HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

Since December 2018, Independent Power Producer Utility stock Ormat has gained more than 50%. Can it keep up the pace?

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

BULL/BEAR MARKET

Ormat Technologies - Clean Energy Leader

01/09/20 03:14:39 PMby Matt Blackman

Since December 2018, Independent Power Producer Utility stock Ormat has gained more than 50%. Can it keep up the pace?

Position: N/A

| Ormat Technologies (ORA) headquartered in Reno, Nevada, is a "pure-play geothermal" renewable energy company and is currently the third largest holding in the iShares S&P Global Clean Energy ETF (ICLN), according to Nanalyze.com. It has a market cap of $3.9 billion, earnings of $93.7 million in the last year and boasts an impressive five-year dividend growth rate of more than 18%. According to the company website, it builds and supplies power generating equipment for geothermal and recovered energy power plants in 30 countries. |

|

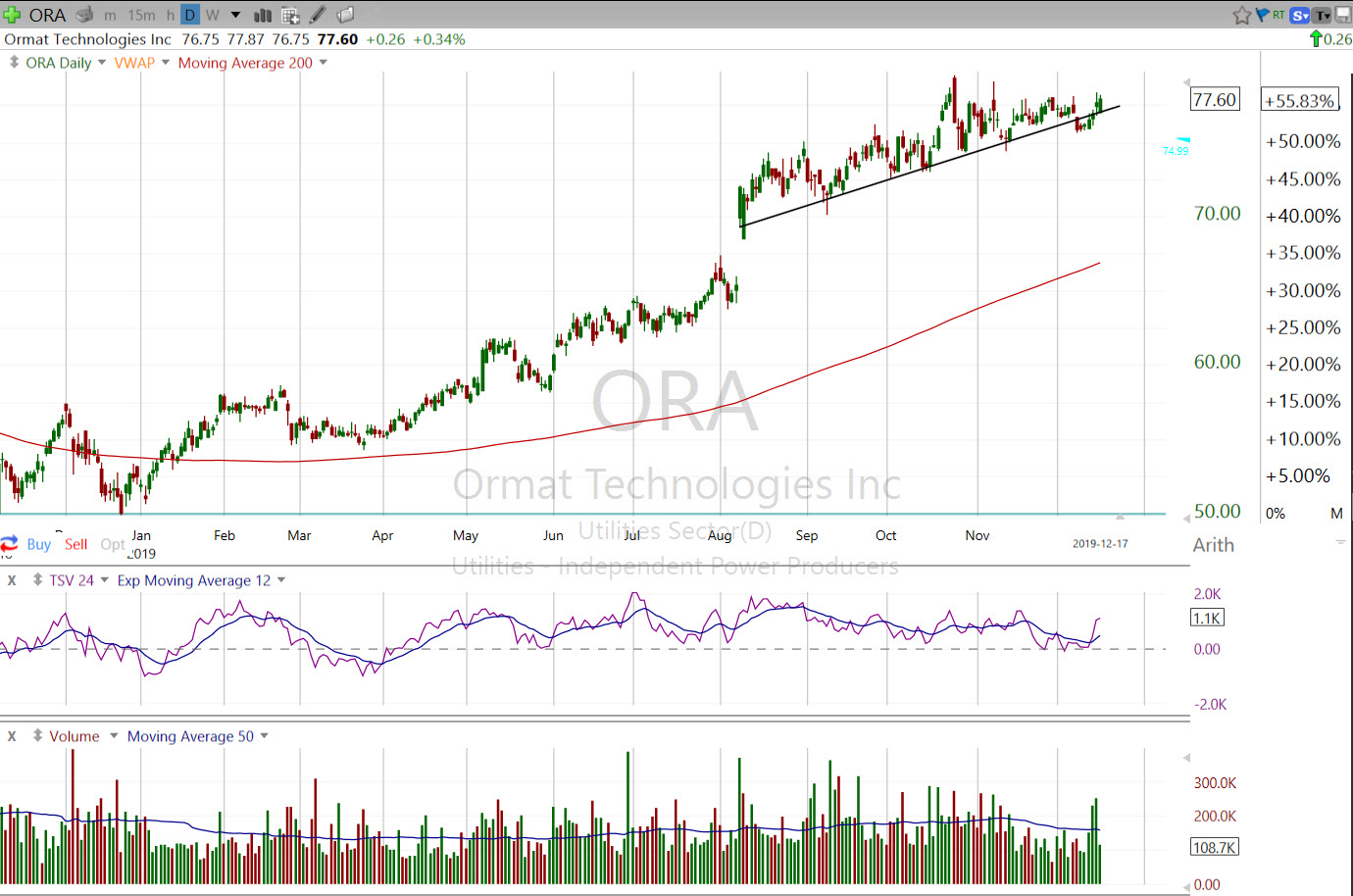

| Figure 1. Daily stock chart of Ormat Technologies showing the strong uptrend in 2019 and high level channel with rising uptrend support heading into year-end. |

| Graphic provided by: Freestockcharts.com. |

| |

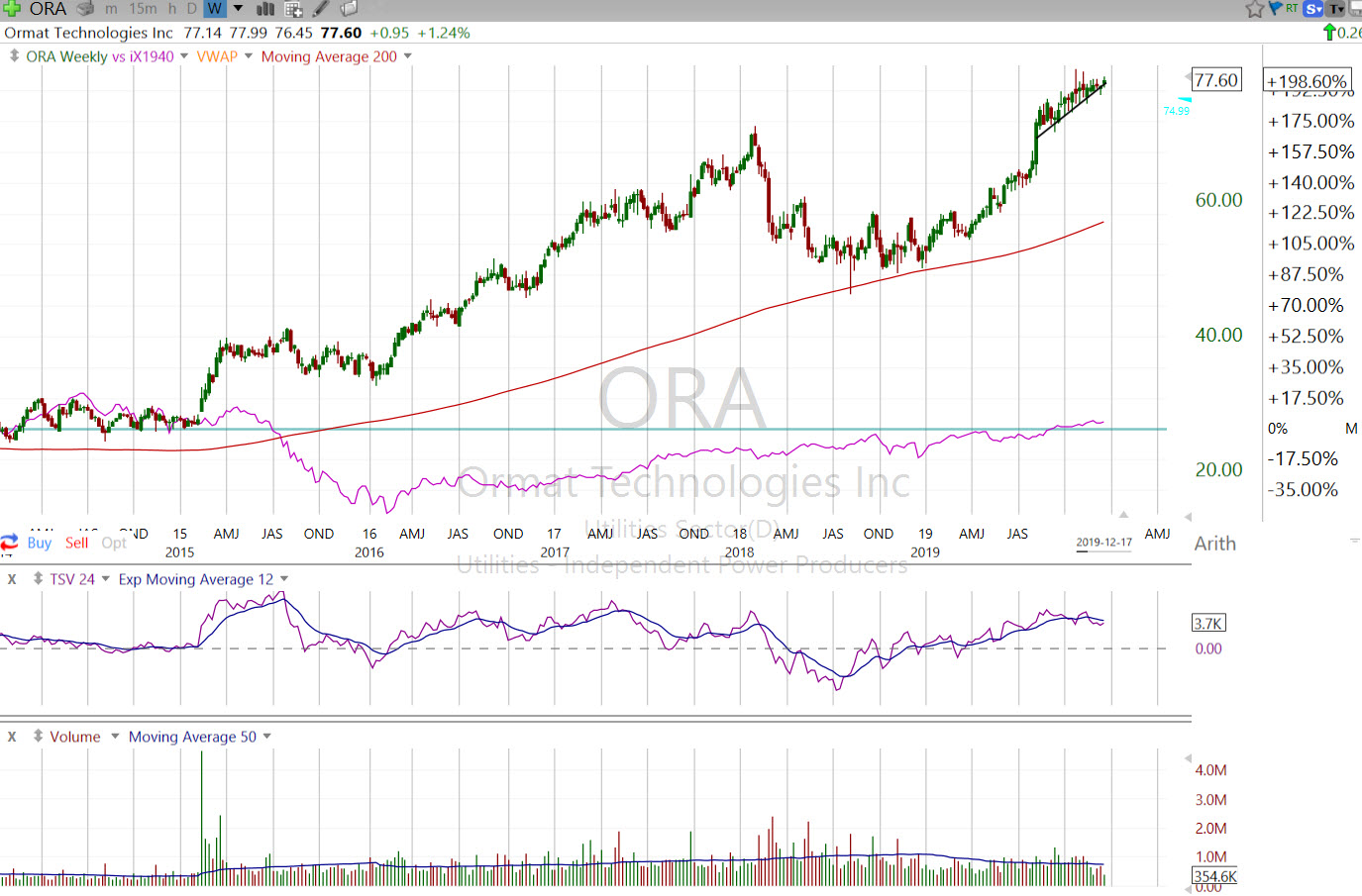

| Also noteworthy — 74% of Ormat shares are owned by institutions. As seen in Figure 1, ORA is posting a rather messy upward channel with a symmetrical triangle continuation pattern that if broken to the upside will be bullish. On the weekly chart (Figure 2), we see a cup-like pattern which isn't a Cup & Handle in that it doesn't sport a 30% rise to the lip before the price broke down into the cup. It is also posting an upward slanting handle that is also atypical of the pattern. |

|

| Figure 2. Weekly chart of ORA showing that is has handily outperformed others in the Independent Power Producers Utility group (magenta line). |

| Graphic provided by: Freestockcharts.com. |

| |

| Another positive is that ORA has strongly outperformed other Independent Power Producer Utility stocks (Figure 2), as well the energy market in general. An exit would be prudent should price break below the uptrend support line in Figure 1, after which it would be best to wait for a new bullish setup and buy trigger. Over the longer-term, this stock has the potential to continue outperforming not only other renewable energy companies, but energy stocks in general given the current malaise in the fossil fuel sector. |

| Suggested Reading: Seasons in the Sun - Sourcing New Economy Winners and the Best Times to Trade Them TerraForm Power - A Short-Term Trade Or One For The Long Haul? Enphase Energy - New Economy Shiner? A Geothermal Energy Stock for Investors |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog