HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

The trouble with Tilray, Inc. (TLRY), the Canadian based grower, processor and researcher of medical cannabis, is that its share price has hit a very rough patch.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

The Trouble With Tilray

08/30/19 11:47:28 AMby Stella Osoba, CMT

The trouble with Tilray, Inc. (TLRY), the Canadian based grower, processor and researcher of medical cannabis, is that its share price has hit a very rough patch.

Position: N/A

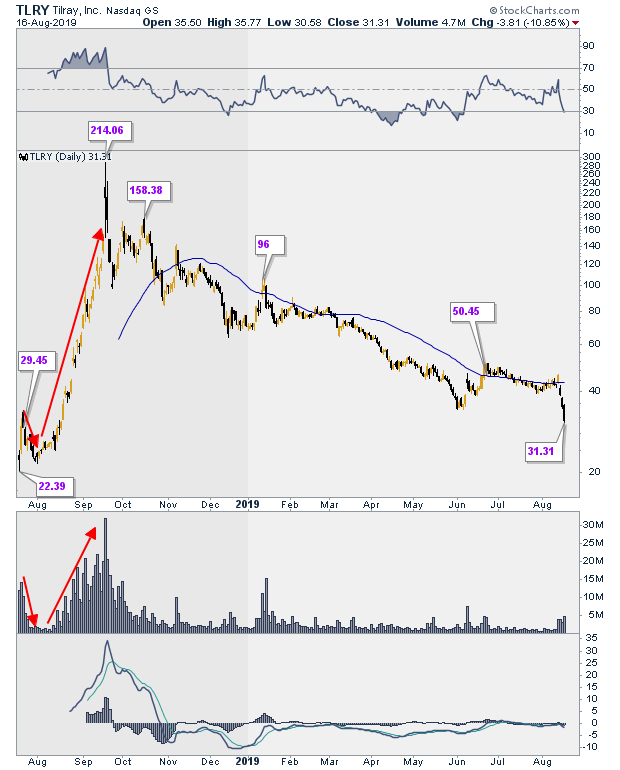

| TLRY made its debut on the Nasdaq on July 19, 2018. Shares were priced at $18, and the stock opened at $23.05. As we can see in Figure 1, two days later price peaked at a high of $34 before reacting to make a higher low on August 1, 2018 at $21.50. Caution is always required when trading IPO's because new buyers are often swept up on shores of exuberance which are not aligned with fundamentals. While a stock that has just begun trading has no track record of publicly available financial data to assess its underlying financial health, the publicity surrounding the company often fans the flames of irrational behavior which allows insiders to hand their shares off to weak hands at wildly inflated prices. This was the story of TLRY. |

|

| Figure 1. Daily chart for TLRY. |

| Graphic provided by: StockCharts.com. |

| |

| Looking at Figure 1, we can see that as the stock price declined between July 23, 2018 and August 1, 2018, volume declined. While those who had just bought the stock might not have been selling, new buyers were scarce. This was not unexpected and it was wise for people to exercise caution. But then what happened next? From August 2, 2018, the stock began to trade higher. And apart from a strongly bearish day on August 14, 2018, it was as if the stock could do no wrong. Its parabolic rise was a wonder to behold, taking the stock from the low of $21.50 on August 1, 2018, to a nose-bleed high of $300 on September 19, 2018. As the stock rose, so did volume, and people piled into the stock as price rose. |

| There is a biblical saying that goes, "The poor is disliked by his neighbors, but the rich has many friends." This saying can also be applied to stocks. Stocks that are rising rapidly in price will find themselves a huge following as people trip over themselves to get in on the act. While inactive or dull stocks (poor in our example) are often ignored by the masses. It would therefore behoove us to remember a fundamental rule of stock trading: The higher the price of a stock, the more risky it is. Those who remembered this would probably have shorted TLRY as its share price rose to unsustainable levels, even while the news was feting the stock. |

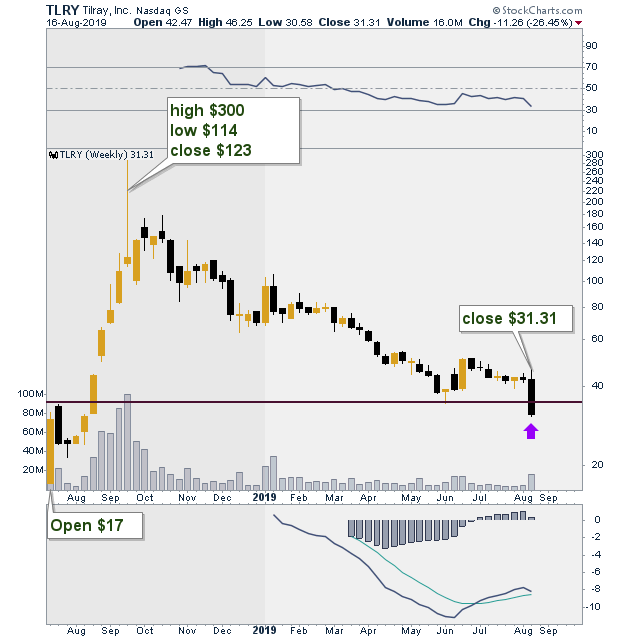

| What happened next was inevitable, even though those who bought shares at elevated prices would have hoped they could deny it away. The stock fell. But it did not drop in a straight line; no stock does. As it fell, there were reactions along the way, giving stock holders opportunities to get out for smaller losses. But many would have held on and hoped. Watching the carnage and their growing losses until the pain became too much to bear before finally selling. So what happened next? The stock closed on August 16, 2019 at $31.31 (See Figure 2). One analyst said it could go to $4. Who knows how low it will go. The thing is, now that the stock price is doing poorly, TLRY has few friends. The news around it is bad. Its last quarterly earnings report was called an "unmitigated disaster". But remember that good news is a contrarian signal. I do not know that TLRY will ever rise from its current woes, but buying in dull markets, or when stocks have fallen to lows from which they show a technical ability to defend, is how you build a position so that when stock does rise you are in a position to sell in exuberant markets. |

|

| Figure 2. Weekly chart for TLRY. |

| Graphic provided by: StockCharts.com. |

| |

| Just remember that on May 15, 1997 a certain company made its IPO debut at a price of $18 a share. Twenty-two years later, on August 16, 2019 the share price closed at $1792. And because the company (which as you might have guessed is none other than Amazon (AMZN)) had three share splits in its history, each share bought around the time of the IPO (the first split was not until June 1998) would be 18 shares today. Though the ride was rocky for long periods of time, with price falling to a low of $5.51 in October 2001, those 18 shares would today be worth $32,256. Not a bad return on an $18 investment. I bring this up only to remind us that in these rocky times, it is easy to lose sight of the forest for the trees. Trading and investing have never been easy, we sometimes need nerves of steel to stay in the market. But in uncertain and volatile times, daring to do nothing is often the hardest, though sometimes the best, cause of action. I bring AMZN up only as an example, an imperfect one in this situation because if instead of buying AMZN you had bought Webvan.com in 2000, it would be worth $0 today. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor