HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Matt Blackman

In my never-ending search for companies that will prosper in the new renewable energy and technology economy, I came across this momentum stock. And it looks to be breaking out to new all-time highs on above average volume again.

Position: N/A

Matt Blackman

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

PRINT THIS ARTICLE

NEW HIGHS-NEW LOWS

Hannon Armstrong Profiting From The New Economy

07/11/19 04:28:50 PMby Matt Blackman

In my never-ending search for companies that will prosper in the new renewable energy and technology economy, I came across this momentum stock. And it looks to be breaking out to new all-time highs on above average volume again.

Position: N/A

| Hannon Armstrong "is proud to be the first U.S. public company solely dedicated to investments that reduce carbon emissions or increase resilience to climate change" by investing in "leading companies in the energy efficiency, renewable energy and other sustainable infrastructure markets," according to the company website. It has $2 billion in assets under management with a stated goal to "own a diversified portfolio that generates long-term, predictable cash flows from proven technologies." Fundamentally, the company looks strong with earnings accelerating strongly through the last four quarters and up an impressive 150% in the last year. It also pays a respectable dividend of 33.5 cents which works out to forward dividend yield of 9.7%. |

|

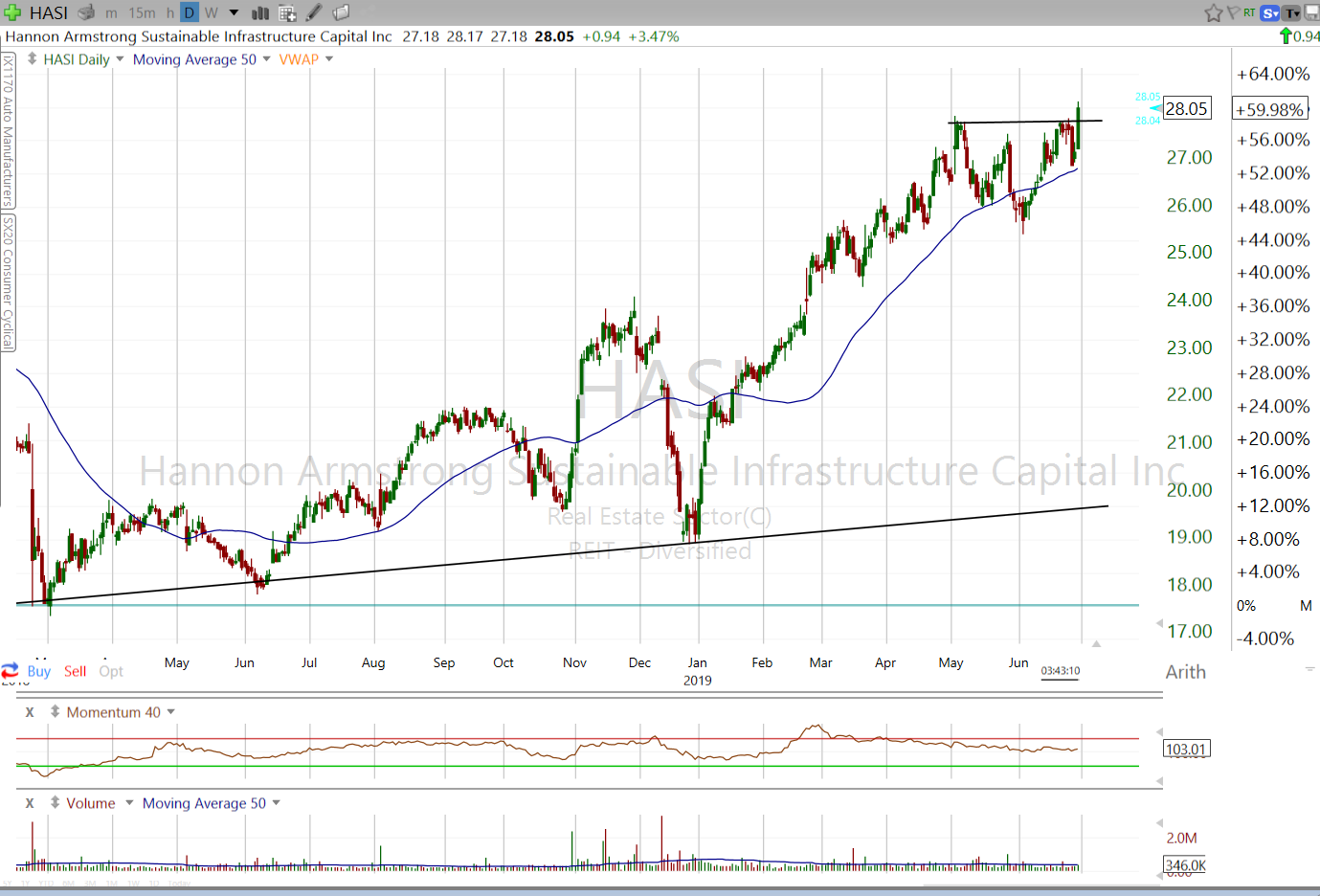

| Figure 1. Daily chart of Hannon Armstrong (HASI) showing a 60% price rise since March 2018. |

| Graphic provided by: Freestockcharts.com. |

| |

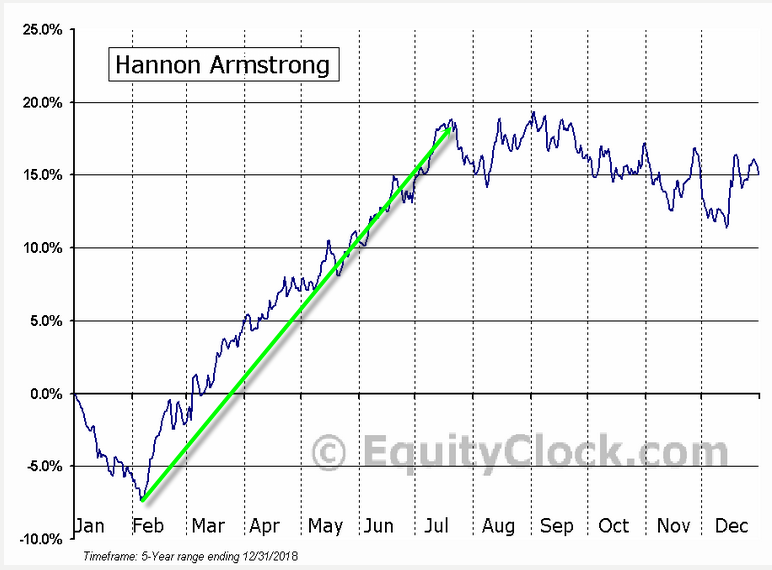

| Finding stocks in this market that combine both strong fundamental and technical strength has been tough so it was a pleasant surprise to see this one pop up on my scan screen. On the last trading day of June, HASI broke up through overhead resistance at $27.90 on a small V-pattern, which is a momentum buy signal. This move will be confirmed if support holds at this level and the stock moves up on strong volume. Although the company only has five years of stock history making any cyclical conclusions highly speculative at best, HASI has shown strong seasonal performance between the first week in February and mid-July each year. |

|

| Figure 2. Seasonal chart of HASI showing strength from early February into July each year. |

| Graphic provided by: EquityClock.com. |

| |

| Depending on which estimate you read, there is forecasted to be $10 trillion dollars or more shifting into the new economy as companies vie to compete in new technologies to power nations in the future with better, more efficient systems. And Hannon Armstrong looks to be doing a good job of finding these winners! |

| Suggested Reading: https://www.hannonarmstrong.com/ |

Matt Blackman is a full-time technical and financial writer and trader. He produces corporate and financial newsletters, and assists clients in getting published in the mainstream media. Matt has earned the Chartered Market Technician (CMT) designation. Follow Matt on Twitter at www.twitter.com/RatioTrade

| Title: | Author |

| Company: | TradeSystemGuru |

| Address: | Box 2589 |

| Garibaldi Highlands, BC V0N1T0 | |

| Phone # for sales: | 6048989069 |

| E-mail address: | indextradermb@gmail.com |

Traders' Resource Links | |

| TradeSystemGuru has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor