HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

When a company is heavily shorted with expectations that its poor fundamentals will push the stock's price lower, the large number of shorts can be a reason for the exact opposite to occur; a quick rise in the stock. This is called a short squeeze. We shall look at this interesting phenomena using Pier 1 Imports (PIR) as our example.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

The Short Squeeze

09/19/19 04:26:36 PMby Stella Osoba, CMT

When a company is heavily shorted with expectations that its poor fundamentals will push the stock's price lower, the large number of shorts can be a reason for the exact opposite to occur; a quick rise in the stock. This is called a short squeeze. We shall look at this interesting phenomena using Pier 1 Imports (PIR) as our example.

Position: N/A

| Pier 1 Imports (PIR) is a small cap value company which started off as a single store in San Mateo, California in 1966 selling chairs and other retail pieces. It has since expanded to about 950 stores throughout the US and abroad. It imports home furniture and other decorative accessories. The company also has an e-commerce website. |

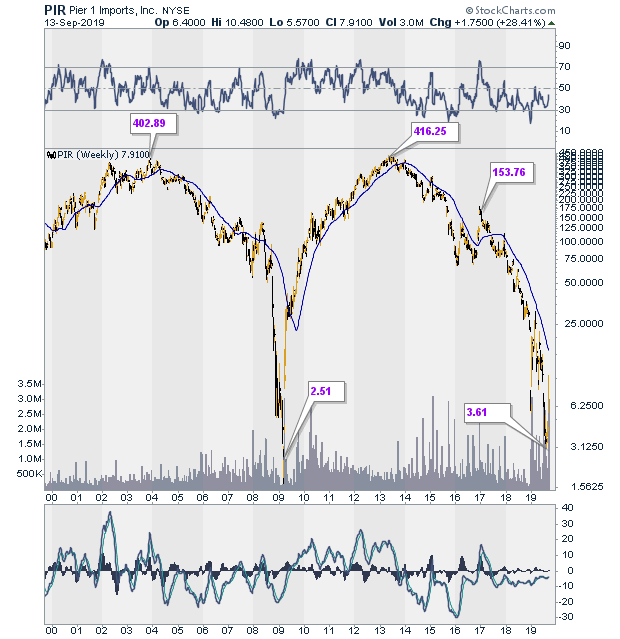

| The company currently has poor fundamentals and its share price has plunged from highs of over $400 in mid 2013 to lows of around $3 in August 2019 (See Figure 1). Its last quarterly earnings on June 29, 2019 showed losses of $19.97 per share. Its upcoming earnings statement is expected to be announced on September 25, 2019 and analysts covering the stock are bearish on its outlook. PIR's P/E ratio is a stunning -62.16 per share based on its share price at the close of trading on September 13, 2019. So why could this stock with its sorry financial picture possibly see a surge in its share price? Because of the shorts. |

|

| Figure 1. Weekly chart for PIR. |

| Graphic provided by: StockCharts.com. |

| |

| As of August 30, 2019, the short interest in this stock is 29.30% of the float. This means that over 1 million shares or almost 30% of the outstanding shares of 4.26 million will need to be bought back to cover short interests in the case of an unexpected rise in price. This will produce a short squeeze because those shorts will need to find shares to borrow to close their positions. |

| A short squeeze happens when there is a rapid price spike in a company's shares caused by shorts buying the shares of the company they are short to close their positions in the event of an unexpected rise in price. Shorts borrow shares to open a position and to close that position they have to buy the shares they have earlier borrowed. The spread between the price they borrow the shares at and the price they buy the shares at is their profit (or loss). With this in mind we can see that while a short seller's profits are finite (a stock cannot go beyond zero), their losses are potentially unlimited. As we can see from the historical chart of PIR (See Figure 1), the stock has traded in the past as high as $420. |

|

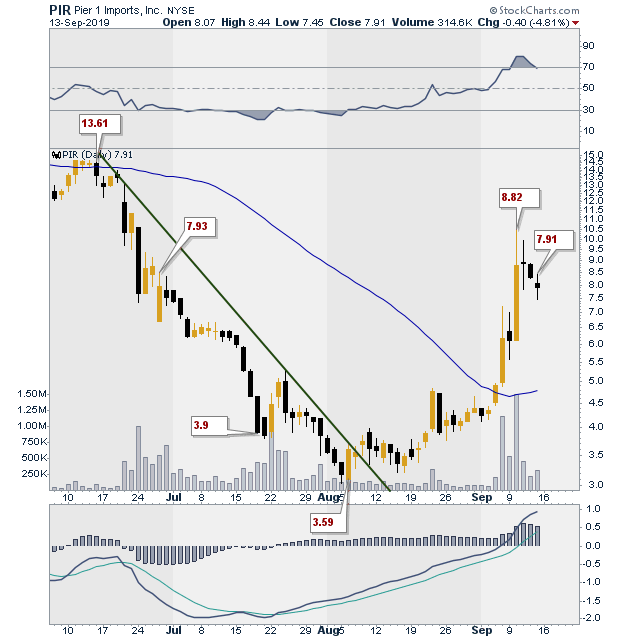

| Figure 2. Daily chart for PIR. |

| Graphic provided by: StockCharts.com. |

| |

| Back to our short squeeze. We know that stock prices rise for any number of reasons unrelated to their fundamentals. Therefore, if, as we see has begun to happen in Figure 2, PIR maintains its rise and the shorts beginning to feel pain at their growing losses decide to get out of their positions en mass, they will need to buy shares in order to do so. With a float of just over 4 million shares and 30% of those shares shorted, it is highly possible that some shorts will have difficulty buying enough shares to cover their short positions. This scarcity of stock can result in the short squeeze. As price runs up, more and more shorts desperate to get out of their positions are willing to pay higher and higher prices. As prices rise, it catches the attention of the public who jump on the gravy train pushing prices up even higher, thereby squeezing the shorts even tighter. This article is for educational purposes only and is just an illustration of the concept known as a short squeeze. I am not recommending you trade this stock or rely on the information herein to open or close a position in the stock. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog