HOT TOPICS LIST

- MACD

- Fibonacci

- RSI

- Gann

- ADXR

- Stochastics

- Volume

- Triangles

- Futures

- Cycles

- Volatility

- ZIGZAG

- MESA

- Retracement

- Aroon

INDICATORS LIST

LIST OF TOPICS

PRINT THIS ARTICLE

by Fawad Razaqzada

If the two periods of vicious sell-offs late last year are anything to go by, then 2019 should be a year of high volatility.

Position: N/A

Fawad Razaqzada

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

PRINT THIS ARTICLE

FALSE MOVES

Stocks Could Face Challenging Year

01/10/19 03:47:31 PMby Fawad Razaqzada

If the two periods of vicious sell-offs late last year are anything to go by, then 2019 should be a year of high volatility.

Position: N/A

| Unlike the past several years when the only strategy that seemed to work was buying the dip, 2019 could be a year for both the bulls and the bears to enjoy. This year, selling the rips might also become fashionable among market participants. The slightly tighter monetary conditions from last year, combined with the potential for softer economic growth and disappointing corporate earnings results could prove to be a toxic mix for equities this year. |

| Economic growth has been hit in part because of the recent currency crises in several emerging market economies. This has hurt demand for developed economies' exports, while growing uncertainty about Brexit — UK's impending departure from the European Union — and the ongoing trade spat between the US and China have also contributed towards slowing economic expansion. In fact, Germany was on the verge of suffering a potential recession following the release of consistently disappointing economic data in recent months. The Eurozone's economic powerhouse suffered a contraction in its GDP in the previous quarter and so another quarter of negative growth would technically tip the nation into a recession. Despite this, the European Central Bank remains determined to end crisis-era stimulus measures and lift interest rates after the summer, though it has apparently lost some of its optimism recently, like most other major central banks who were or about to turn hawkish. One of them was the US Federal Reserve, which has now indicated it won't be tightening its belt again for a while as it assesses the economic impact of the past rate hikes and monitors financial and economic developments in the early parts of 2019, before thinking about hiking again. |

| So, looking ahead, stock market participants will be watching incoming global economic data more closely for changes in macro conditions in order to gauge the health of corporate earnings and stock market valuations. But in the absence of quantitative easing (QE) stimulus from the likes of the Fed and the ECB, bad economic data does not necessarily mean good news for stocks, as was the case in the previous years. Thus, we may see a more straight-forward reaction in equities this year to incoming macroeconomic data; good numbers might underpin stocks while negative readings could undermine them. Still, it might not be all doom and gloom out there. The outlook for slower economic growth, recent falls in crude oil prices and the impact of the past tax cuts falling out of the equation, means that inflationary pressures are likely to wane further in 2019, thus reducing the need for the Fed to tighten its policy. This may help to limit the potential downside for equities. But, if the economy were to unexpectedly grow strongly again this year, then stocks may remain supported for a while yet. |

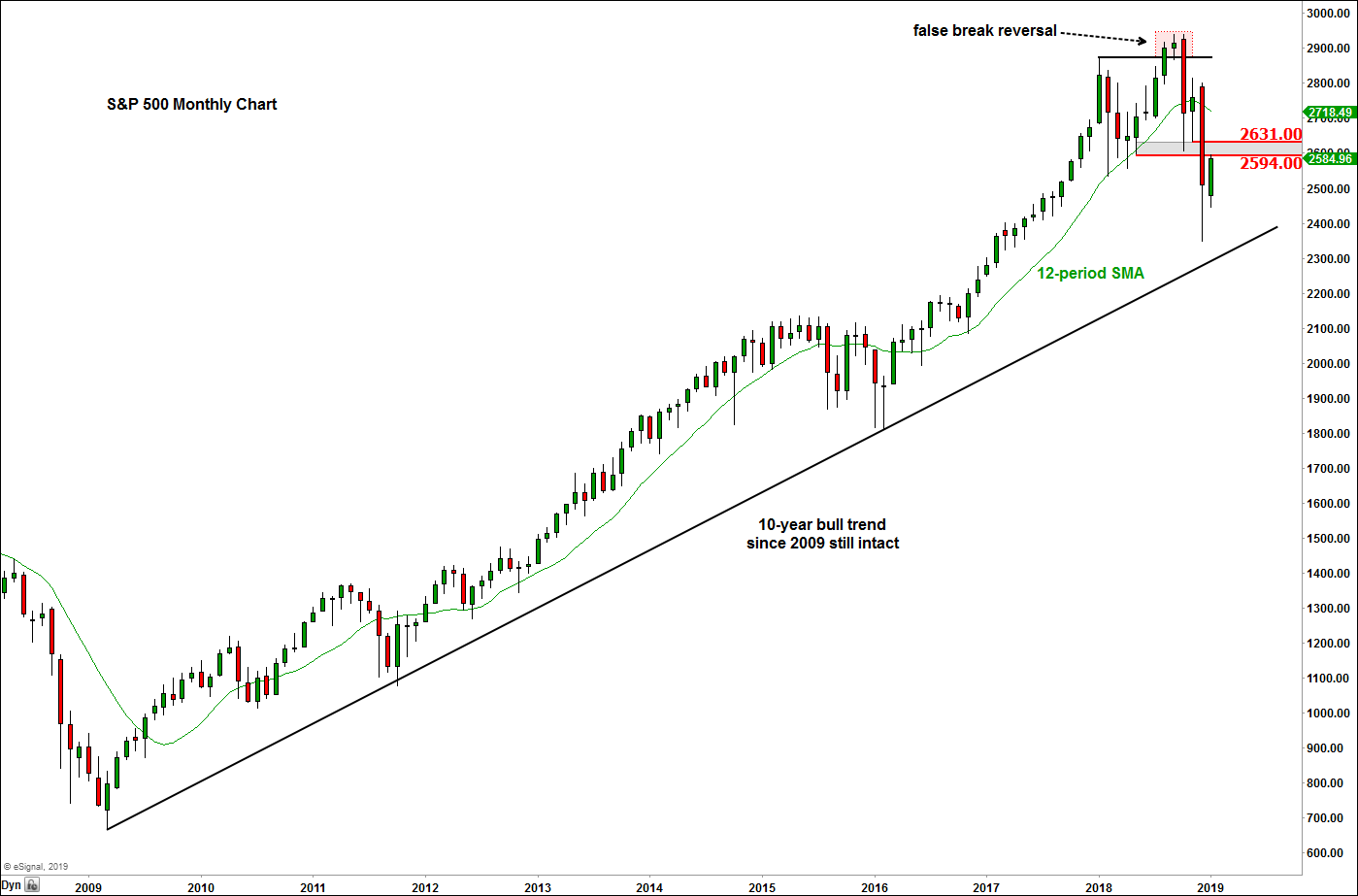

| The above fundamental considerations are reflected in the longer-term monthly chart of the S&P 500 (Figure 1), which has shown a few bearish developments of late. After staging a false break reversal at the end of the summer, when it failed to hold above the previous record high of 2872.87 (hit back in January 2018), the index has fallen sharply to break its old lows. At the time of writing in early January 2019, the index was rising back to the old support area around 2594-2631, which could now turn into resistance, leading to another potential drop. So, based on this, I certainly wouldn't rule out the prospects of a potential drop to the 10-year old bullish trend line in the upcoming months. For now, the medium-term directional bias seems to be favoring the bears, even if the very long-term picture is still bullish. So, 2019 could be a challenging year for stock market bulls who are used to basic trend-following strategies. |

|

| Figure 1. S&P 500 index breaking down after it created a false break reversal |

| Graphic provided by: eSignal. |

| |

Fawad Razaqzada is an experienced analyst and economist having been involved in the financial markets since 2010 working for leading global FX and CFD brokerages. Having graduated with a degree in economics and leveraging years of financial market experience, Fawad provides retail and professional traders worldwide with succinct fundamental & technical analysis. In addition, he also offers premium trade signals to subscribers, and trading education to help shorten the learning curves of developing traders. He has also been trading on his personal account for many years. Follow Fawad on twitter @Trader_F_R or visit his website at TradingCandles.com.

| Title: | Financial Market Analyst |

| Company: | TradingCandles.com |

| London, | |

| Website: | tradingcandles.com |

| E-mail address: | fawad.razaqzada@hotmail.co.uk |

Traders' Resource Links | |

| TradingCandles.com has not added any product or service information to TRADERS' RESOURCE. | |

Click here for more information about our publications!

Comments

Request Information From Our Sponsors

- StockCharts.com, Inc.

- Candle Patterns

- Candlestick Charting Explained

- Intermarket Technical Analysis

- John Murphy on Chart Analysis

- John Murphy's Chart Pattern Recognition

- John Murphy's Market Message

- MurphyExplainsMarketAnalysis-Intermarket Analysis

- MurphyExplainsMarketAnalysis-Visual Analysis

- StockCharts.com

- Technical Analysis of the Financial Markets

- The Visual Investor

- VectorVest, Inc.

- Executive Premier Workshop

- One-Day Options Course

- OptionsPro

- Retirement Income Workshop

- Sure-Fire Trading Systems (VectorVest, Inc.)

- Trading as a Business Workshop

- VectorVest 7 EOD

- VectorVest 7 RealTime/IntraDay

- VectorVest AutoTester

- VectorVest Educational Services

- VectorVest OnLine

- VectorVest Options Analyzer

- VectorVest ProGraphics v6.0

- VectorVest ProTrader 7

- VectorVest RealTime Derby Tool

- VectorVest Simulator

- VectorVest Variator

- VectorVest Watchdog