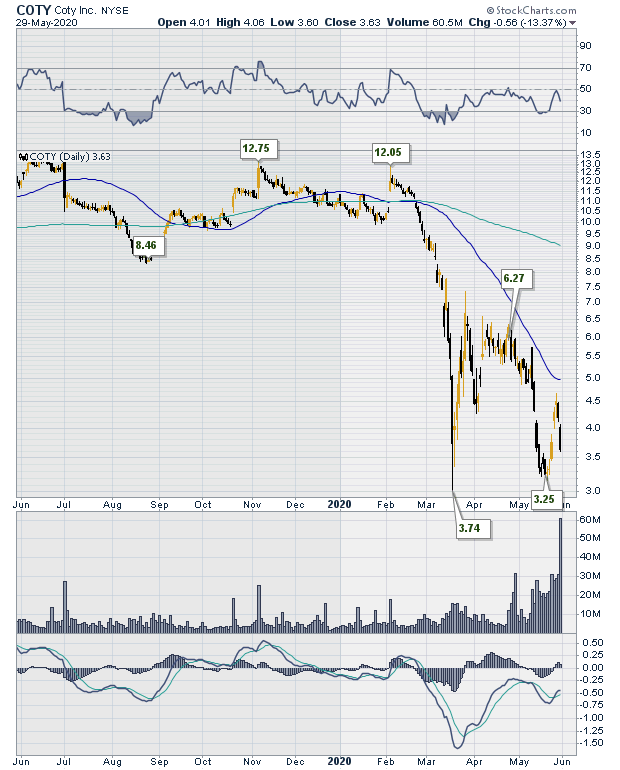

| Figure 2 is a daily chart of COTY showing the price lows in March 2020 and a rebound from those lows. The test of those lows came in May 2020 with price trading higher than the prior lows. But then news of the allegations by Forbes that "Kylie's business is significantly smaller, and less profitable, than the family has spent years leading the cosmetics industry and media outlets...to believe," sent its shares down 13% on Friday, May 29, 2020. |

|

| Figure 2. Daily chart for COTY. |

| Graphic provided by: StockCharts.com. |

| |

| Bad press is not always a reason to ditch a stock. It might be well to pay attention for a possible contrarian trade. The reason is that it is often the case that when a stock which has been in a significant downtrend is poised for a trend reversal, bad news piles on shaking out the last of the remaining weak hands. |

| The higher low in the MACD which is in the panel below the price chart, while not quite a positive divergence, hints to a slowing of price declines. It might be well to watch this chart. If the lows are finally in, this value stock could eventually deliver gains. As always allow price to tell you what it will do. Will there be another test of the March lows? Will the test fail to make new lows? Patience and discipline are, as always, a trader's best friends. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor