HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Taylor Ireland

In this article, we examine the order flow and limit order book data in the WTI futures market that provides insight into the development of support for Thursday, April 11, 2019's auction. Market structure and order flow provide insight into the actual transactional activity of a dual-auction's price discovery process. Analysis of this data provides real-time insight into the actions of market participants, providing a dynamic data set to inform one's risk management process.

Position: N/A

Taylor Ireland

Sharedata Futures, Inc. provides historical data mining and visualization for the benchmark NYMEX Energy Futures Markets.

Sharedata combines structural analysis of the market generated data, dynamic systems analysis, and Bayesian causal inference techniques favored by the scientific and intelligence communities to provide a robust framework for addressing the uncertainty and risk in energy pricing.

PRINT THIS ARTICLE

DAY TRADING

WTI Order Flow Weekly: Structural Insight In The Market Profile Provide Trend Continuation Clues

04/24/19 11:56:51 AMby Taylor Ireland

In this article, we examine the order flow and limit order book data in the WTI futures market that provides insight into the development of support for Thursday, April 11, 2019's auction. Market structure and order flow provide insight into the actual transactional activity of a dual-auction's price discovery process. Analysis of this data provides real-time insight into the actions of market participants, providing a dynamic data set to inform one's risk management process.

Position: N/A

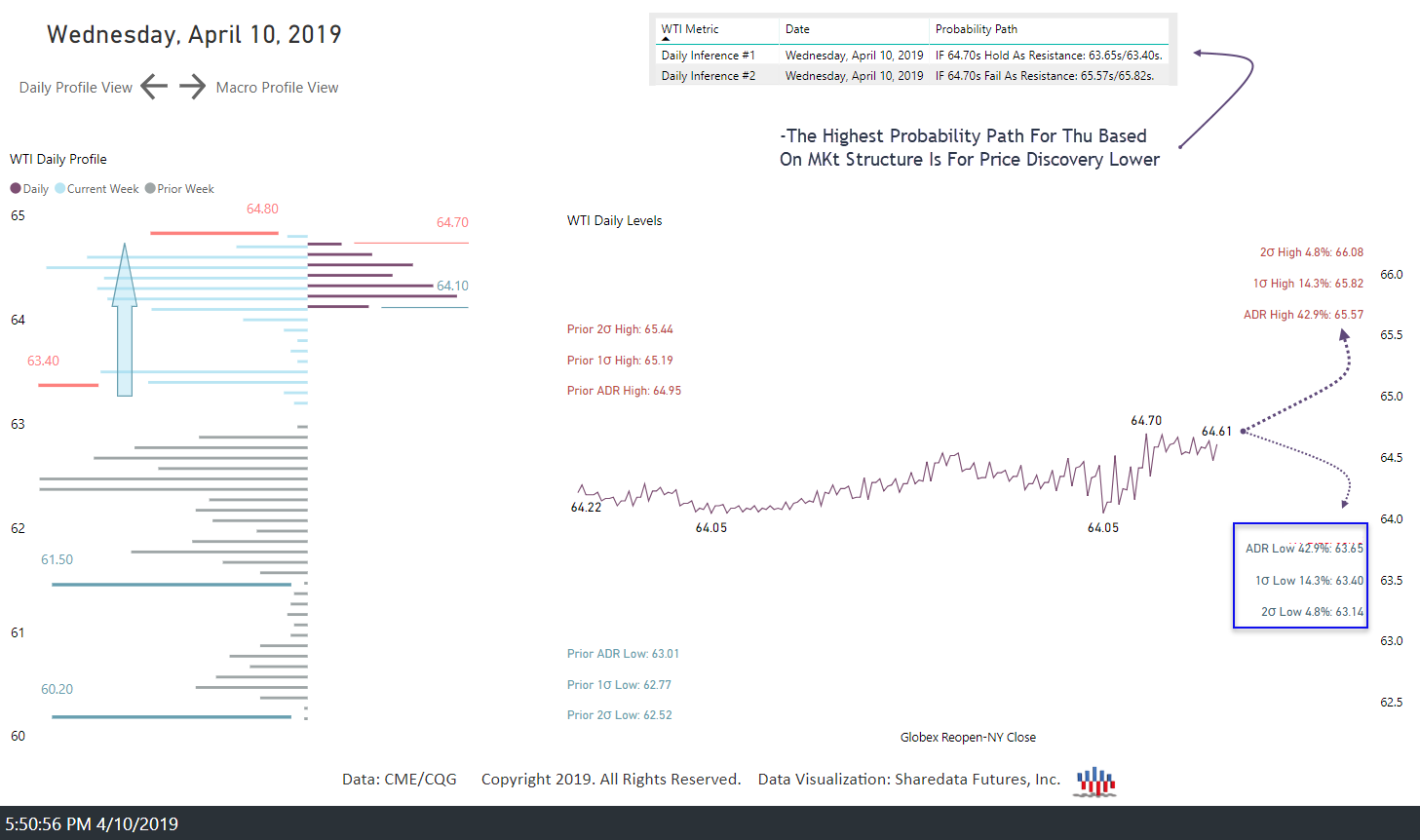

| April 11, 2019: The structural framework provided in Sharedata's Daily Dashboard for Thursday, April 11's auction was for price discovery lower. Our daily statistical support targets were: 63.65s/63.40s/63.14s. Qualitatively, these levels had held as supports 42%, 14%, and 5% (respectively) of recent market auctions based on the market generated data. This data provided a sell-side framework with a probable support "zone" between 63.65s-63.40s. This type of daily framework, while useful, is made more effective when using live order flow and structural analysis to confirm or negate the most probable daily inference. |

|

| Figure 1. WTI Daily Dashboard For April 11, 2019. |

| Graphic provided by: Sharedata Futures, Inc.. |

| |

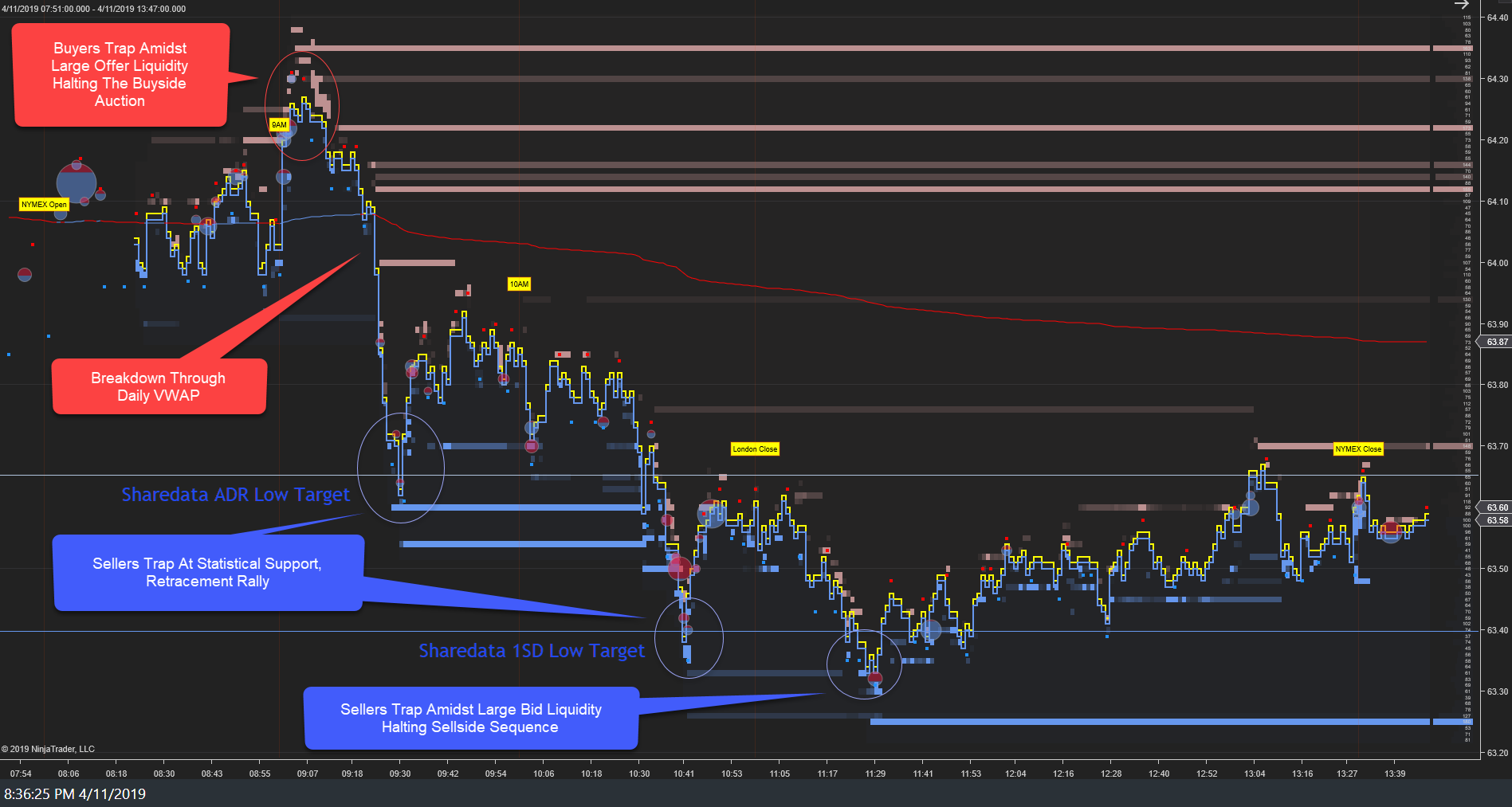

| Selling interest emerged early in Thursday's Globex auction, driving price lower to 63.63s in London trade before buy excess halted the sell-side phase. A retracement rally developed early into the NY auction. A structural sell excess emerged early in NY trade, 64.31s-64.18s, indicating the rally had been terminated. Price discovery lower ensued, ultimately driving price lower to 63.31s at or near the daily 1st standard deviation low target where buying interest emerged, halting the sell-side sequence. The structural sell excess that developed in NY (and subsequent failure of London's buy excess) were structural indications of potential sell-side continuation and confirmation of the daily inference from Wednesday's NY close. |

|

| Figure 2. WTI Daily Auction For April 11, 2019. |

| Graphic provided by: NinjaTrader. |

| |

| The practice of analyzing market structure developments is best accomplished with the use of order flow and limit order book (LOB) analysis. In short, plotting the buy and sell transactions of significance (in this case volume equal to or greater than 150 contracts) as well as the resting limit bids and offers (equal to or greater than 75 contracts) allows us to see both the actions and intent of larger participants (who significantly affect price). |

|

| Figure 3. WTI Daily Limit Order Book For April 11, 2019. |

| Graphic provided by: NinjaTrader. |

| |

| Price discovery lower then ensued through both the daily VWAP and the London buy excess. Sell-side continuation first developed to 63.61s at or near the average daily range low target. Buying interest emerged there amidst large bid liquidity in the LOB. Minor balance ensued before buyers tapped at this support resulting in sell-side continuation to 63.34s at or near the 1st standard deviation low target. Sellers were trapped here amidst large bid liquidity in the LOB as another minor balance phase ensued. The market ultimately probed this level, driving price modestly lower to 63.31s, where again sellers were trapped within large bid liquidity in the LOB, halting the sell-side sequence. As noted earlier, the qualitative difference in these two support levels was material in that the 1st standard deviation target had held as support in approximately 86% of the recent auctions (versus 58% at the average daily range target). While the low that formed was unsecured (ultimately being tested in the following week's auction), the buy-side absorbed selling interest in sufficient quantity to halt the sell-side sequence before a minor uptick in the NY close. |

| Market structure provided the directional context (sell-side based on sell excess). The order flow and limit order book data confirmed the sell-side development of the directional context provided by the market structure. The daily framework identified statistical support targets and their qualitative potential to hold as support. This confluence of structural, statistical, and order flow data provided insight into the auction's outcome based not on lagging price indicators but rather structural formation and the transactional behavior and intent of significant quantity to drive price discovery. |

Sharedata Futures, Inc. provides historical data mining and visualization for the benchmark NYMEX Energy Futures Markets.

Sharedata combines structural analysis of the market generated data, dynamic systems analysis, and Bayesian causal inference techniques favored by the scientific and intelligence communities to provide a robust framework for addressing the uncertainty and risk in energy pricing.

| Title: | Founder |

| Company: | Sharedata Futures, Inc. |

| Dallas, TX | |

| Website: | www.sdfanalytics.com |

| E-mail address: | support@sdfanalytics.com |

Traders' Resource Links | |

| Sharedata Futures, Inc. has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor