HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

Following the company's earnings results, Barrick Gold ended the week with a bang as it broke out of a recent consolidation zone and threatened to break further away in the weeks ahead.

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Barrick Gold Shining Brightly

02/20/20 04:35:08 PMby Fawad Razaqzada

Following the company's earnings results, Barrick Gold ended the week with a bang as it broke out of a recent consolidation zone and threatened to break further away in the weeks ahead.

Position: N/A

| Barrick Gold reported adjusted net earnings per share of $0.17 on February 13, easily beating estimates of $0.13, and announced a 40% increase in dividend payout. The company reported growth in free cash flow and announced a significant reduction in net debt. Its shares closed last Friday near the highs at $19.72 after a more than 4% rise on the session. |

| Barrick Gold is the second largest gold mining company in the world. It is headquartered in Toronto, Canada, and has mining operations in several countries, including Argentina, Australia, Chile, Ivory Coast and Saudi Arabia. Precious metals and gold miners have been rising sharply over the past year or so thanks to renewed weakness in bond yields driving investors into both higher-yielding equity markets and zero-yielding metals. Unlike metals though, gold miners provide a yield, potentially making them more attractive in this market environment. Indeed, they might even outperform other equity sectors in the event of a sharp rise in risk aversion due, for example, to concerns over the economic impact of the coronavirus outbreak. |

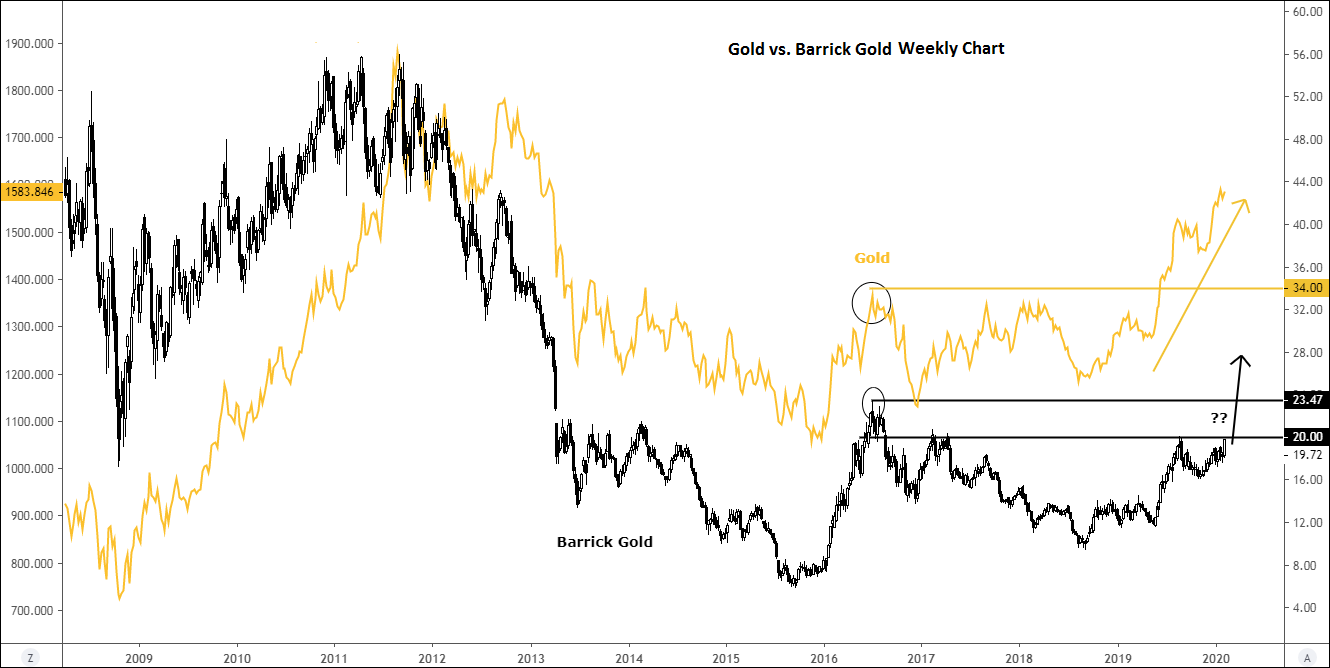

| Undeniably, Barrick's 37.3% rise in 2019 and the 6% increase so far in 2020 looks impressive. But the gold miner is still well below its 2011 high. What's more, the percentage gains only look impressive because Barrick has risen from a low base. Thus, in nominal terms, it is yet to match the corresponding gains that gold has enjoyed over the past year. |

|

| Figure 1. Weekly chart for Gold and Barrick Gold. |

| Graphic provided by: TradingView. |

| |

| However, with Barrick being a gold miner, its share price will be impacted by changes in the underlying value of gold. And given the big breakout in gold, Barrick may have some catching up to do. So, don't be surprised if the stock were to break above $20 and embark on a rally beyond its 2016 high just below $23.50 — the same way gold broke its corresponding level in the summer of last year. |

|

| Figure 2. Daily chart for Barrick Gold. |

| Graphic provided by: TradingView. |

| |

| On the daily time frame, Barrick's price action looks solid. Over the past 4 months or so, it has been consolidating its sharp gains that were made during last summer. With the stock now back above the 21-day exponential moving average and making higher highs and higher lows, a breakout looks likely. Short-term support comes in at $18.17 then at $18.65. This bullish outlook will become invalidated however should the stock break its most recent swing low at $17.63. |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog