HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Billy Williams

The market seems ready to implode but one stock is resisting it's gravitational pull to the downside

Position: Hold

Billy Williams

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

DCXM Resisting the Market's Gravity

02/13/20 04:13:15 PMby Billy Williams

The market seems ready to implode but one stock is resisting it's gravitational pull to the downside

Position: Hold

| The market got rocked by news that the Coronavirus has escalated to the point where travel restrictions to China are now going into effect. No Chinese that have come from, or recently been to, the mainland will be allowed into the U.S. and Australia, with more countries signaling that they are likely to fall in line. The market responded with a massive sell-off, the biggest one-day drop since last October, as investors wonder what the fallout will be on a Chinese economy and the countries that do business there. However, taking guidance from the old Chinese proverb that "out of every crisis there comes opportunity", what opportunities will materialize as the markets climb a wall of fear over an uncertain future? China is a massive economic power that has interests throughout Asia, Europe, and North America. Its influence is enormous and the potential for disaster is extremely high in regards to this outbreak. While the death toll is relatively low (it just passed 300 deaths) the real fear is that the virus will spread worldwide? But, is this an overreaction? |

|

| Figure 1. The selloff caused the SPX to break its intermediate trendline with more room to go to the downside. |

| Graphic provided by: TC2000.com. |

| |

| Consider this, the pandemic ranking from the World Health Organization (WHO), which details 6 phases of pandemic escalation: "The World Health Organization (WHO) provides an influenza pandemic alert system, with a scale ranging from Phase 1 (a low risk of a flu pandemic) to Phase 6 (a full-blown pandemic): Phase 1: A virus in animals has caused no known infections in humans. Phase 2: An animal flu virus has caused infection in humans. Phase 3: Sporadic cases or small clusters of disease occur in humans. Human-to-human transmission, if any, is insufficient to cause community-level outbreaks. Phase 4: The risk for a pandemic is greatly increased but not certain. Phase 5: Spread of disease between humans is occurring in more than one country of one WHO region. Phase 6: Community-level outbreaks are in at least one additional country in a different WHO region from phase 5. A global pandemic is under way." |

|

| Figure 2. On the daily chart, the SPX tried to make it back up above the trendline but price trades lower after a feeble initial run-up. Friday's sell-off caused price to into a freefall, blowing past the lows on 1-27-20. |

| Graphic provided by: TC2000.com. |

| |

| With that, recently, we have entered Phase 5 with a recent death in The Philippines, the first outside the border of China, and are likely to enter Phase 6. Adding to that, this explains why countries around the globe will be implementing travel bans on China as it's the first line of defense to keep the virus from spreading. So, in summary, it's hard to overstate how big of a deal this is, which makes its impact even more stark as it effects a world superpower. China's economic engine could come to snail-crawl or, worse, to a grinding halt. As China's misfortune isn't restricted to within it's own borders but can easily bleed over into other borders as fast as the contagion it's fighting at this moment. Foreign companies that have manufacturing plants within China are now faced with hard questions on how to get their goods to market around the globe. Lack of trade revenue could cause the Chinese to default on its debt owed to foreign banks. Government workers could be faced with the prospect of not getting paid. Political unrest, cries for freedom from Hong Kong echoing to the rest of the mainland, a martial crackdown on citizens, a military coup, and more scenarios (none of them positive) could have far-reaching implications for the rest of the world. |

|

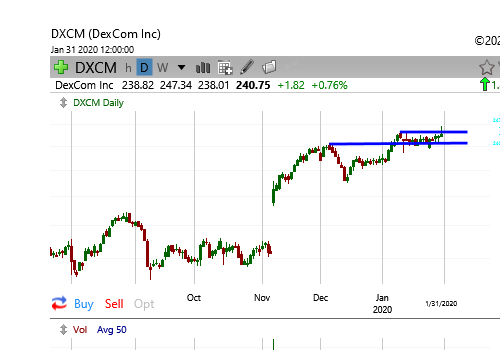

| Figure 3. DXCM has a strong technical profile with price trading near its highs combined with a strong Base-On-Base pattern. If the market turns back up then DXCM is in a plum position to ride the trend back to the upside. |

| Graphic provided by: TC2000.com. |

| |

| So, where is the opportunity in the midst of such dim prospects? The S&P 500 (SPX) has recently broken it's intermediate trendline and is trading around it's price low from 1-27-20 at 3234. But it's unlikely that this a price retest as the SPX traded down convincingly on higher volume and near the lows of the day. Given the fear pouring into the market it's likely to keep trading down and testing the long-term trendline. Price stops should be revised to control risk and good judgment would suggest selling part of your positions to capture gains and observe from the sideline. And while you're sitting on the sidelines, start looking at stocks that trade with enough strength that they have shrugged off the Bear's downward gravitation pull and stand ready to go higher at the first opportunity. |

| Dexcom, Inc. (DXCM) is a medical service company that develops continuous glucose monitoring systems for ambulatory use by patients with diabetes. Currently the company is 3rd in its industry that is riding a strong trend among its peers but whose earnings are lagging. The thing that makes this stock so compelling is its technical traits due to it resisting the sell-off and staying near its all-time price high. The smart way to play this is to add a small position and add to it as price proves its strength to upside. The buy point is $241.85 with a trailing stop and adding positions after each pullback. Till then, sit tight, respect risk, and let the price action in the overall market dictate your next move. |

Billy Williams has been trading the markets for 27 years, specializing in momentum trading with stocks and options.

| Company: | StockOptionSystem.com |

| E-mail address: | stockoptionsystem.com@gmail.com |

Traders' Resource Links | |

| StockOptionSystem.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

|

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor