HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

Silver has enjoyed a remarkable recovery after its vicious falls during the height of the coronavirus pandemic when demand concerns saw the metal slump to below $12 from around $18, before supply worries saw prices stage an equally sharp rally. Where do we go from here?

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

Silver's Remarkable Recovery Suggests More Gains Likely

05/29/20 02:13:59 PMby Fawad Razaqzada

Silver has enjoyed a remarkable recovery after its vicious falls during the height of the coronavirus pandemic when demand concerns saw the metal slump to below $12 from around $18, before supply worries saw prices stage an equally sharp rally. Where do we go from here?

Position: N/A

| To say silver has had a rollercoaster ride during this pandemic is an understatement. When the lockdowns started, it initially dropped sharply as investors worried about physical demand for the precious metal. It then staged an equally sharp recovery on concerns over supply, as well as haven demand buying. Silver's mining production was reportedly impacted the most compared to the other key mining sectors. Investors are now wondering whether demand will rebound quickly in order to keep silver supported or whether it will be a speedy recovery for supply to pre-Covid-19 levels, which would likely pressurize prices. Right now, concerns over weakness in demand have been offset by worries over supply shortages. But if more economies re-open and factories restart manufacturing, then demand will likely recover quickly, potentially faster than the supply of silver catches up given that many parts of the world are still in lockdown. What's more, mines are likely to function at reduced capacity for a while because it is likely that responsible miners will, or should, be limiting the number of workers on site in order to minimize the spread of COVID-19. |

| Meanwhile, silver in its paper form (that is futures and options) has been supported by the actions of governments and central banks. As a result, the dollar has weakened because of reduced haven demand due to the equity market rally. Silver, being priced in dollars, has therefore benefitted along with commodity dollars. What's more, the Fed and other major central banks have somewhat successfully managed to suppress volatility by introducing more QE and cutting interest rates further. As a result, bond yields have been suppressed, further boosting the appeal of noninterest-bearing precious metals on a relative basis. With monetary conditions set to remain extraordinary loose for the foreseeable future, the outlook for silver looks bright from this point of view. However, it is difficult to forecast how the physical demand and/or supply outlook will look like. A lot will now depend on how fast lockdown restrictions will be lifted, or whether there will be a second round of coronavirus to contend with. From a technical point of view, silver continues to exhibit bullish characteristics: |

|

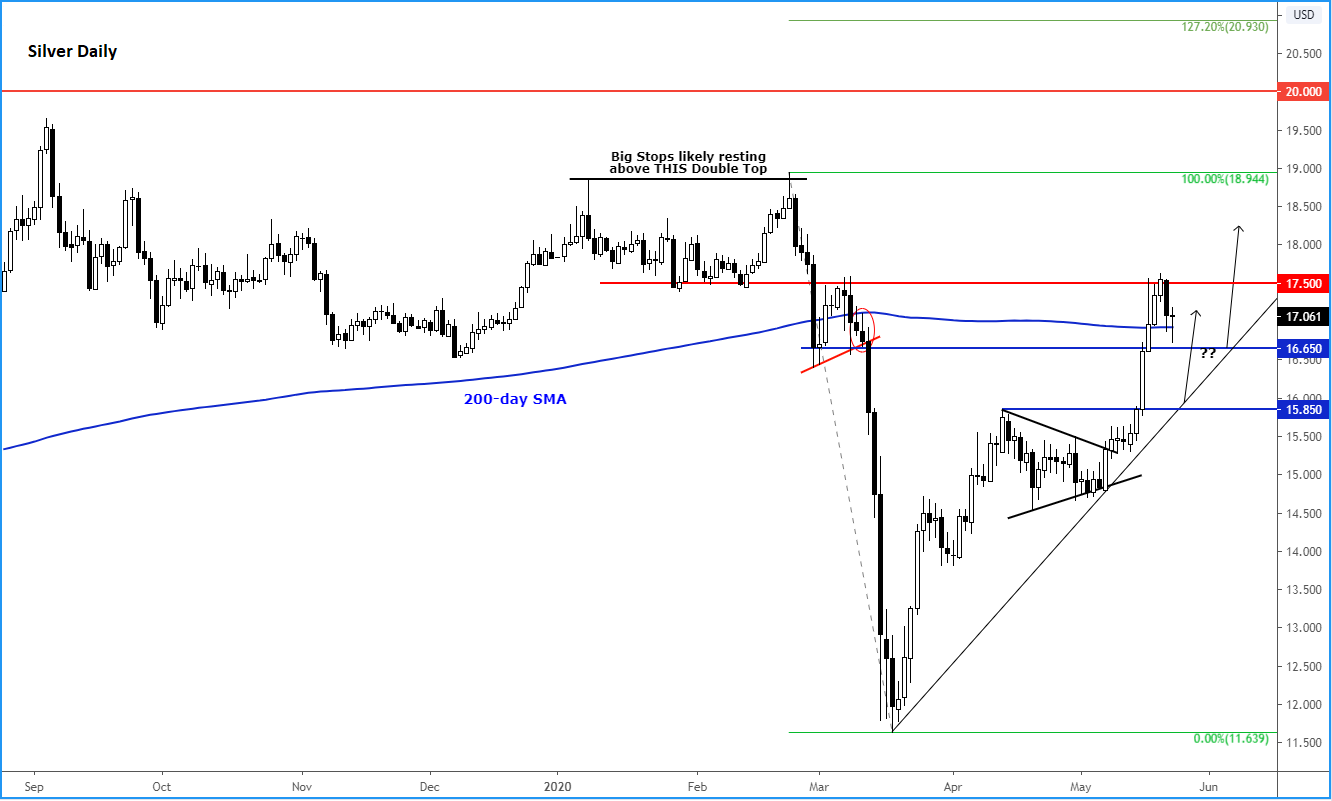

| Figure 1. Silver Daily Chart. |

| Graphic provided by: TradingView. |

| |

| Since hitting a low of under $12, the precious metal has now recovered nearly all of its coronavirus-related losses, before coming under a little bit of pressure again around an old support and resistance level of $17.50. With the metal staging a V-shaped recovery, the technical bias thus remains bullish, despite its consolidation last week. As such, dips back to key support levels are likely to be bought. There are two key levels of support that need to be watched closely. The first is at $16.65, which was the point of origin of that big drop back in March. This level should have offered some resistance when silver rallied hard into it following a breakout from a multi-week consolidation pattern in early May. But it didn't, suggesting that the buyers were in control. If they still are in control, then this level "should" offer at least some short-term support now. |

| However, it is possible silver may retrace a little deeper to consolidate its sharp gains, and as investors await fresh fundamental stimulus and/or re-assess the economic outlook in determining the fundamental direction for prices. So, a pullback to the rising trend line at around $15.85 is possible, while an even deeper correction cannot also be ruled out. This $15.85 level also corresponds with the breakout point from the triangle pattern, making it a key technical level. |

| On the upside, the first key resistance has already been tested at $17.50. If and when this level breaks, the next bullish objective would be the prior double top high just below the $19 handle. It is likely that a cluster of stop orders from trapped sellers might be resting around there. So, that's the next big pool of liquidity that the bulls might be aiming for. |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog