HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Stella Osoba, CMT

Tilray, Inc. (TLRY) is a cautionary tale of why it is never a good idea to buy a stock on hype.

Position: N/A

Stella Osoba, CMT

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

PRINT THIS ARTICLE

TECHNICAL ANALYSIS

Never Buy On Hype

05/02/19 04:07:51 PMby Stella Osoba, CMT

Tilray, Inc. (TLRY) is a cautionary tale of why it is never a good idea to buy a stock on hype.

Position: N/A

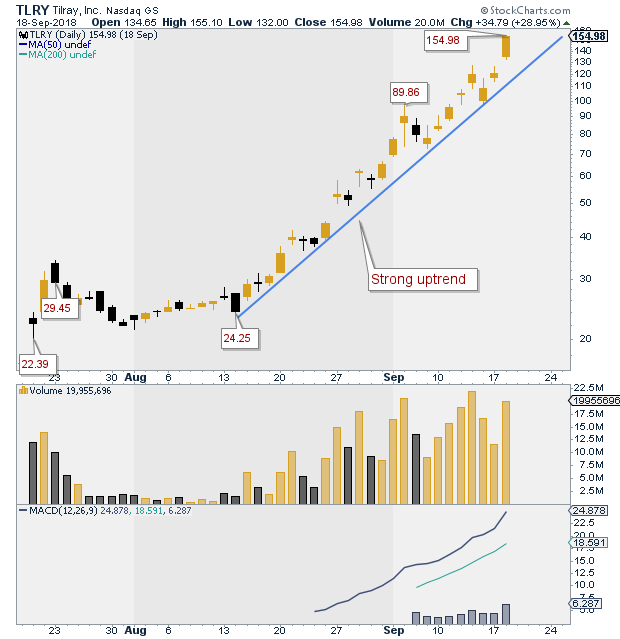

| Patience is one of the most important qualities a trader can have. Patience to wait for the right time to buy a stock, and patience to allow the market to show you when the time is right to exit a trade that is working. TLRY is a good example of how using patience before entering a trade can help to avoid costly losses. Figure 1 is a daily chart of TLRY showing the stock in a strong uptrend shortly after its listing on the Nasdaq on July 19, 2018. After basing for a few weeks, the stock broke out on strong volume and proceeded to rise impressively over the next five weeks. This parabolic rise caught the attention of the media, and everyone seemed to be talking about TLRY in particular, and pot stocks in general. |

|

| Figure 1. Daily chart for TLRY in August and September 2018. |

| Graphic provided by: StockCharts.com. |

| |

| The media hype caught the attention of market participants, resulting in increasing trading volumes as the stock sky-rocketed. The euphoria of rising prices lured unsophisticated traders to bet on TLRY, a stock that at the time seemed as if it could do no wrong. But that was the very time to avoid the stock on the long side. |

| TLRY was a new listing, there was not enough data to do a proper analysis of the stock. The meteoric rise of the stock was based on hype and sentiment not on company performance as the stock was yet to make a profit. For these reasons and more, it was a stock best avoided for the time being. Placing the stock on your watch list to let the stock prove itself would have required patience. Patience is a good trading partner to have. |

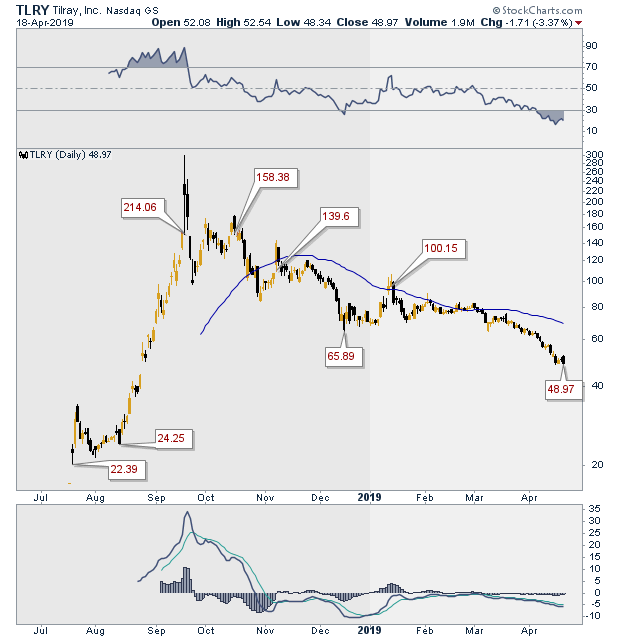

| On September 19, 2018, the euphoria surrounding the stock reached a level of madness that was a wonder to behold. The stock, which had closed at 154 the previous day, rose to a high of 300. It closed the day down at 214, which though still a close above that of the prior day showed irrational behavior that should have concerned anyone in the stock that day. Those lured to the stock by this price behavior were asking for trouble if they were in it to go long. Remember, when trading you want to be in a stock that acts right. TLRY was not acting right. |

|

| Figure 2. Daily chart for TLRY showing downtrend since the September 2018 high. |

| Graphic provided by: StockCharts.com. |

| |

| Figure 2 shows what happened after September 19, 2018. As it turned out, 300 was the high. TLRY never touched that price again before it began its controlled but painful descent. The downtrend is now well established as TLRY has gone on to make a series of lower highs and lower lows. The stock is now trading below its 50-day moving average at 48.97. Anyone who had gotten into the stock during its uptrend and is still waiting for a turn around will likely be sitting on losses. Let this be a cautionary tale never to buy a stock on hype. Patience is a key word in trading because the person who can ignore the hype and wait until the right moment to enter a stock, long or short, will eventually take home the riches that most people drawn to the stock market desire. |

Stella Osoba is a trader and financial writer. She is a frequent contributor to "Technical Analysis of Stocks and Commodities" magazine and "Traders.com Advantage" as well as other financial publications.

| E-mail address: | stellaosoba@gmail.com |

Click here for more information about our publications!

PRINT THIS ARTICLE

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog