HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Sometimes it is difficult to determine what the market will do next. We want to be on the right side of the market and our fear of loss can mean we become hyper-vigilant and over sensitive to minor fluctuations. We try to decipher every market move, and as a result we get too close to the market and lose sight of the forest through the trees.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Waiting For Clarity

05/16/19 04:31:48 PMby Stella Osoba, CMT

Sometimes it is difficult to determine what the market will do next. We want to be on the right side of the market and our fear of loss can mean we become hyper-vigilant and over sensitive to minor fluctuations. We try to decipher every market move, and as a result we get too close to the market and lose sight of the forest through the trees.

Position: N/A

| Patience is one of the most important qualities a trader can bring to their work. The ability to let things unfold after taking a position, trusting our skills and knowledge of market movements to such an extent that we know that the market will tell us when it is changing direction. Patience and self-trust will allow us to step back and watch market action without being hyper-vigilant and reacting to our fears and irrelevant market fluctuations to take actions that are against our interests. |

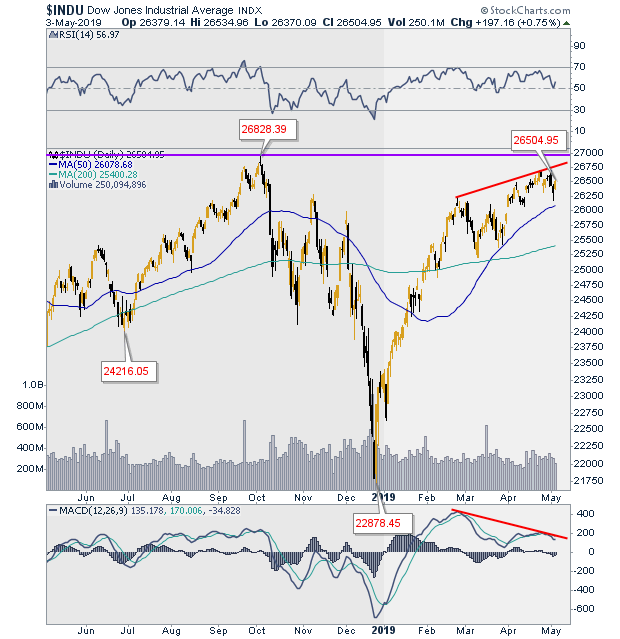

| Figure 1 shows a daily chart of the Dow Jones Industrial Average ($INDU). What does this chart tell us about the trend of the market? Are we currently in an uptrend? If we are, is the uptrend overextended? What does the negative divergence with the MACD in the panel below price tell us about coming price action? Has price formed an inverse head and shoulders? If it has, what does this say about future price action? |

|

| Figure 1. Daily Chart For DJIA. |

| Graphic provided by: StockCharts.com. |

| |

| So many questions, but the only real answers come from future price action; price action that will form on the chart and make what is today unclear, evident. Our weakness derives from the way we are wired as humans. We are risk adverse, we feel the pain of losses far more than the joy of gains, so to reduce that pain, we will often act in ways that are harmful to our success. Let us look at the chart of $INDU. What does it, in fact, tell us about the trend? Can we answer any of the questions raised above by a study of current price action? Is the information before us sufficient to determine future price action or should we step back and allow the market to give us more information? |

| The only thing this chart tells me is that we are in an uptrend. Is it likely to end soon? I do not know. There is negative divergence with the MACD, but this alone is not enough to tell you that the trend is about to change. Confirmation of signals must come from price action. What about the fact that price is currently close to prior highs formed on October 3, 2018? Since price has not reversed we cannot anticipate what will happen when, or if, price gets to that level. |

| It is wise to remember one of the main tenets of Dow Theory, "[a] trend is assumed to be in effect until it gives a definite signal that it has reversed." Adhering to this principle means practiced patience and patience is not something we are wired to bring to the markets in the face of uncertainty which could result in loss. But the best traders can maintain a sense of detachment and allow the market to control their actions instead reacting to other external stimuli which can trigger our aversion to risk. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog