HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

During this coronavirus pandemic, the single most important action you can take is to stay at home. Not only are you saving lives, but also helping to support services like Netflix.

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

Stay Home, Watch Netflix

04/10/20 03:57:08 PMby Fawad Razaqzada

During this coronavirus pandemic, the single most important action you can take is to stay at home. Not only are you saving lives, but also helping to support services like Netflix.

Position: N/A

| At the start of this week, global stock markets rallied sharply, reducing some of the covid-19-related losses. Many Americans and people around the world have been stuck in their homes for weeks in an attempt to try to flatten the coronavirus curve. There are signs that social distancing is working in the U.S. and elsewhere, which was part of the reason for the market's big jump Monday, April 6. |

| With lots of countries in lockdown, the global economy is suffering. But thanks to the actions of governments and central banks, stocks have recovered from their lows, although remain susceptible for further weakness. |

| However, certain stocks have performed exceptionally well during these tough times. Not least, Netflix. Demand for the services of the video streaming company is likely to have risen noticeably as people in most parts of the world are forced to watch the television given that they are only allowed to leave their homes for very limited reasons and with many sporting events cancelled. |

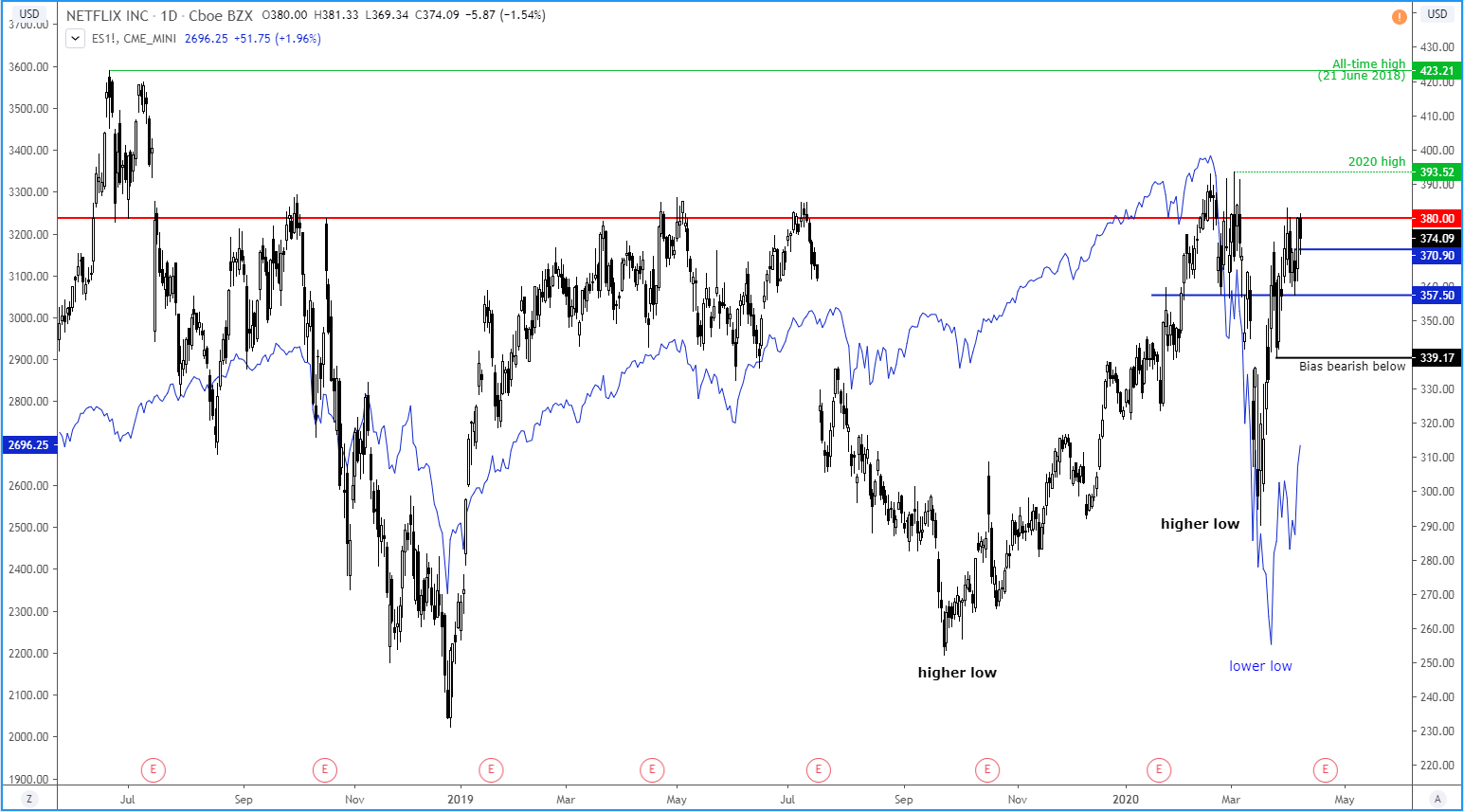

| So, when Netflix reports their results on April 21, expect to see a jump in the monthly active users and profit. Analysts expect the company to post a first quarter earnings per share of $1.61 compared with $0.52 in Q4. To give you an idea of how well Netflix was performing, the stock was just 11.9% off its record high at the time of writing, while the S&P 500 was 20.8% worse off. Graphically, this is how they looked: |

|

| Figure 1. Netflix vs. S&P 500. |

| Graphic provided by: TradingView. |

| |

| Netflix was coming under a bit of pressure, though, as it once again struggled to get through resistance in the $380 region. A closing break above here could pave the way for a potential move to a new 2020 high beyond $393.52, followed by the all-time high at $423.21. However, if we start to see the breakdown of key supports such as $357.50 and $339.12 first, then this could potentially spell trouble for the bulls. |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog