HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

With the debuts of these two ride sharing companies on public exchanges, is it possible to choose the better one to trade, or are they both best avoided?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Lyft or Uber?

05/30/19 04:13:05 PMby Stella Osoba, CMT

With the debuts of these two ride sharing companies on public exchanges, is it possible to choose the better one to trade, or are they both best avoided?

Position: N/A

| An IPO is an Initial Public Offering. It is the first time a company will be listed on an exchange, allowing the public to trade its shares. Many companies are private companies and remain so for many years, or indefinitely, with no plans to go public. Some companies were public but then decided to go back to being private. What seems to get the attention of the media are those companies that have become household names, which then go public. This short article will look at the two ride sharing companies that have recently garnered intense public attention by their IPOs, both of which have come in for criticism. |

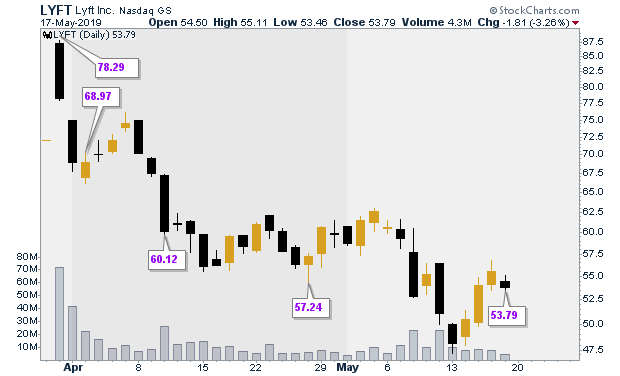

| Lyft, Inc. (LYFT), is the smaller of the two and the first to go public. Its shares were first listed on the Nasdaq on March 29, 2019. The shares were initially offered at $72 and opened on March 29, 2019, at $87.24, closing that day down at $78.29. The shares have continued to sink (See Figure 1) and on May 17, 2019, closed at $53.79. LYFT's public offering has been dismal, to put it mildly. As the stock sunk, participants began searching for scapegoats to blame for their dwindling trading accounts. There is currently a class action lawsuit which claims that investors were mislead by false and misleading statements which they allege that LYFT made prior to its IPO. Others blame Special Purpose Vehicles for sinking the stock price. SPVs are entities often created for a specific limited purpose. One purpose SPVs have been set up is to invest in fast growing private companies such as LYFT and UBER. These SPVs will often buy the stock of private companies from holders looking to cash out before an IPO happens. When an IPO eventually takes place the SPV may then sell stock or short stock to hedge positions. |

|

| Figure 1. LYFT Daily Chart. |

| Graphic provided by: StockCharts.com. |

| |

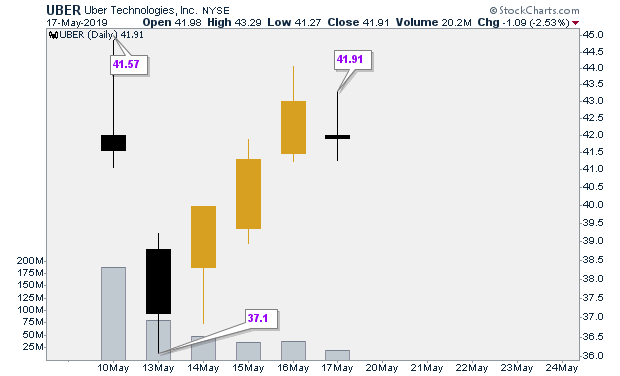

| Uber Technologies (UBER) is LYFT's ride sharing rival and its shares debuted on the NYSE less than six weeks after LYFT's at an opening price of $42 (See Figure 2). The following day, price gapped down to close at $37. UBER's price has since closed that gap, rising to close the day at $41.91 on May 17, 2019. The company had initially priced its shares at $45 per share which was near the bottom of the $44 to $50 range it had planned for a market capitalization of about $75.5 billion. The fact that its shares did not manage to trade at the levels it had hoped for was a disappointment to investors. |

|

| Figure 2. UBER Daily Chart. |

| Graphic provided by: StockCharts.com. |

| |

| It might be that the poor performance of LYFT's shares acted as a drag on UBER's shares, or it might simply be the fact that UBER overvalued itself and people got wise to it. Whatever the reason, we have to remember that as technicians the WHY is irrelevant. More importantly, we must also remember that IPOs are simply a way for insiders to cash out of their holdings. Since reading charts is our business, an IPO can never be an attractive trade because we are doing what we must not do; in the absence of trading history reflected on price charts, we are buying shares with no price performance history to guide us, instead, our strategy is one of hoping. Hoping that the shares will act right. Hoping that we will not lose money. Hope can never be a strategy. Therefore, IPOs are usually best avoided. |

| So, to answer the question raised above, the best strategy would have been to avoid both companies during their debut, but to have the patience to watch their price action unfold over the coming weeks and months to decide when, and if, a trade might be possible. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor