HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Trading well is all about reading charts with a cynical cold eye. The further away we move from our emotions, the more we are able to see and assess. Many people say candlestick signals do not work. They are right, sometimes. And then again what about the times they are just plain wrong? Knowing how to use candlesticks means interpreting patterns which become our signals. Interpreting these signals means that you are constantly looking for confirmation to prove or disprove your analysis. Lack of confirmation means that the signal failed. Working with candlesticks means that you are confident enough to let the charts light the way knowing that the map is not the territory.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Signals And Confirmation

08/22/19 04:43:04 PMby Stella Osoba, CMT

Trading well is all about reading charts with a cynical cold eye. The further away we move from our emotions, the more we are able to see and assess. Many people say candlestick signals do not work. They are right, sometimes. And then again what about the times they are just plain wrong? Knowing how to use candlesticks means interpreting patterns which become our signals. Interpreting these signals means that you are constantly looking for confirmation to prove or disprove your analysis. Lack of confirmation means that the signal failed. Working with candlesticks means that you are confident enough to let the charts light the way knowing that the map is not the territory.

Position: N/A

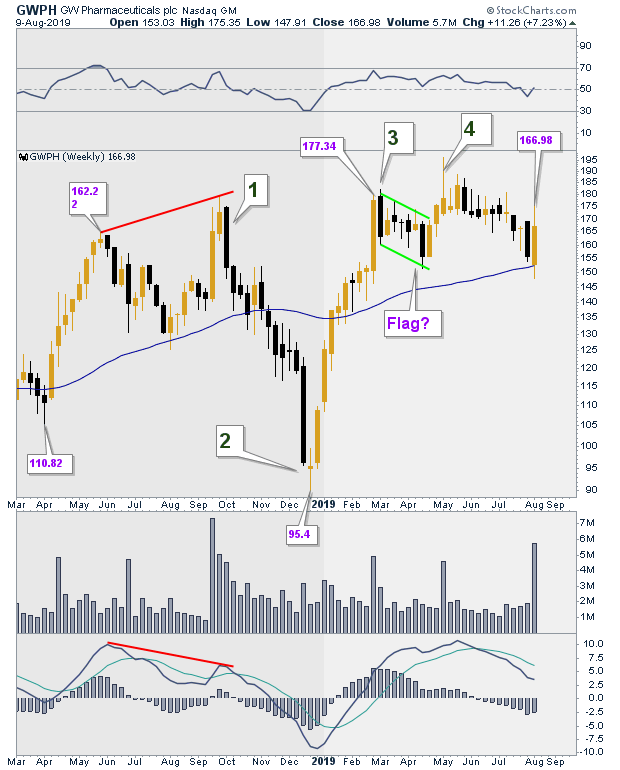

| We all know that charts are fractal, so the time frame you choose depends on your trading preference. The chart below is the weekly chart of GW Pharmaceuticals PLC (GWPH). This stock was recently in the news for reporting that sales of its cannabis derived epilepsy drug more than doubled from the previous quarter. The news sent its shares shooting up in after hours trading on August 6, 2019 and made me decide to take a closer look at the chart. Especially the candlestick patterns with a view to judging whether the signals worked or failed. |

|

| Figure 1. Candlestick patterns on the weekly chart for GWPH. |

| Graphic provided by: StockCharts.com. |

| |

| The first signal we will look at is in the area marked 1 in Figure 1. The long black candle engulfed the smaller bullish candle of the prior week. This was a classic bearish engulfing pattern. The bearishness of the signal was exacerbated by the negative divergence which formed with the MACD and price (price was making higher highs while the MACD was forming lower highs). Confirmation was the following week on the bearish candle with its lower closing. Entry would be the following week. The signal worked. Price fell from a high of about $175 to a low of about $95. Successfully trading at the center of this price range would have made for a good trade. |

| The next signal came at 2 indicated on Figure 1. The three candles formed the morning star pattern which is another classic candlestick pattern. The long black candle on the first week of the pattern was followed by a star which opened and closed below the low of the prior week's candle. The third week was a strong bullish candle. Confirmation of the pattern was on the week following the completion of the formation which was also a strong bullish candle. The ensuing up move took price from lows of $95 to highs of about $177. Again, it was totally unnecessary to expect to get in at the lows and exit at the highs. Trading the pattern for about a 30 to 40 point move would have made for a successful trade. |

| At 3 in Figure 1 was a pattern commonly known as a flag. The downward sloping pattern enclosed by light green parallel lines moved downwards for 8 weeks to halt above the 50-day moving average. Confirmation of the patterns completion came on the breakout of the pattern's downward sloping parallel line to the upside. A Flag is a continuation pattern which usually marks the midpoint of the move. So it would have been completely reasonable to anticipate a 60 point move to the upside. So what happened next? |

| At 4 marked on Figure 1, the candle that formed at the completion of the week following the breakout of the flag was bearish. Commonly called a spinning top, the candle with the long upper tail totally negated the bullishness of the breakout candle. The correct way to trade is for you to be willing to constantly reassess your analysis. The spinning top told us that the previous trade had failed. This is true irrespective of what our wishes might have been. We cannot hope we are wrong in our analysis. We now have new information that means that the spinning top takes precedence over the flag. The trade has switched from bullish to bearish. It is time to close out longs. But not yet time to go short. This, in short, is how to use candlestick signals and confirmation to enter and maintain trades. Emotions must always be set aside so that we can allow the candlestick patterns to light our paths. Then chances of successful trades increase and we no longer need to engage in futile discussions about the usefulness of the individual candlestick patterns themselves. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog