HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

When a security is in a well established trend, taking a position can raise so many perplexing questions. What to do?

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Trading Rules

05/09/19 04:36:11 PMby Stella Osoba, CMT

When a security is in a well established trend, taking a position can raise so many perplexing questions. What to do?

Position: N/A

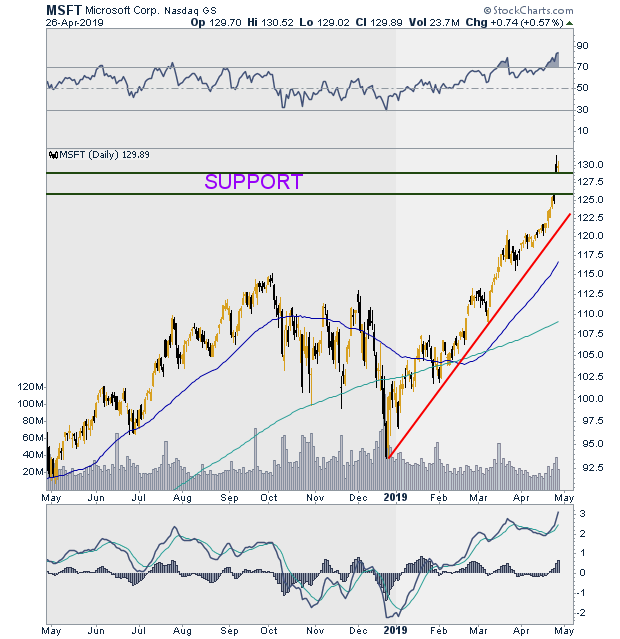

| Figure 1 is a daily chart of Microsoft Corp.(MSFT). One glance at the chart shows that it is a well established up trend. The 50-day moving average is sloping upwards and is well above the 200-day moving average. There is an uptrend line which shows prices moving up and away from the trend line. There is a strong gap up showing new support near price highs. But the clarity depicted on the chart does not make taking the trade any easier. |

|

| Figure 1. MSFT Daily Chart. |

| Graphic provided by: StockCharts.com. |

| |

| Many questions arise such as: Should I take the long side of the trade now? If not now, when is a good time to get into the trade? With the parabolic move up, is the uptrend now overextended? Should I wait for the gap to be filled? What if there is a reaction after I enter the trade? How would I know if it is a reaction or reversal? Should I wait for price to reverse and bounce up off the uptrend line before taking the trade? |

| The trading universe offers an unbounded environment. There is no beginning and no end. Prices are always moving and we are free to enter and exit as we like. The market offers us no rules to guide its behavior. The only rules we are subject to are those we make for ourselves. This is one reason why trading can be so difficult for so many. It is up to us to design our rules, or not, as the case might be. There is no one to make us do it. And there are so many ways to get it wrong even if we do have rules. Many who come to trading will not even have designed the most basic of rules to guide their behavior and of those who do, many will find justifications to ignore those rules and hope for trading miracles. |

| In trading, nothing is certain. The future is uncertain, markets are uncertain, price behavior is uncertain. The only certainty we can have in this environment is the certainty governing our behavior. If we have developed a well thought out set of trading rules, we can know that for us to enter a trade, the right set of conditions must first present themselves. We can choose to enter the market or to stay on the sidelines. We can choose when to participate and when to observe. The choice is always ours. But this freedom to choose can, in itself, be a hindrance to success for many because it is the precise opposite of how we interact in society, where rules dominate and guide behavior. |

| So before taking your next trade, go over your rules if you have some. If you have none, create some. Train yourself to operate with rules and see how, in time, well thought-out rules remove uncertainty from trading and build trading confidence. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

Comments

Date: 05/11/19Rank: 3Comment:

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor